There is a growing number of cryptocurrency based investment funds with the estimated number rotating around a few hundred and AUM of around $20B. The number of funds declined after the famous crypto bust of late 2018, but has risen again since as the price of major cryptocurrencies has recovered. We wanted to take a look at the overall benefits of such funds and compared performance of the Barclay Cryptocurrency Traders Index to Bitcoin (BTCUSD) and the S&P500.

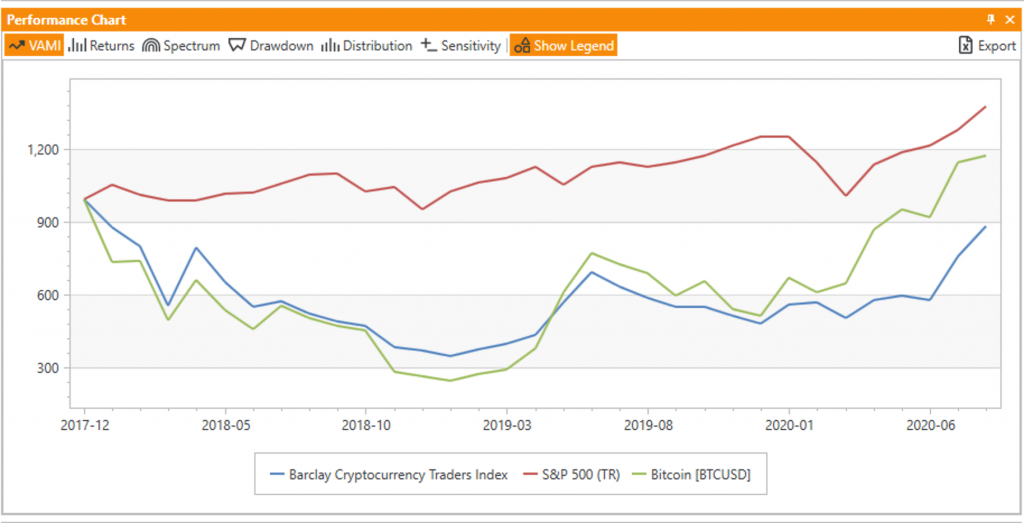

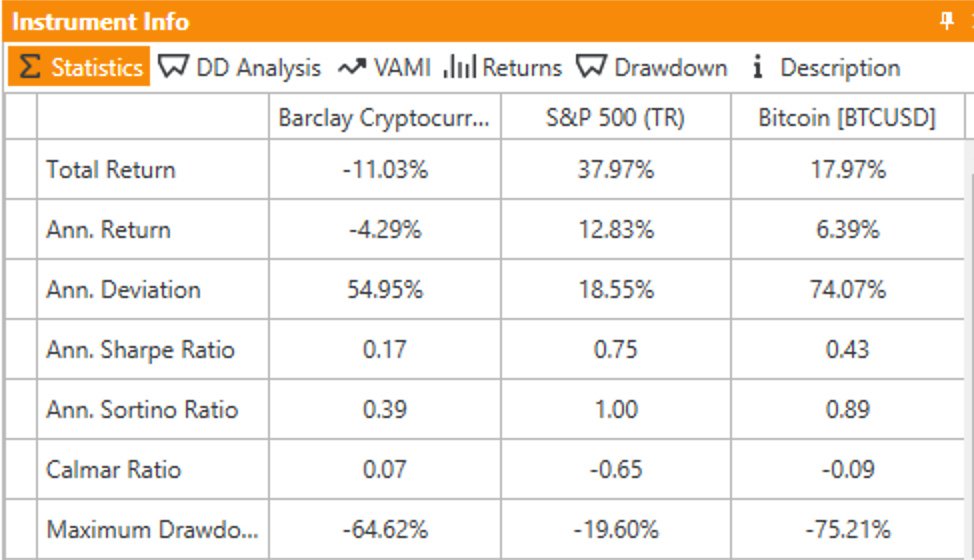

The returns in our analysis go back to Jan 2018 and sadly the overall picture leaves much to be desired for the Barclay Crypto Traders index within this timeframe as it underperformed both US equities and Bitcoin:

The period we’re looking at includes the crypto-crash, so the performance relative to the equities is understandable. Yet, the returns in comparison to pure Bitcoin exposure suggests that the funds are not doing a great job at adding value.

The goals of investing into a fund vs a standalone instrument such as Bitcoin are well-known: diversification, which should reduce volatility, risk-management skills of fund managers. Which should reduce drawdowns and, if the fund is actively managed, alpha, or an additional return on top of a passive benchmark. In the case of the Barclay Crypto Traders Index we can see that the reduction in volatility is not worth the loss of performance and the drawdown is on the same order of magnitude, so basically none of the benefits are materializing within this timeframe.

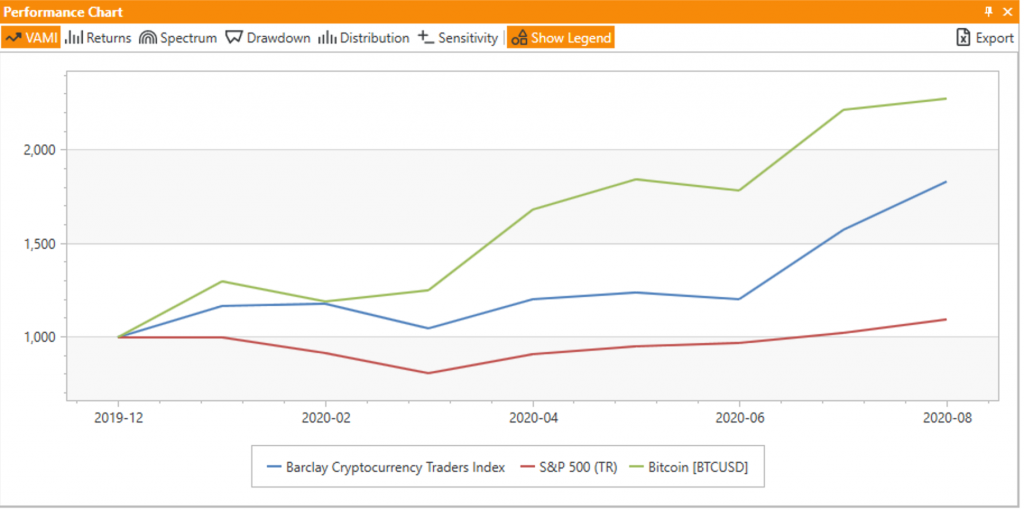

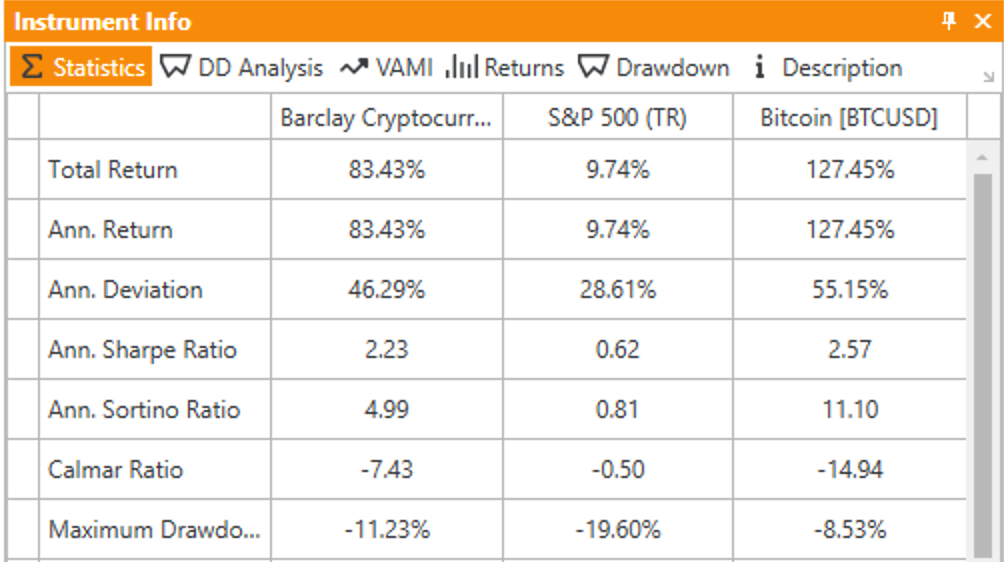

If we focus solely on 2020 year to date, the perspective differs. Many investors have flocked to cryptocurrencies as they perceive them to be a form of asset protection. As can be seen below, US equities have underperformed both the Barclay Crypto Traders Index and Bitcoin itself so far this year.

Equity prices were quite volatile in the spring, observing both the fastest decline since the Great Depression followed by the fastest recovery, but compared to the dynamics of the cryptocurrency asset class, even this much drama seems quite tame; Bitcoin really surged this year, more than doubling in price. At the same time, the Crypto Traders index achieved none of the 3 objectives again, even in this time of great opportunity. The volatility and drawdown did not really improve, and return is lagging (vs Bitcoin). It looks like crypto traders should take a really good look at their offering and try to improve their skills.

Of course, we are talking about an aggregated index, so there are funds doing better than the average (as well as funds doing much worse, obviously), so we will, as always, be keeping an eye on the space. The next time we revisit the crypto hedge fund space, however, we’re hoping to see better results.