The rise in public equity prices during the ZIRP and quantitative easing years was mirrored in the private equity space as an abundance of cheap debt armed an ever increasing number of buyout funds with the ammunition they needed to complete deals.

DSC Quantitative Group in Chicago works with Refinitiv to produce an interesting index, the Refinitiv Private Equity Buyout Index, which “seeks to replicate the performance of the Refinitiv Private Equity Buyout Benchmark Index through a combination of liquid, publicly listed assets.” We’ve covered the index a few times before, but not for a while, and given the recent tumult in both public and private markets, we thought it would be interesting to revisit it to see how the private equity folks are doing versus their public peers – specifically, the S&P 500.

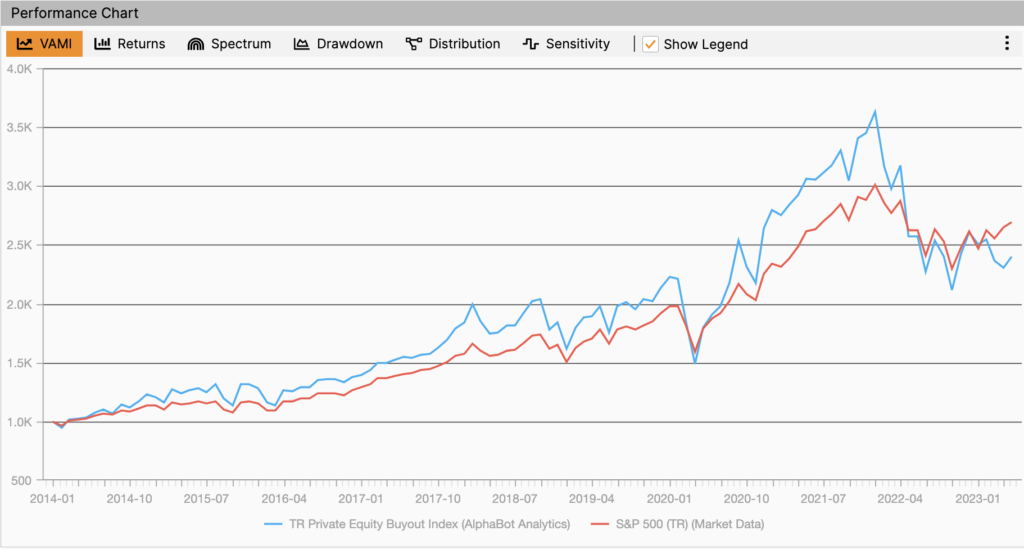

When looking at the historical performance of the two indexes, one can easily observe the persistent out-performance of the private side from 2014 through the end of 2021. But then, at the same time that the QE program in the United States ended (officially the program ended in March 2022), the PEBI experienced something of a sudden collapse.

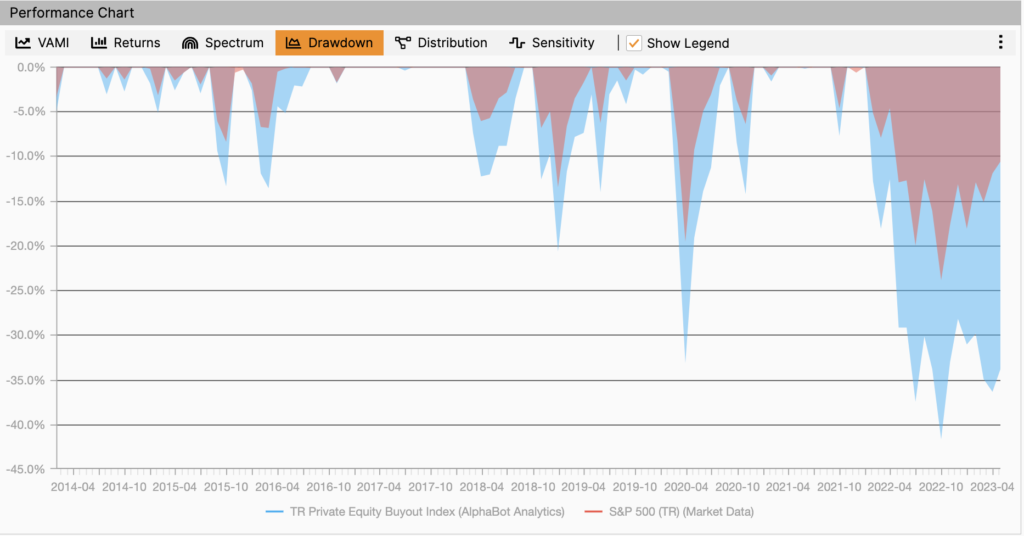

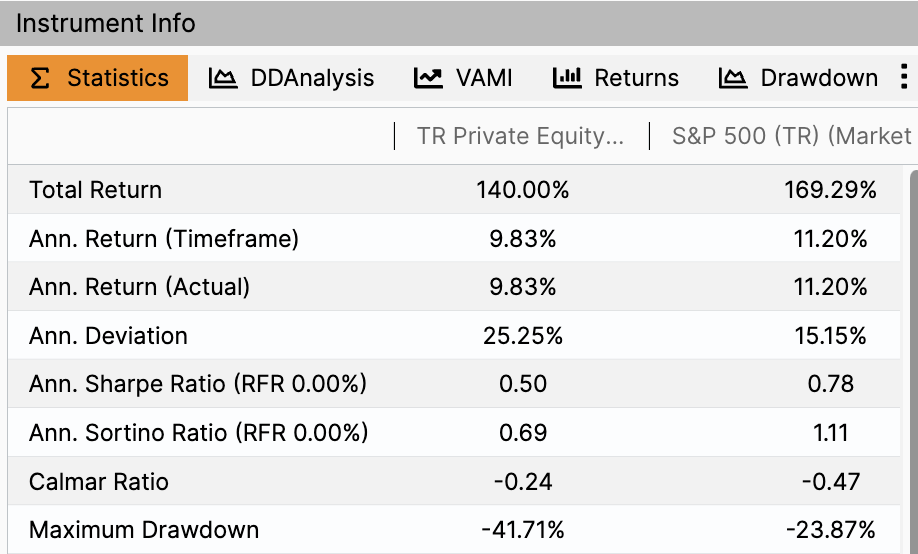

To appreciate the size of the drop, it is best to look at the drawdown chart below. Basically, the drawdown of the PE index – which it is still in – is almost twice the size of that of the general market, and while its volatility is also larger, the Sharpe and Sortino ratios show the trade-off in the past ten years is not on the side of the PE Index.

How can this behavior be explained? One guess is that the removal of cheap credit contributed significantly to bursting the PE asset bubble; after all, higher interest rates impact valuations in the PE space significantly.

The interesting question, as usual, would be about the future potential of PE. Will it “work” – that is, outperform public equity markets – in an environment of rising interest rates? Yes, plenty of successful private equity funds were raised and closed during the pre-Global Financial Crisis period. And surely, as in most types of investments, some deals will work better than others, and good GPs will outperform. But competition in the space has never been greater, and so finding the successful ones will likely be more difficult going forward.

The Refinitiv Buyout Index had only one losing year – 2018 – since its inception at the beginning of 2014. But it ended 2022 down -31.07%, and year to date, is down -13.87%. The S&P 500 is up around 11% so far this year. It’ll be interesting to see whether private equity does enjoy an ‘illiquidity premium’ or whether it’s much more cyclical.