We have previously covered the Thomson Reuters Private Equity Buyout Index and the Thomson Reuters Venture Capital Index – both of these indices use public market comparisons to attempt to replicate the Thomson Reuters Buyout and Venture Capital Benchmark Indexes, two different indexes which use private company valuations. Thomson Reuters and Chicago-based DSC Quantitative Group built the two public market versions almost a decade ago now.

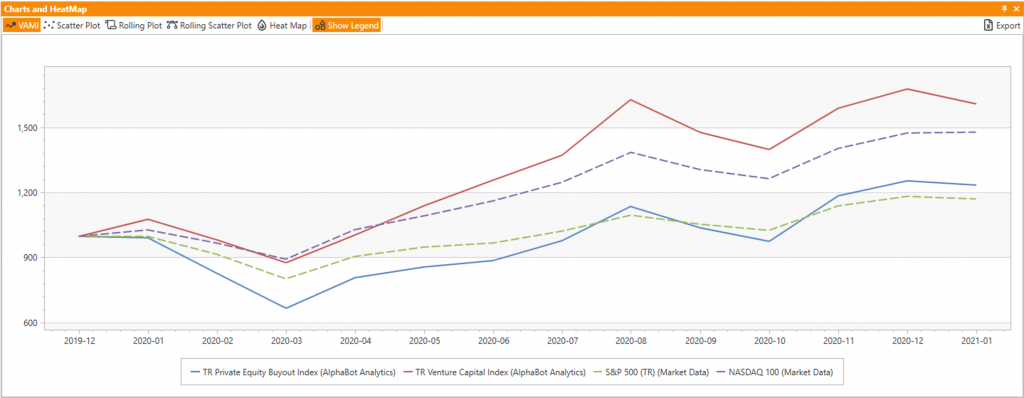

It appears that the performance trends we observed earlier continue to persist – namely, the performance of Private Equity seems to be converging with overall equities, while Venture Capital is outperforming, supporting their “smart money” nickname.

Source: AlphaBot

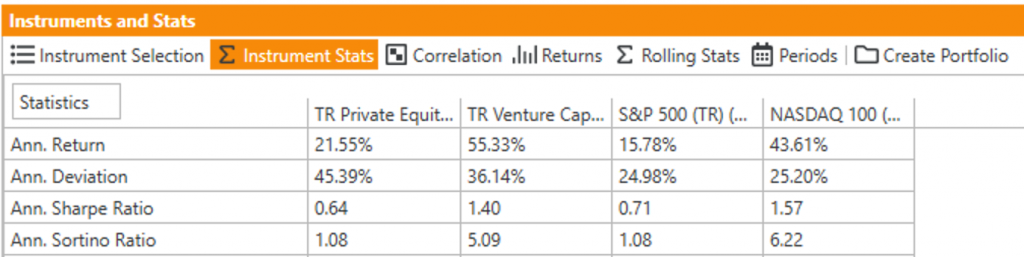

The stats for the Venture Capital index are quite impressive, outperforming all 3 other instruments in our comparison – January 2020 to January 2021, not full calendar year 2020 – by a considerable margin of almost 12% vs the Nasdaq 100 and almost 40% (!) vs the S&P 500.

Source: AlphaBot

To get a better insight into the source of such a dramatic performance difference we looked at the sector composition in the January Factsheets for each index, available on DSCQ.com, and noticed that the largest difference is in sector allocation to the technology sector – 78% for the Venture Capital index vs only 35% for the Private Equity one.

| Sector and Weight | Venture Capital Index | Private Equity Index |

| Technology | 81% | 35% |

| Healthcare | 9% | 9% |

| Industrials and Materials | 5% | 18% |

| Other Sectors | 5% | 38% |

Source: Refinitiv/TR, AlphaBot

The allocations are perhaps not surprising, given the tech-heavy nature of venture capital investing and the continued bull run in US tech stocks in part due to the tailwind given to them by the effects of the Covid-19 pandemic. But what’s equally interesting is that it appears that you can get venture capital returns without needing a 10- or other multi-year lock on your investment. From the start of the live index in October 2012 it amounts to slightly more than an 800% total return.

We will continue monitoring this interesting pair of indices and covering them in future posts, so stay tuned. But in the meantime, we’ll leave it to the VCs and the VC replication disciples to see who can truly claim bragging rights here.