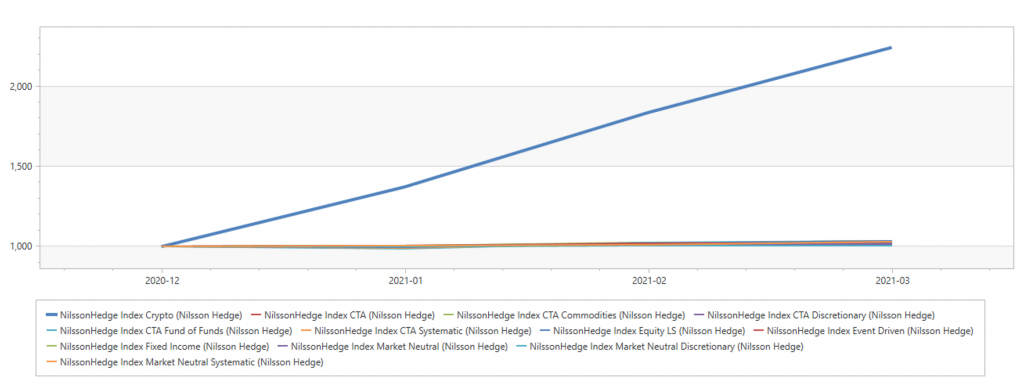

As the first quarter of the “post-2020” era came to a close, we wanted to take a look at how the various hedge fund strategies published by NilssonHedge fared to begin the year.

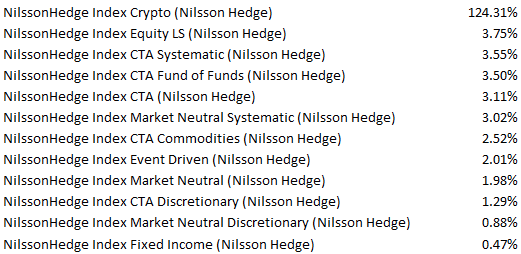

Continuing the trend set in 2020, Crypto Hedge Funds keep outperforming the rest by triple digits. While all strategies have positive returns for Q1, everything except Crypto fits in a narrow range of about +0.5% for Fixed Income to +3.75% for Equity Long Short. Crypto funds, on the other hand, returned an astonishing 124.3% for the first 3 months of 2021 on average.

In any “normal” year, a return of 3%+ in a quarter for a broad strategy index is a very good result, but clearly 2021 is not such a normal year. Whether investors are seeking “structural diversification” away from the traditional financial system, or putting their money into crypto to shield themselves from potential run-away inflation, the cryptos are charging boldly into uncharted territory and have recently reached $2trn in capitalization, with Bitcoin owning approx 55% of the entire market.

It will be interesting to see how things develop for this segment as there are major structural developments underway, from smaller scale initiatives like Crypto-based ETFs to massive projects like entire countries experimenting with putting their national currencies on the blockchain (such as China), not to mention continuing regulatory challenges.

Without a widespread payment system based entirely on crypto, the weak link for investors remains the point of conversion to a local currency, where all the most important advantages such as anonymity, security, and ease of transactions disappear and get replaced by local laws and regulations that vary considerably from being crypto-friendly (Japan seems to lead the world here) to outright hostile (China, for example, wants to use its own currency in a blockchain format). The changing regulatory landscape definitely adds to the inherent volatility of the asset class and only time will tell how a “matured” crypto-space will look like in a few years.