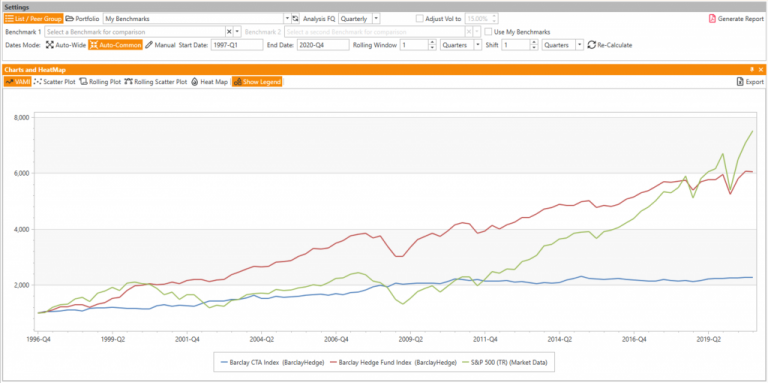

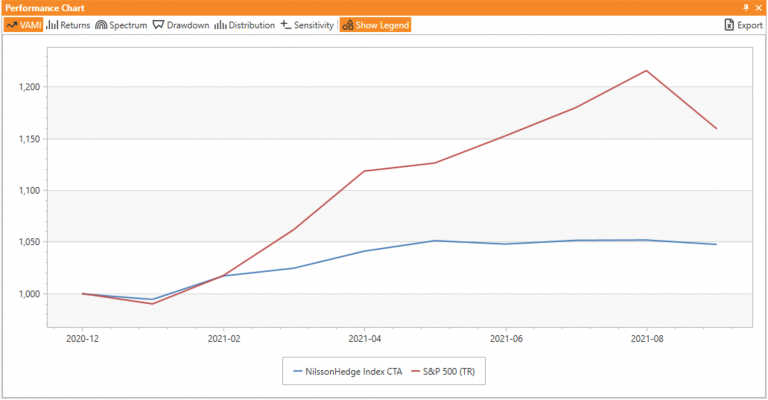

Managed Futures Q3 Performance Review

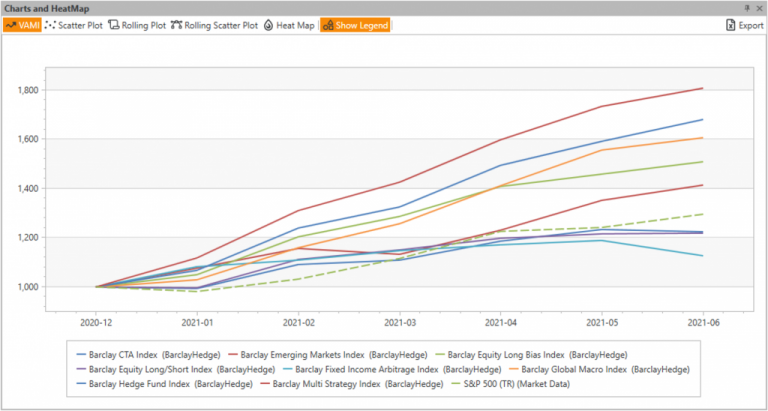

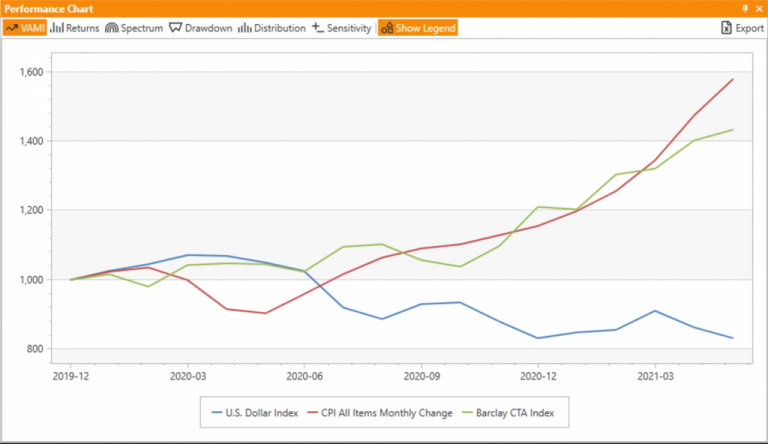

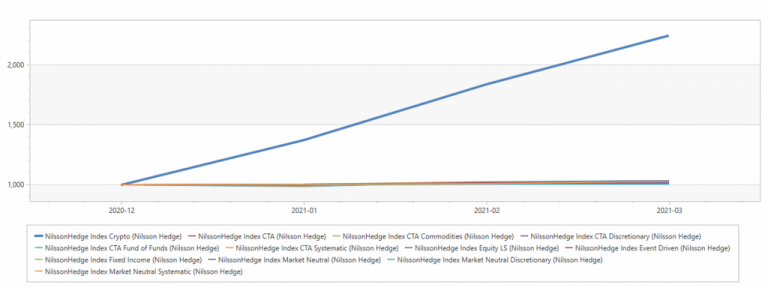

2021 is a year when many people have begun to enjoy a return to something like ‘normal’ life after the difficulties of 2020. And it certainly appeared like that for a while in financial markets - until recently - as many sectors bounced back and hedge fund strategies did well.