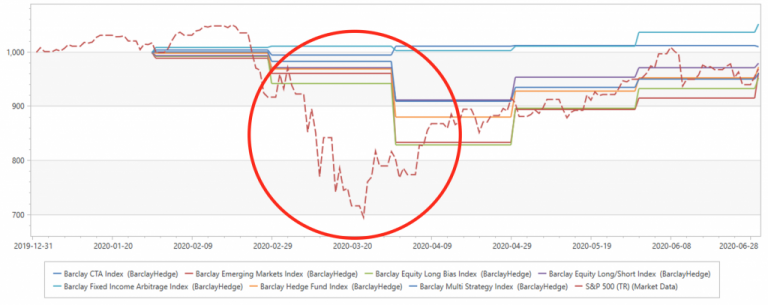

Reaching the midpoint for the year 2020 can be viewed as a positive because many people, I am sure, want this year to be over with as soon as possible. Yet, the end of H1 is a good point to pause and review the first half, and hopefully see some indication of what to expect in the second half. We’re going to take a look at the 7 largest Hedge Fund strategies in terms of AUM, courtesy of BarclayHedge.

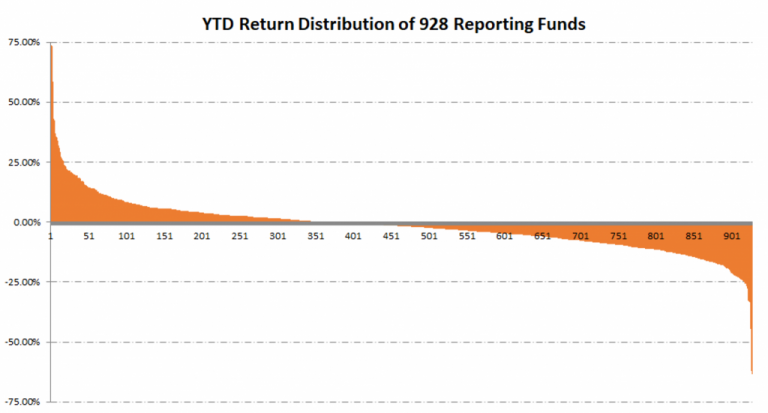

Funds reporting through June on the NilssonHedge database, a public database of hedge fund returns, shows the industry split in half during the first six months of the year. The average positive and the average negative returns of the 928 funds that NilssonHedge has data for through June are the same to within a basis point: 7.82% vs -7.83%, with negative returns being a majority (about 2/3rds or 562 of all returns).

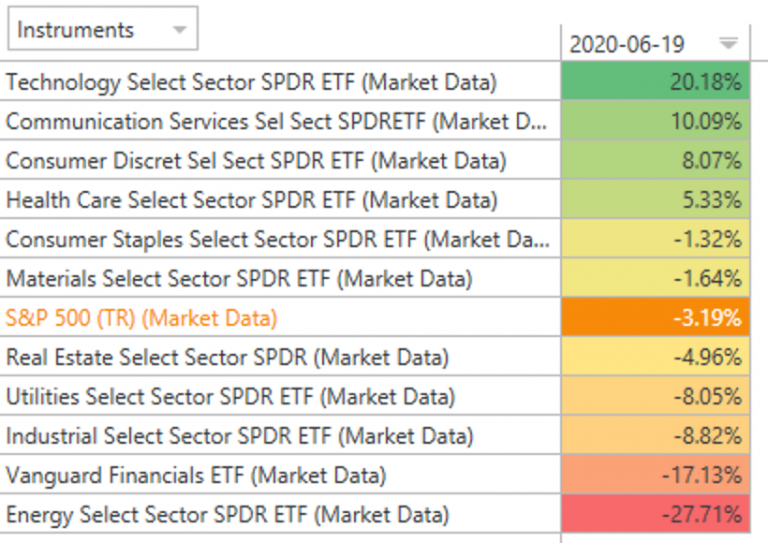

Equity Sector Specific ETFs have very high correlations of 80% or more on average, but it does not stop them from having dramatically different performance this year.

These 5 stocks are now more than 15% of the S&P500 index. What happens next?

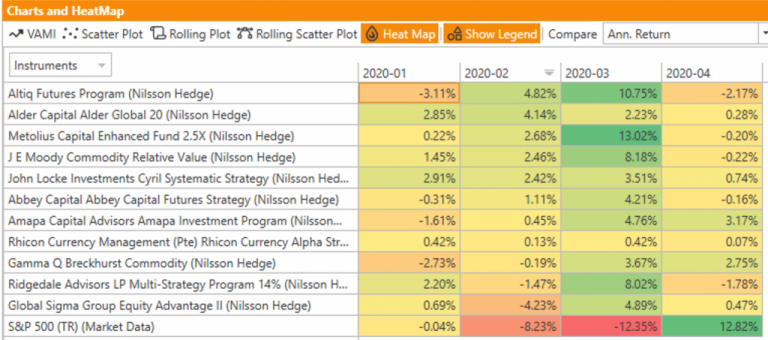

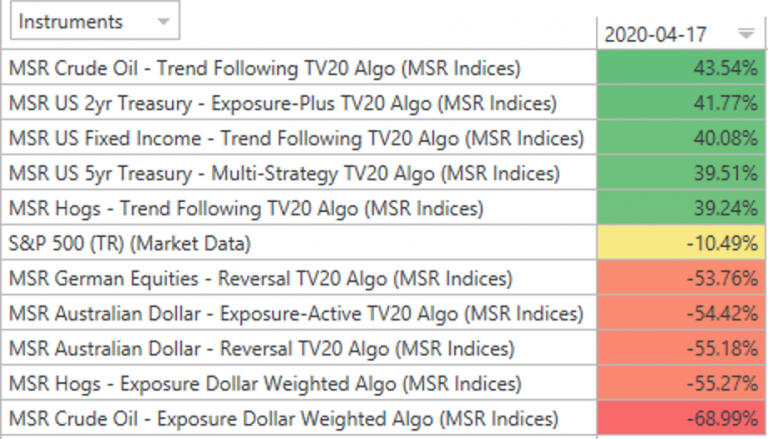

We repeat our filtering to find CTAs that are performing well YTD through April by using Nilsson Hedge database.

Is there a difference in performance of Hedge Funds and Equities between those years when there are new Star Wars movies coming out and those when not? The answer is surprising!

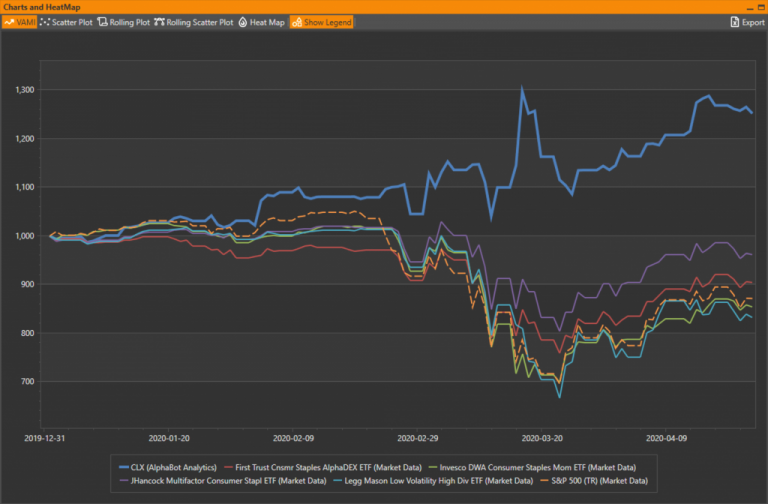

It appears that Clorox is not only working against the virus chemically but also financially!

There is a huge dispersion in strategies trading oil, from 50% up to 70% down Year-To-Date