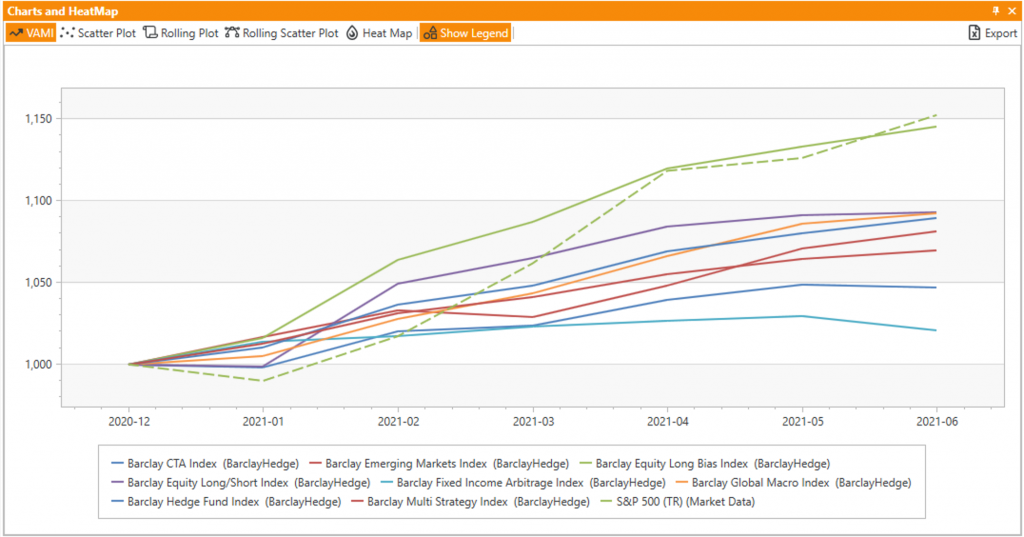

The first half of 2021 came and went, and so we’re going to look at the major hedge fund strategy indexes published by Backstop BarclayHedge to see which fared better. Not surprisingly, with everything from housing and cars to raw materials being pushed higher by continuing monetary stimulus and reopening economies, the long equity strategies are leading the pack. And while many say that the S&P500 is not a good benchmark for hedge funds, these days it is difficult to do any comparison without looking at stocks as a reference point. So, we’re including it in our chart as well.

Interestingly enough, the S&P500 – the dotted line – was behind in Q1 but then had a very strong two months in March and April, catching up with the Long Bias funds and overtaking them at the end of June. Other strategies did reasonably well, too, and their H1 returns seem to line up almost directly to the amount of long equities in their portfolios, with the two strategies with the least amount of stock holdings falling to the back of the pack – Managed Futures strategies, represented by the Barclay CTA Index, and Fixed Income.

Source: AlphaBot, BarclayHedge (learn to do analysis like this in minutes)

Notably, all of the main strategies tracked by Backstop BarclayHedge delivered positive performance in H1 this year.

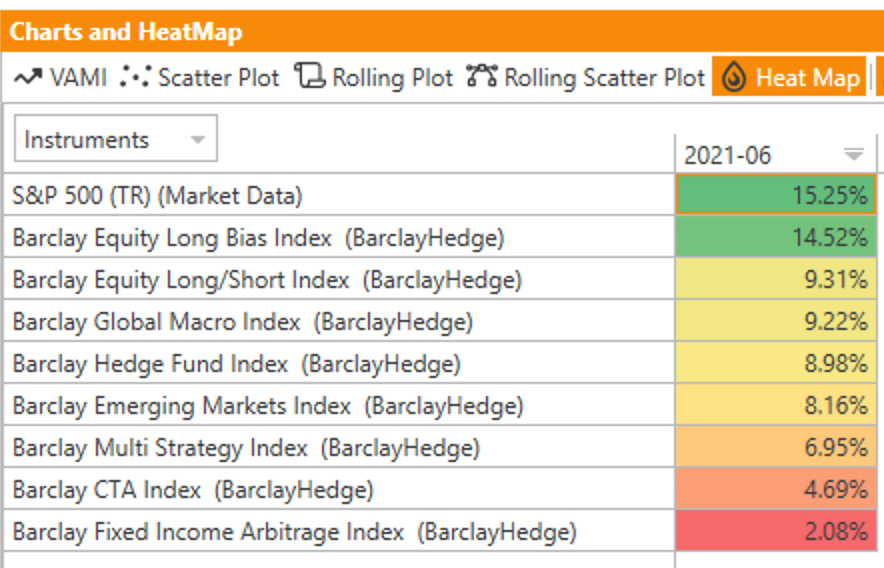

Source: AlphaBot, BarclayHedge (learn to do analysis like this in minutes)

The performance difference between the top Long Bias and the bottom Fixed Income Arbitrage strategies is quite substantial – more than 12 percentage points for the first six months of the year. Such numbers definitely lead to investors asking the question of whether there is anything other than equities to invest into, if one is looking for great returns. It seems that the moment equity indices give back gains and investors start looking for alternatives (pun intended), stocks bounce back strongly in the following couple of months and hedge fund investing falls back into the “to consider later” category.

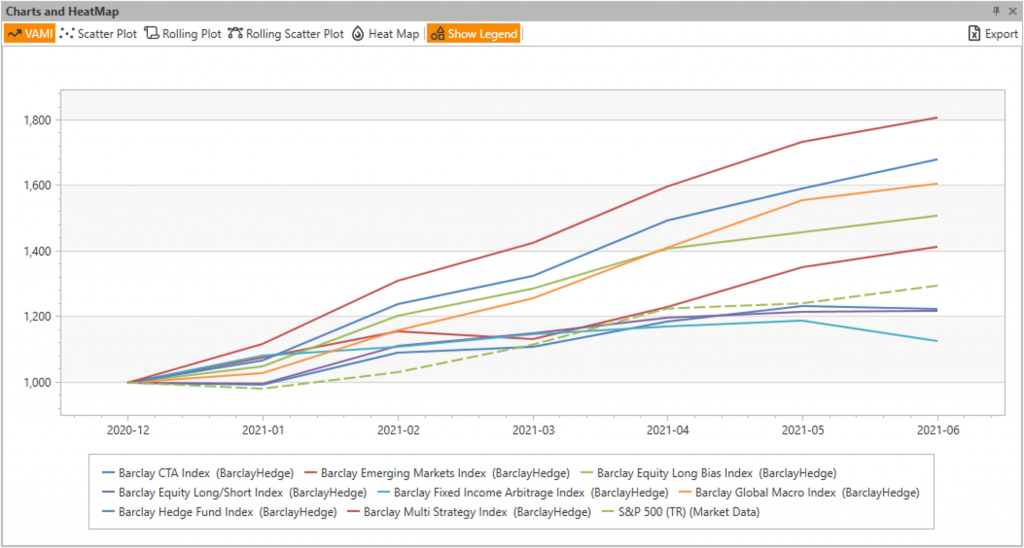

At the same time, the potential market, structural, and political risks keep mounting globally, and this justifiably leads many investors to consider the “what if” scenarios of declining stock markets. With this consideration, adjusting for risk (in our case – measured by volatility, adjusted to 15% annualized for all indices) can provide some valuable insight and reveal an interesting picture.

Using such a risk-adjusted view, the Multi-Strategy, overall Hedge Fund, and Global Macro indices are taking the lead with predominantly equity-long strategies sliding to the middle of the line up. And while this analysis is done over a very short time frame of just 6 months, it still offers insight on the value of hedging when risk and volatility are taken into consideration.

Source: AlphaBot (learn to do analysis like this in minutes)

Stay tuned for our regular performance updates as we keep monitoring the industry, looking for interesting patterns and observations to share with our readers.