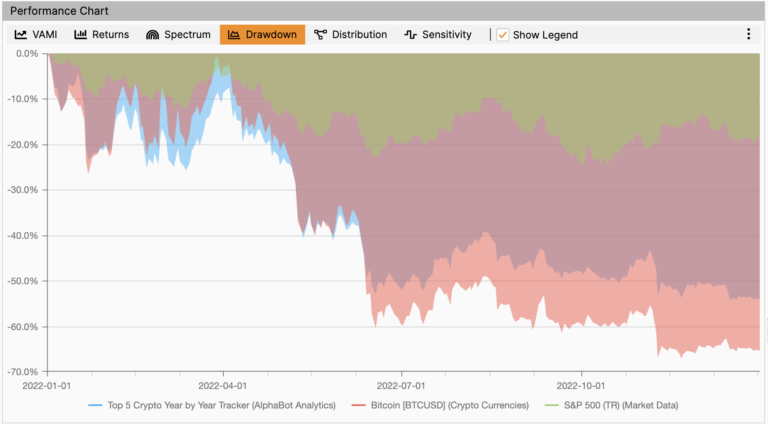

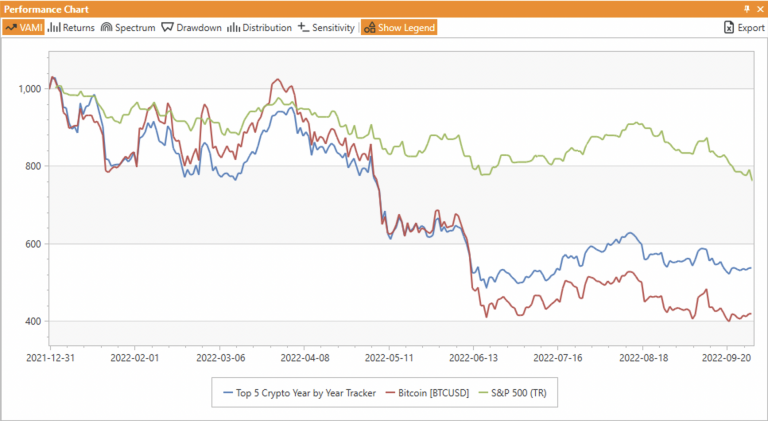

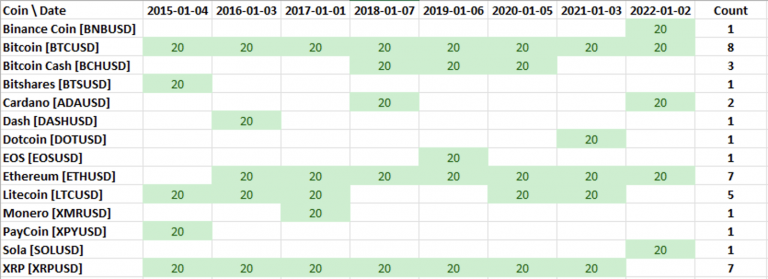

In April last year we created an index-like portfolio of major cryptocurrencies; it was constructed using the five coins with the highest market cap each year (measured by year-end) and then held for one year). This approach has shown interesting results over more than seven years of analysis, basically doubling the return of Bitcoin alone and outperforming equities.

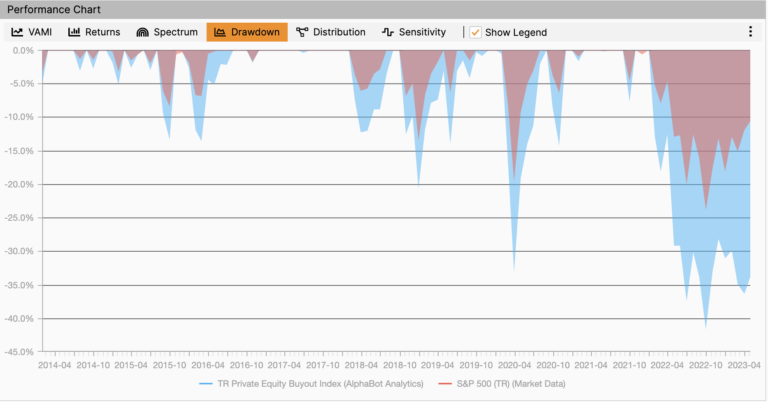

The rise in public equity prices during the ZIRP and quantitative easing years was mirrored in the private equity space as an abundance of cheap debt armed an ever increasing number of buyout funds with the ammunition they needed to complete deals.

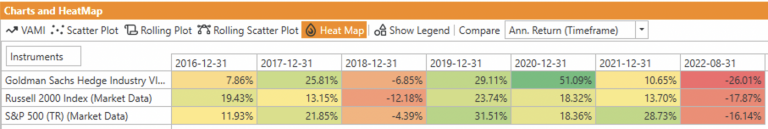

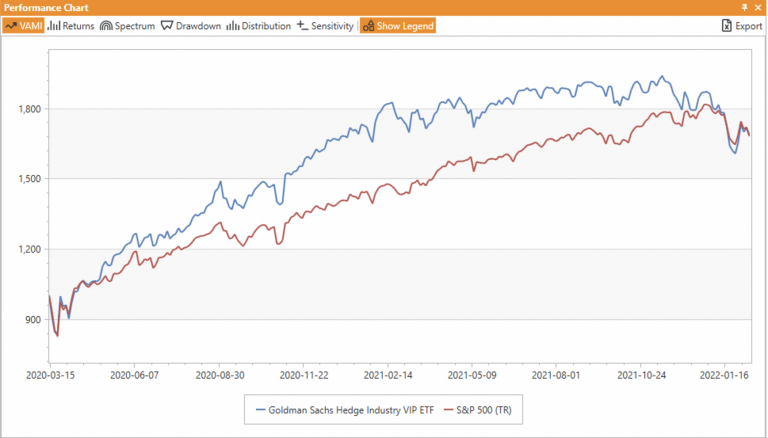

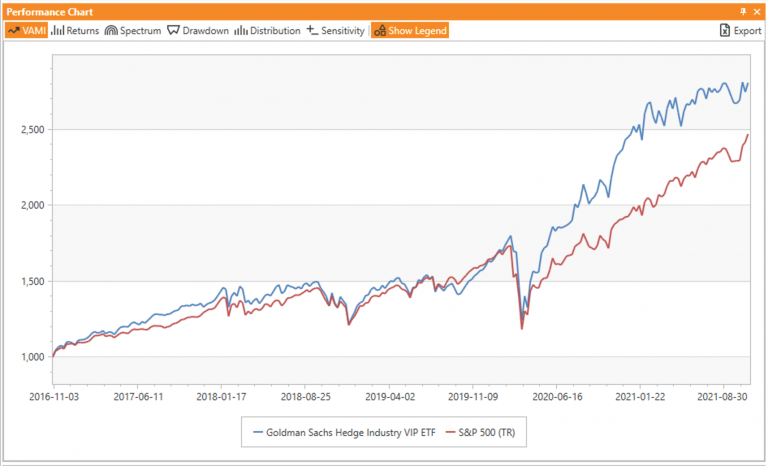

Are hedge funds good at picking their favorite long positions? We review GVIP ETF performance for 2022 to find the answer.

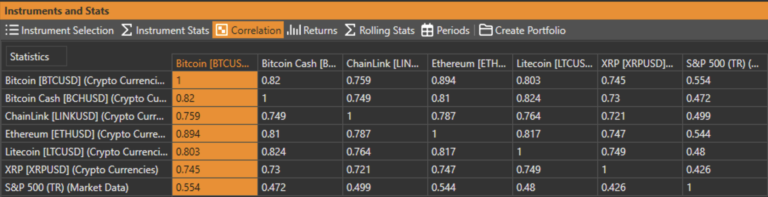

Year 2022 may prove to be fundamental or even "epochal" for cryptocurrency world development. Is it all just a deflating hot air balloon or will the events of the past year lead to a healthier and more mature space?

As crypto space matures, are there tools and techniques from the "old age" of investing to be applied? Here we build an index-like portfolio of cryptos to check what benefits this approach may bring to the space.

Can long-only strategies based on 13-F filings outperform the market? We follow up with tracking GS GVIP ETF over recent months

As crypto space matures, are there tools and techniques from the "old age" of investing to be applied? Here we build an index-like portfolio of cryptos to check what benefits this approach may bring to the space.

Can long-only strategies based on 13-F filings outperform the market? We take another look after our original analysis in November 2021.

Can long-only strategies based on 13-F filings outperform the market? We are taking a closer look at one ETF that tries to do just that.

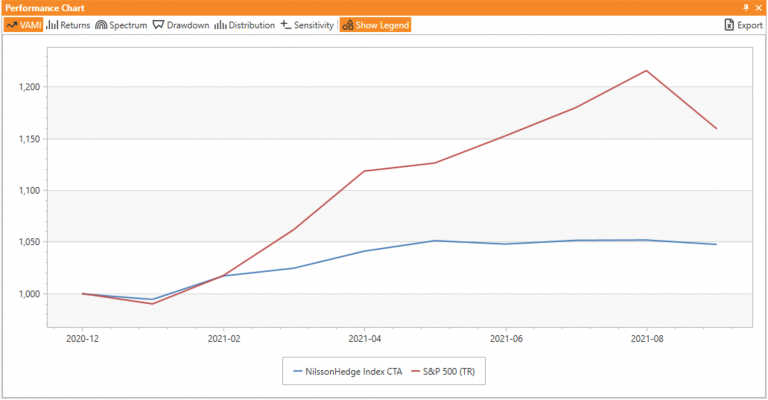

2021 is a year when many people have begun to enjoy a return to something like ‘normal’ life after the difficulties of 2020. And it certainly appeared like that for a while in financial markets - until recently - as many sectors bounced back and hedge fund strategies did well.