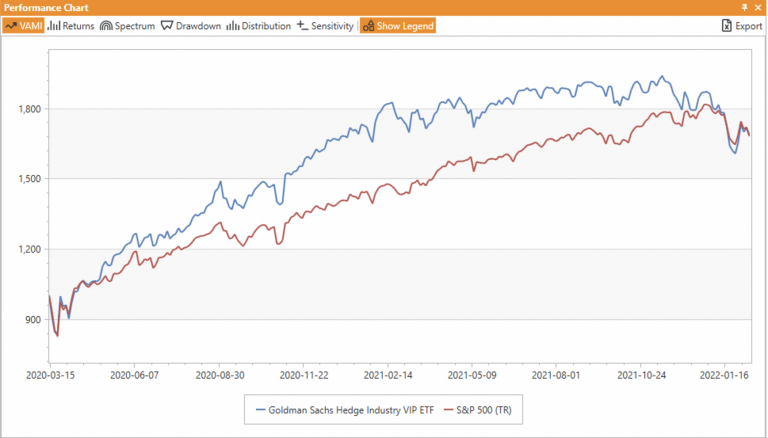

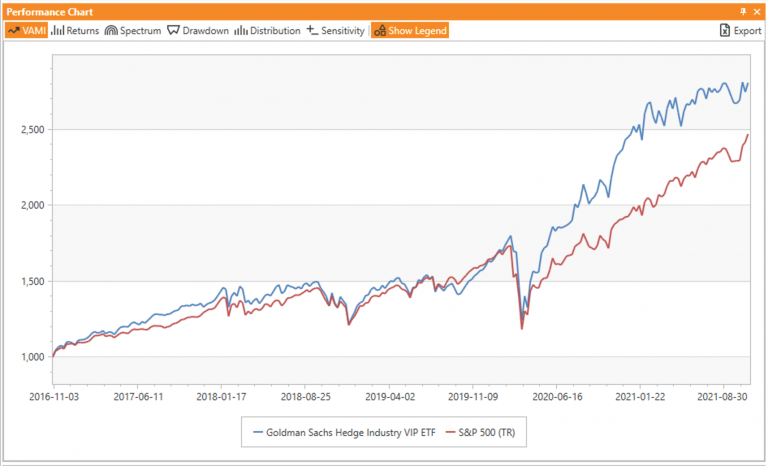

Goldman Sachs Hedge Industry VIP ETF Update

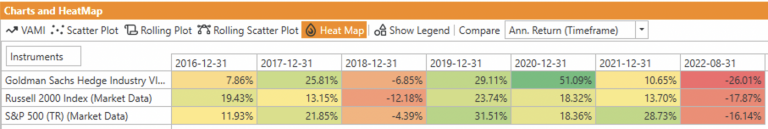

Can long-only strategies based on 13-F filings outperform the market? We follow up with tracking GS GVIP ETF over recent months

Can long-only strategies based on 13-F filings outperform the market? We follow up with tracking GS GVIP ETF over recent months

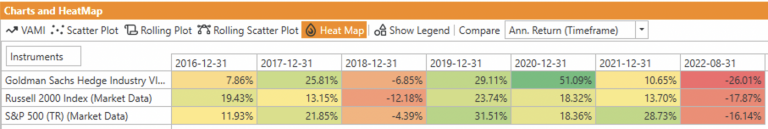

In January we announced winners of 2021 Tactical Award Winners, and 15 managers made the list across a number of categories. Where are they now, 6 months into the difficult 2022?

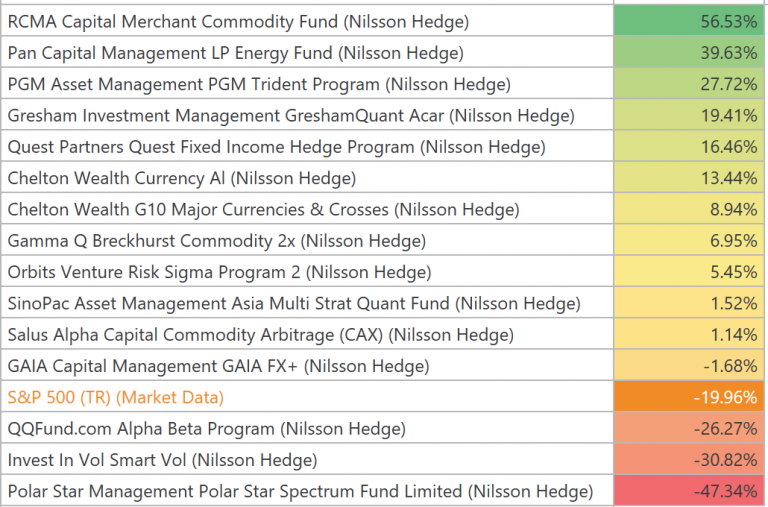

As crypto space matures, are there tools and techniques from the "old age" of investing to be applied? Here we build an index-like portfolio of cryptos to check what benefits this approach may bring to the space.

Can long-only strategies based on 13-F filings outperform the market? We take another look after our original analysis in November 2021.

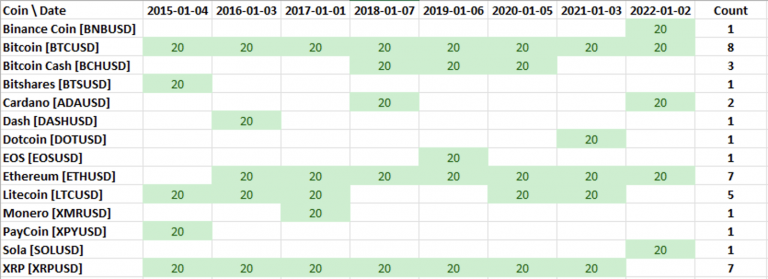

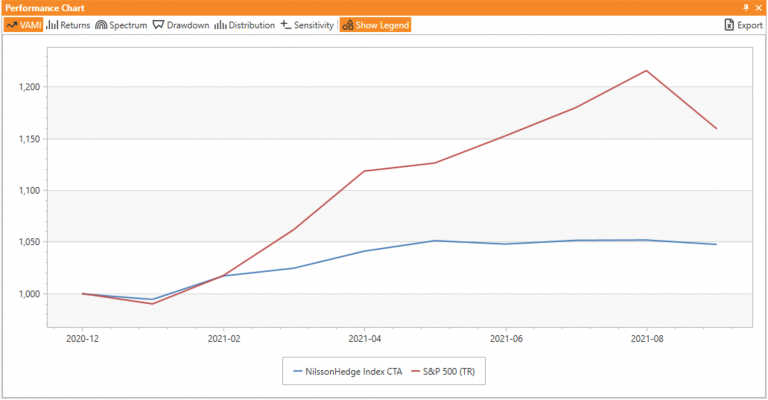

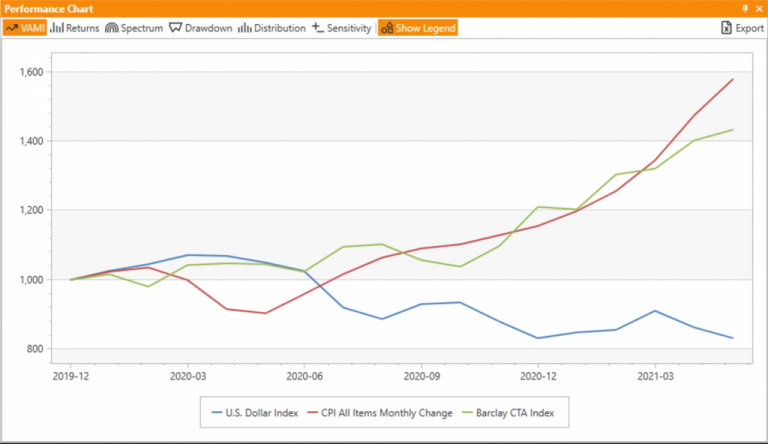

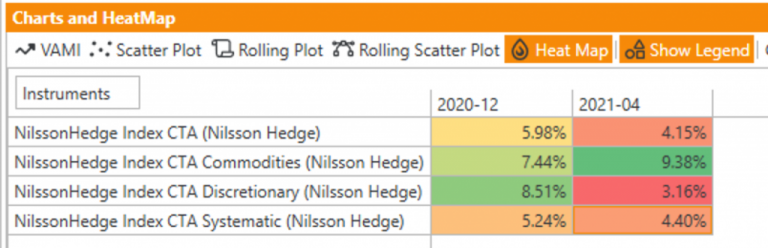

Commodities have traditionally been an inflation hedge, and with growing concerns over rising prices expressed by many, including yours truly, we wanted to take a look at how managed futures strategies are doing in the current environment.

Can long-only strategies based on 13-F filings outperform the market? We are taking a closer look at one ETF that tries to do just that.

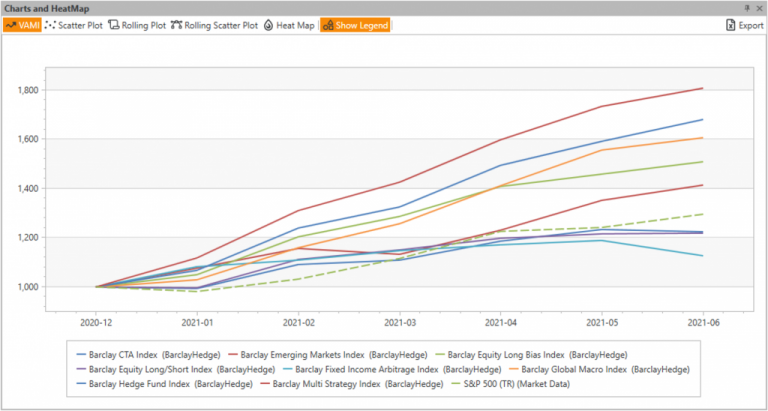

2021 is a year when many people have begun to enjoy a return to something like ‘normal’ life after the difficulties of 2020. And it certainly appeared like that for a while in financial markets - until recently - as many sectors bounced back and hedge fund strategies did well.

The equities keep charging forward as the first half of 2021 comes to a close, and hedge fund strategies performance in H1 seems to correlate to the amount of equites they hold. However, on Risk-Adjusted basis the picture is not so obvious.

Commodities have traditionally been an inflation hedge, and with growing concerns over rising prices expressed by many, including yours truly, we wanted to take a look at how managed futures strategies are doing in the current environment.

Commodity Managers are outperforming in the CTA pack of Nilsson Hedge indices through April 2021.