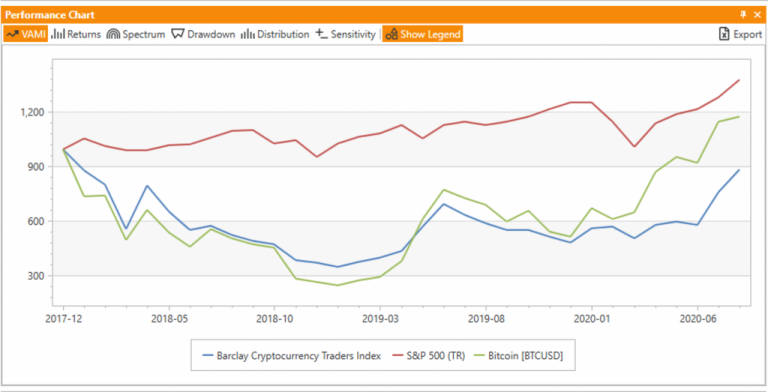

What Bitcoin’s Correlation with the Stock Market Means for Investors

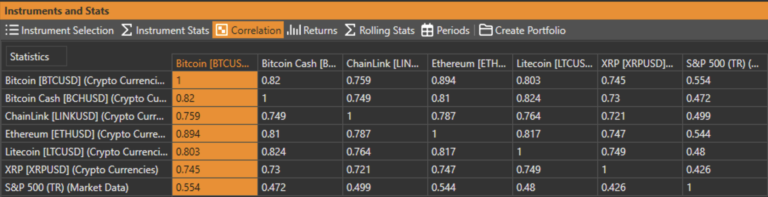

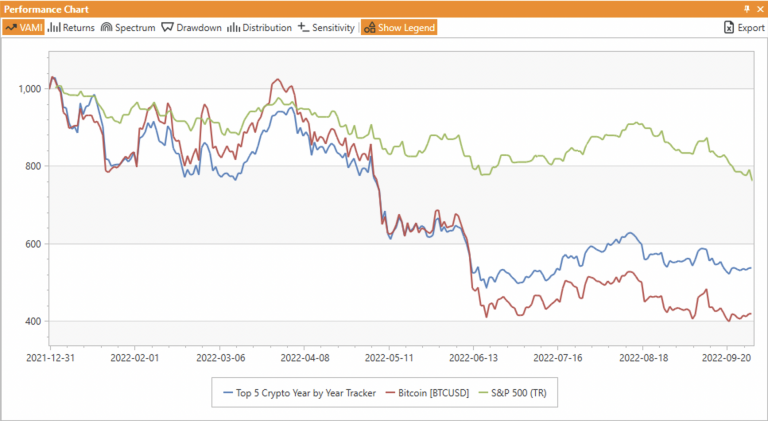

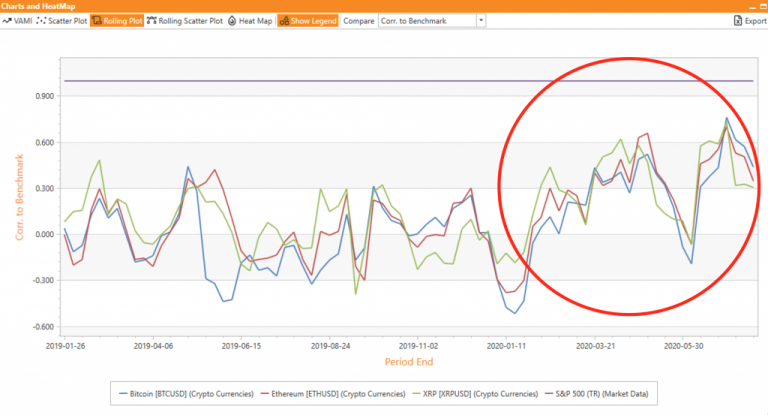

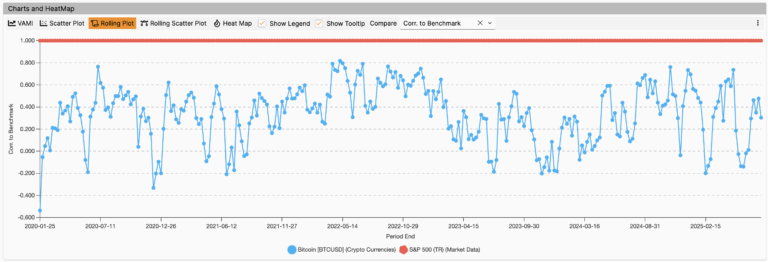

As Bitcoin reached a new all-time high, surpassing $123,000 on Monday, July 14, 2025 fueled by ETF inflows, growing institutional interest and investor optimism, it is important to reflect on its overall relationship with the stock market. As an investor, understanding the dynamics between different asset classes is critical in crafting a balanced and diversified portfolio.