The head-spinning market dynamics of 2020 have affected many investment styles, giving some fund managers a chance to truly shine whilst others have fared rather less impressively. Now that we’ve finished up the third quarter of the year, we decided to take a look at the Nilsson Hedge database, a publicly available database of primarily managed futures strategies, and see what funds are on top so far.

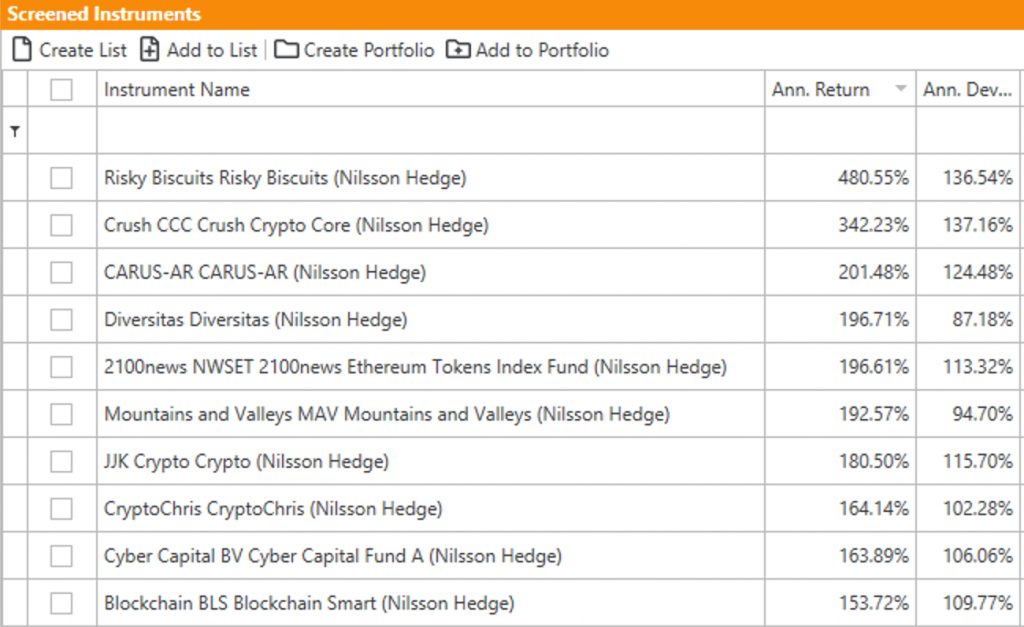

As of the time of writing, there were 844 funds/programs in the NilssonHedge database which have both performance data for September as well as performance data for the full year. We used AlphaBot’s Quant Screener tool to calculate the returns and were quite impressed with the top performers:

The triple-digits returns are very impressive, especially considering that on the other end of the spectrum funds have lost more than 30% YTD. And, as it turns out, all 10 top performers are crypto-funds, so the returns should be taken with some caution due to very high levels of volatility associated with crypto-currencies and crypto-funds (the second column).

In our previous note, “Are Crypto Funds Actually Adding Value” we observed that *on average* crypto funds do not outperform the underlying cryptos such as Bitcoin. As the funds listed above illustrate, the average is not a very representative measure due to high dispersion of performance.

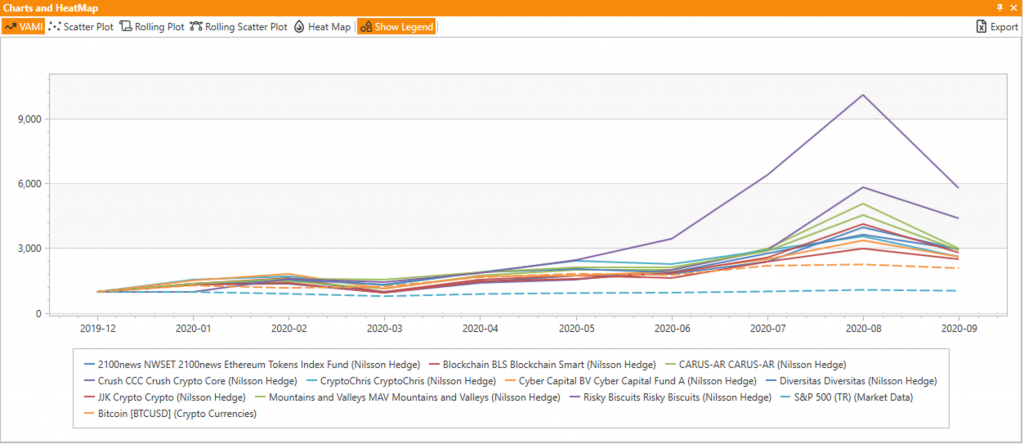

The above comparative chart of the performance for these 10 funds shows they have outperformed both the S&P500 and Bitcoin year-to-date, by a wide margin. The ultimate question is, of course, how an investor can select funds that have a good potential to outperform their peer group. This question, of course, does not have a simple answer and requires considerable expertise in the asset class, the markets, and understanding of investment methodology of managers involved, and deserves a separate post (or even a series of posts) that we will address at a future date.