The world of cryptocurrency investing continues to evolve. There are many factors supporting increasing attention to the space, from geo-political instability forcing people to look for ways to protect and transfer their assets, to central banks activities in creating blockchain versions of their national currencies. As time has passed, the crypto space that was totally new just a few short years ago has adopted traditional investment tools and techniques as indexing, trend-following (and systematic trending in general), and risk management.

In this post we take a look at the potential benefits of using an index-like portfolio construction mechanism to control risk and produce a more stable portfolio than, say, allocating to a single crypto-currency. Due to the large number of crypto currencies available, we’ve used a pretty standard approach that we’ve taken from the world of equities, where we’ve focused on a few top performers only.

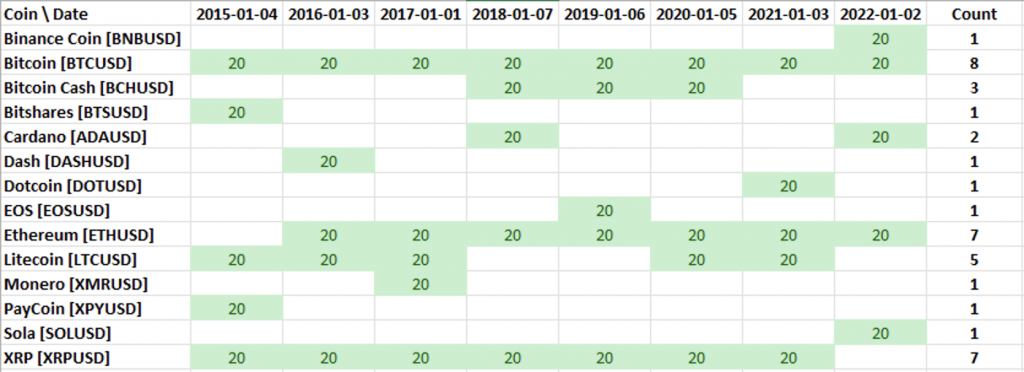

Since those change quite often (with the exception of Bitcoin, that has maintained market cap dominance over the years as a de-facto staple of the space), we have created our portfolio by picking the five largest cryptos at the beginning of each year from 2015 through 2022, using historical data from Coinmarketcap.com and allocating equal weights to each of them. Then we held this portfolio until the first business day of the next year and so on. We’ve ended up with 14 coins total and the following selection matrix (number inside is the weight, 20% each):

On the right we also included the count of how many times a particular coin has been used in this process with the total max of 8 periods. Clearly Bitcoin has been there from the start, but the rest of selections is not so obvious and represents yet another reminder of the dynamic nature of the space where winners and losers change quite often.

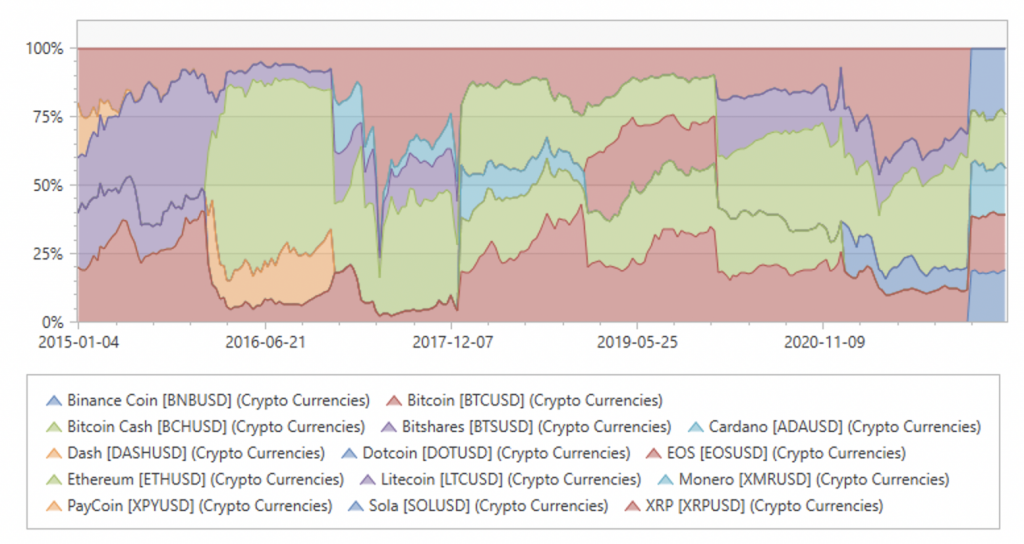

Despite allocating 20% to each of the coins at the beginning of each year, the volatility of the space makes the weightings fluctuate significantly due to the relative performance of the coins. The resulting weight chart seems like a cut of some geological layer with a lot of volcanic activity, and it is no surprise as the price action of cryptos is, quite often, explosive.

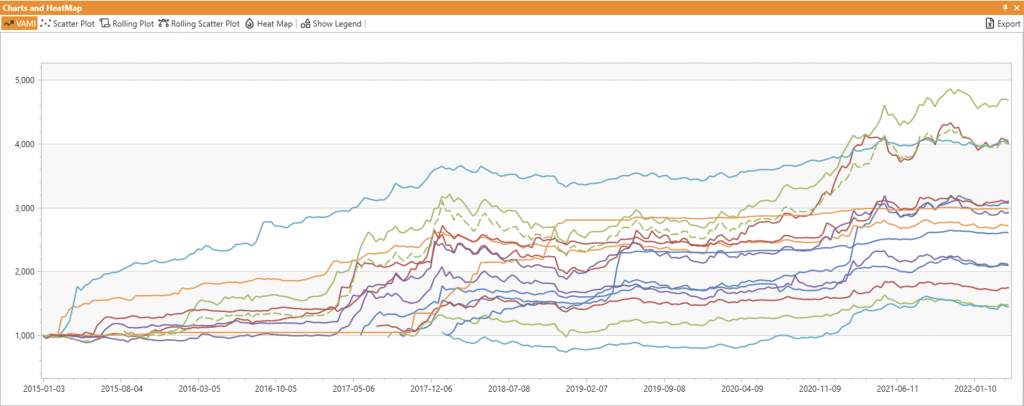

So, with this approach, what do the results look like? First, we look at the overall portfolio performance vs. the individual ingredients, and notice that it does tend to stay in the upper half of the pack (which is good). To make the VAMI chart easier to read, we have vol-adjusted it to 15% annualized volatility, otherwise due to the triple-digit volatility of coins, it all lumps together. Check the dashed green line below if you can spot it:

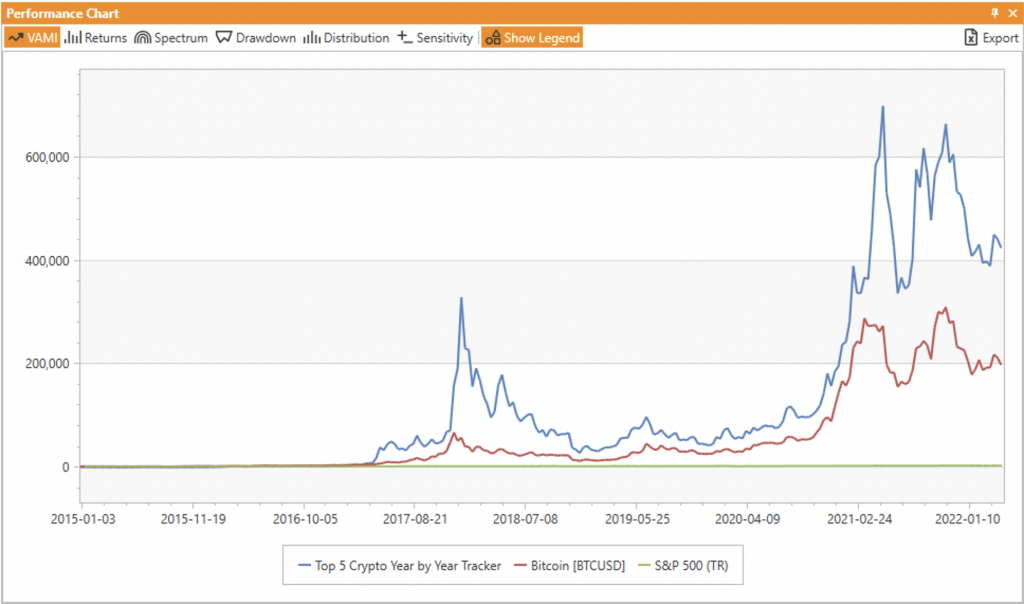

Ok, but besides looking pretty cool, what does all this mental gymnastics give us? Excellent question! Let’s take a look at one more chart that will put this into perspective. First, our little portfolio exercise allowed us to actually outperform Bitcoin!

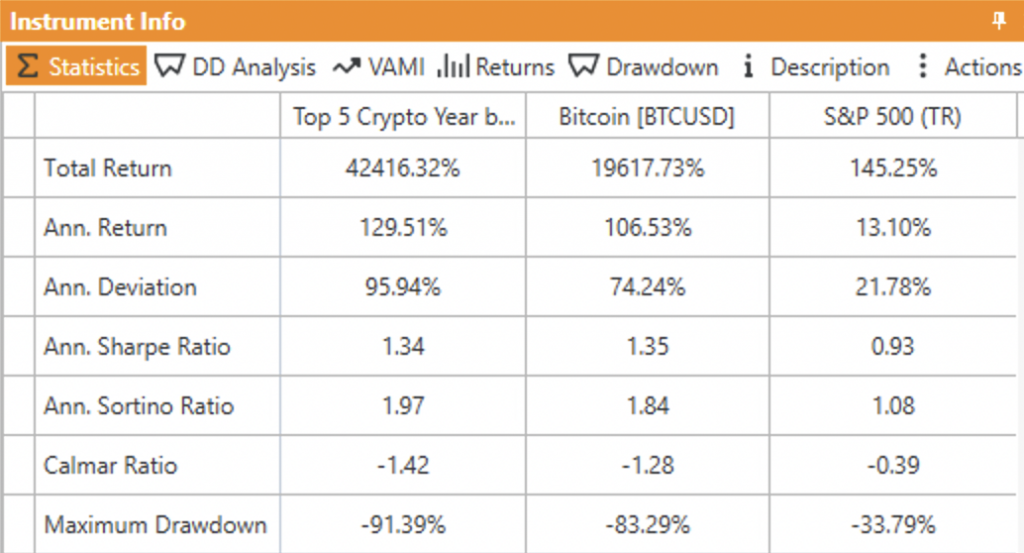

The stats are correlating with the visuals for the chart above:

This portfolio, created in an index-like fashion, has beaten Bitcoin, an industry leader, by approximately 23% a year, *doubling* the overall performance vs Bitcoin. The outperformance is also almost double the annual S&P500 rate of return in itself, and by any historical standard, a 13% annualized return over the course of seven years is a very decent result. Considering that portfolio volatility has increased only by a third, this approach really makes us think that there is something behind classic index-like investing in cryptos. For the price of periodic rebalancing, it reduces reliance of the investor on a single coin, can reduce risk of loss if any particular one goes “bust” (and we had just a case like that in our portfolio with the Solo coin) and creates opportunity to benefit from other competing coins in this supercharged space.

What is not to like? Share your ideas, I will be happy to discuss! And we’ll be checking back in later in the year to see how our current portfolio is doing. For more hints on portfolio construction from the front-line experts such as hedge fund and cta managers, check our other posts on the topic.