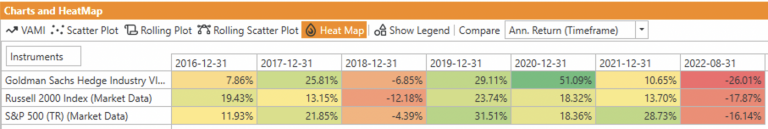

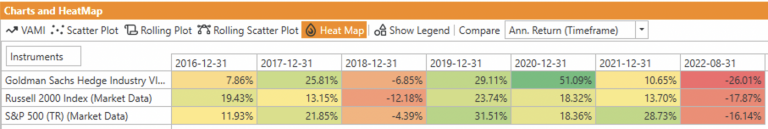

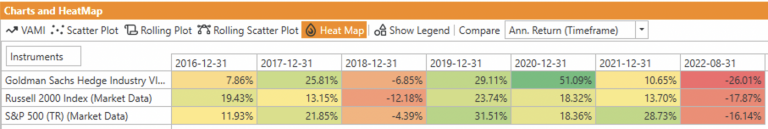

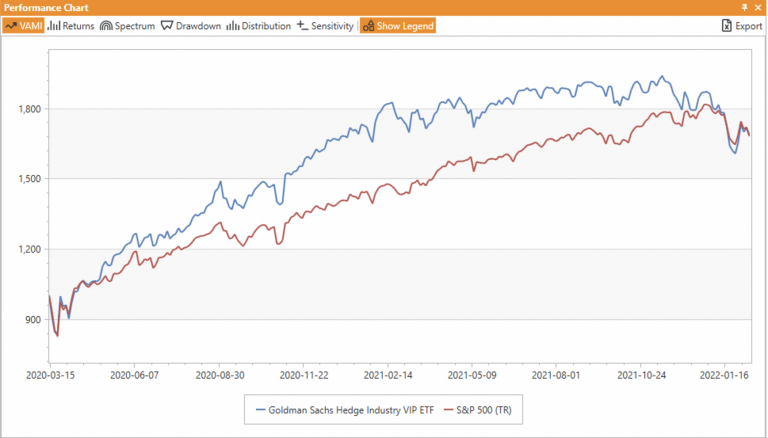

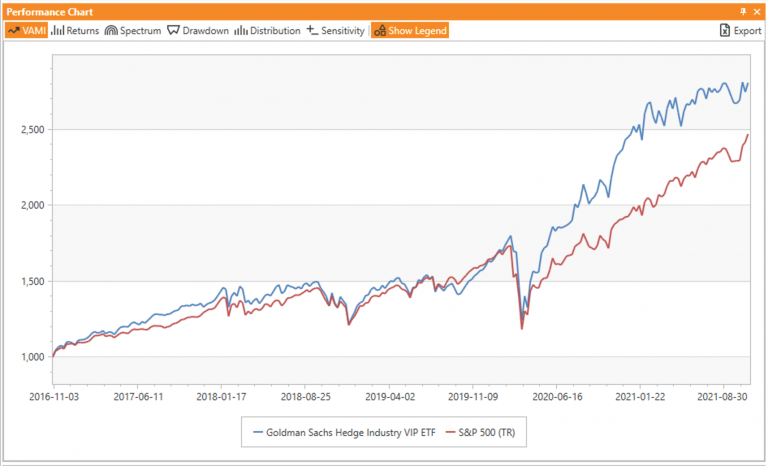

Goldman Sachs Hedge Fund VIP ETF 2022 Review

Are hedge funds good at picking their favorite long positions? We review GVIP ETF performance for 2022 to find the answer.

Are hedge funds good at picking their favorite long positions? We review GVIP ETF performance for 2022 to find the answer.

Can long-only strategies based on 13-F filings outperform the market? We follow up with tracking GS GVIP ETF over recent months

Can long-only strategies based on 13-F filings outperform the market? We take another look after our original analysis in November 2021.

Can long-only strategies based on 13-F filings outperform the market? We are taking a closer look at one ETF that tries to do just that.

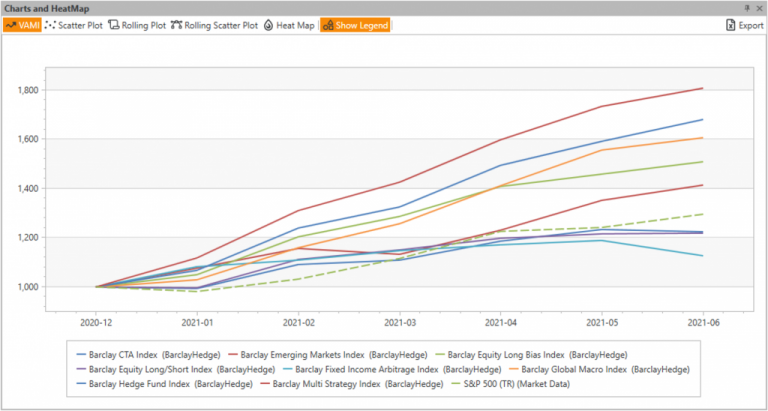

The equities keep charging forward as the first half of 2021 comes to a close, and hedge fund strategies performance in H1 seems to correlate to the amount of equites they hold. However, on Risk-Adjusted basis the picture is not so obvious.

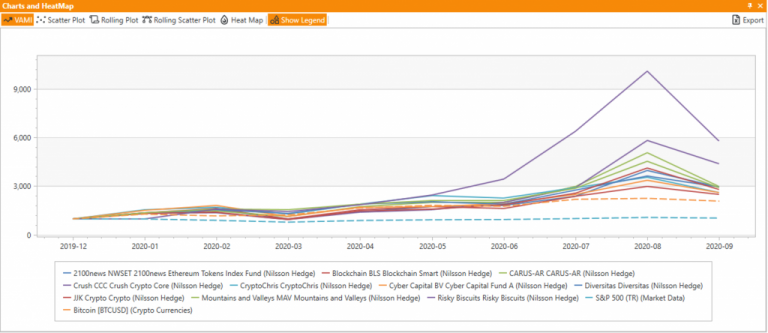

September's top 10 performers list derived from Nilsson Hedge database is dominated by the Crypto hedge funds.

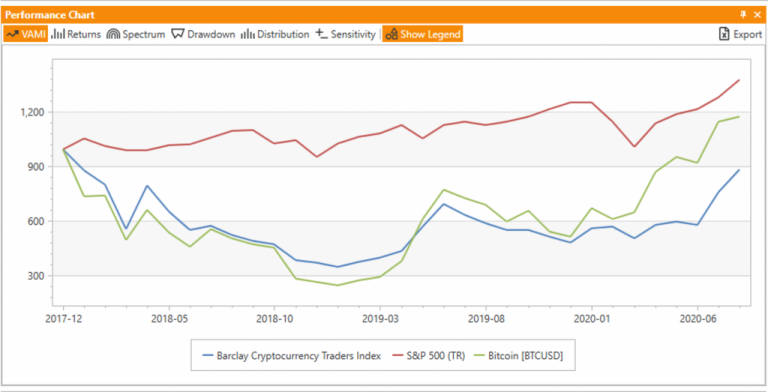

There is a growing number of cryptocurrency based investment funds with the estimated number rotating around a few hundred and AUM of around $20B. Are they adding value for the investors?

Join Vishal Olson (Holson Asset Management), Kambiz Kazemi (Financiere Constance) and Timothy Jacobson (Pearl Capital Advisors) for an exciting discussion of benefits, risks, and investor tips when researching and investing in volatility and options based strategies. Moderated by Dmitri Alexeev, Ph.D. (AlphaBot)

Join Vishal Olson (Holson Asset Management), Kambiz Kazemi (Financiere Constance) and Timothy Jacobson (Pearl Capital Advisors) for an exciting discussion of benefits, risks, and investor tips when researching and investing in volatility and options based strategies. Moderated by Dmitri Alexeev, Ph.D. (AlphaBot)

Matt Brown, MSR Indices and Jonathan Webb, C8 Technologies, taking a look at the current state of the art of Risk Premia solutions. Moderated by Dmitri Alexeev, Ph.D., AlphaBot.