As parts of the western world begin a partial return to ‘normal’ and the news becomes ever-so-slightly less dominated by Covid, other issues are beginning to move into the spotlight. Chip shortages are affecting many industries from cars to computer manufacturers, there are shipping problems due to not enough shipping containers (who might have thought that the world cannot make enough steel boxes, really?), and many other issues are disrupting what we used to think was a smooth and comfortably boring process around logistics and assembly lines.

Commodity prices are one such thing, and we are seeing a considerable rise in commodity prices affecting many industries, from construction to electronics manufacturing, and the trends are being picked up by Commodity Trading Advisors.

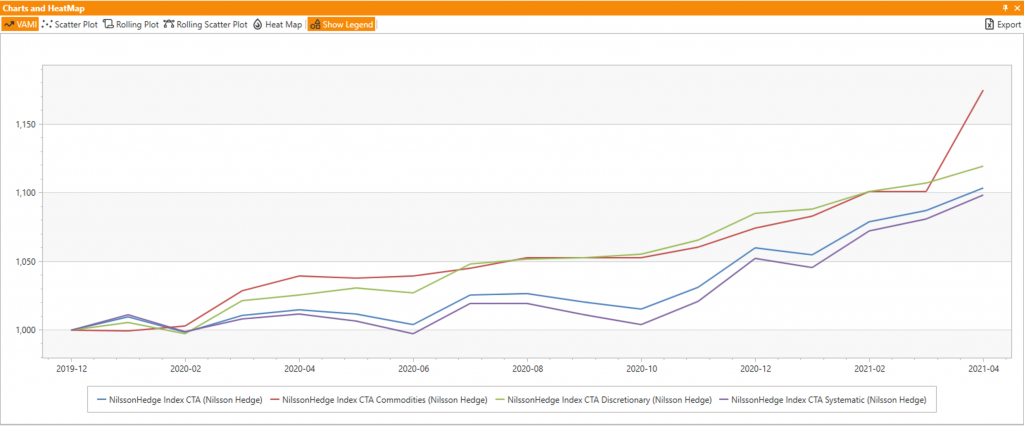

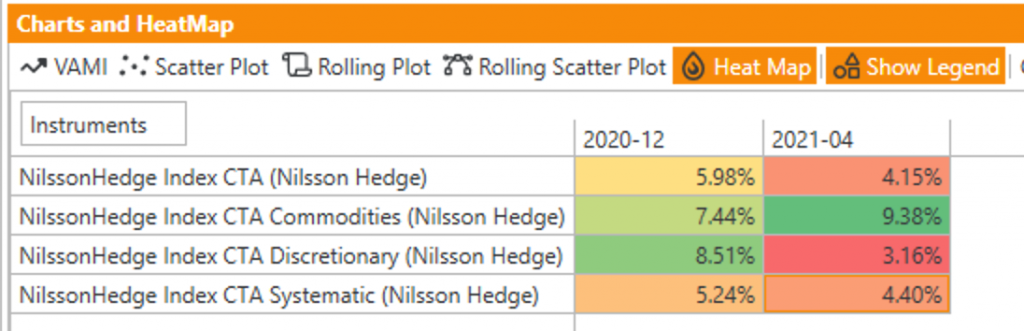

Looking at the returns of 4 CTA indices courtesy of NilssonHedge, a publicly available database of hedge fund returns, we can see the NilssonHedge commodity index rising most dramatically, up a whopping 6.7% in April (quick caveat – usually the best performing managers report earlier in the month, so we might expect to see this pull back slightly in the next week or two as NilssonHedge gathers more data). In fact, in the first three months of this year, the Commodities managers have already outperformed their entire 2020 by almost 2 percentage points.

It appears that government stimulus, limited jobs, and strained industries have created a perfect storm for what some are concerned may become run-away inflation – limited capacity with growing demand. People and companies are willing to pay large premiums for smaller resource variety, houses, construction, wood, energy, and almost everything else. At the same time, pandemic-related limitations and concerns continue reducing production and processing capacities in many countries and US States.

Hyperbolically speaking, we are about to see what happens when the unstoppable force (of governments printing ever more money) meets an immovable object (a stalled economy). The resulting fireworks will be spectacular, but our concern is that we – i.e., most people – may not enjoy the show too much. Commodity managed futures strategies, however, just might continue to do so.