Is The Private Equity Hype Over (?)

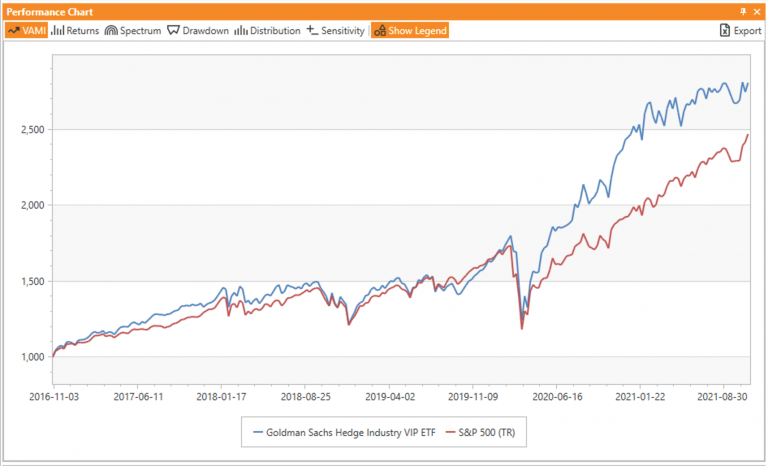

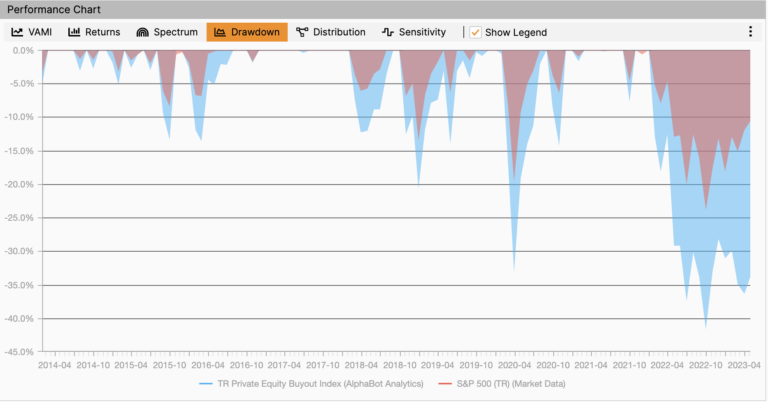

The rise in public equity prices during the ZIRP and quantitative easing years was mirrored in the private equity space as an abundance of cheap debt armed an ever increasing number of buyout funds with the ammunition they needed to complete deals.