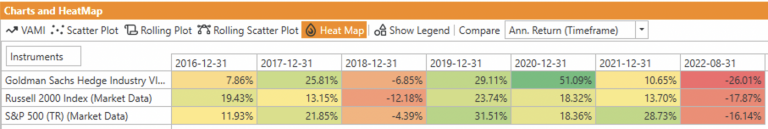

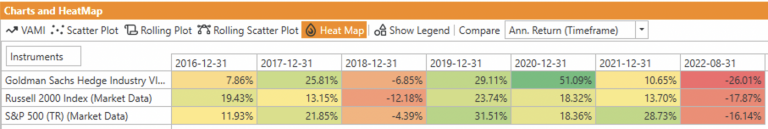

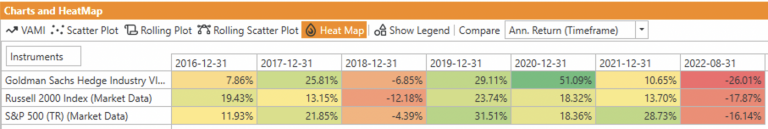

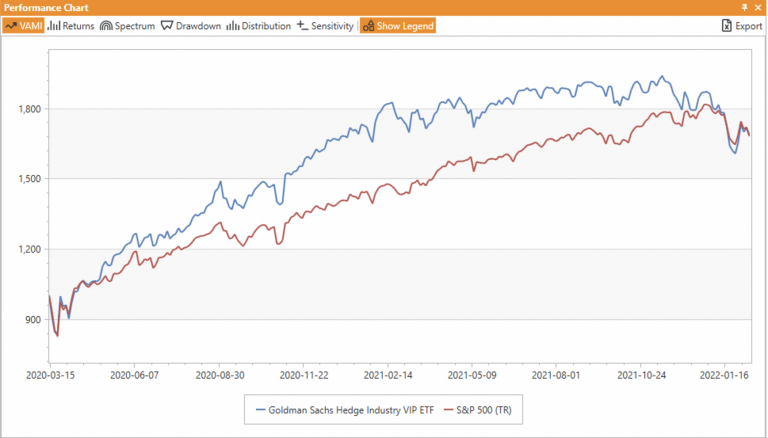

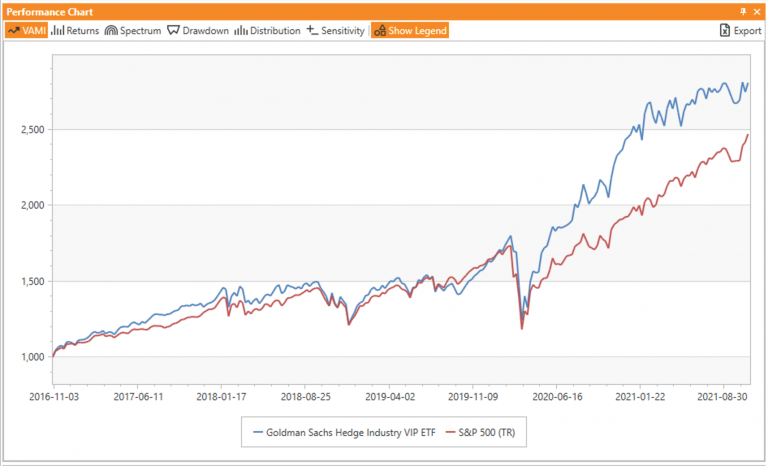

Goldman Sachs Hedge Fund VIP ETF 2022 Review

Are hedge funds good at picking their favorite long positions? We review GVIP ETF performance for 2022 to find the answer.

Are hedge funds good at picking their favorite long positions? We review GVIP ETF performance for 2022 to find the answer.

Can long-only strategies based on 13-F filings outperform the market? We follow up with tracking GS GVIP ETF over recent months

Can long-only strategies based on 13-F filings outperform the market? We take another look after our original analysis in November 2021.

Can long-only strategies based on 13-F filings outperform the market? We are taking a closer look at one ETF that tries to do just that.

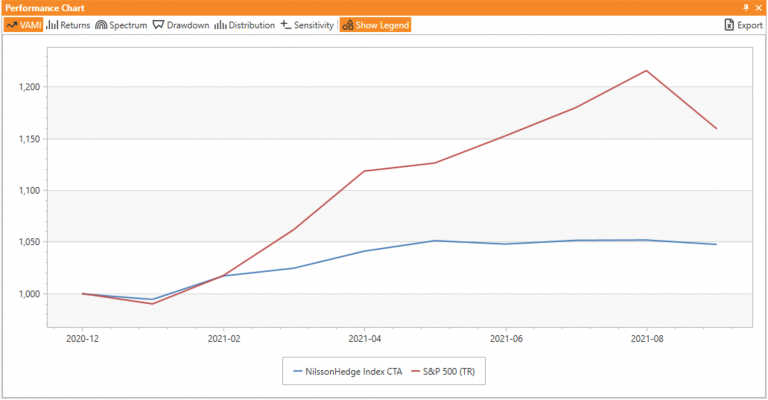

2021 is a year when many people have begun to enjoy a return to something like ‘normal’ life after the difficulties of 2020. And it certainly appeared like that for a while in financial markets - until recently - as many sectors bounced back and hedge fund strategies did well.

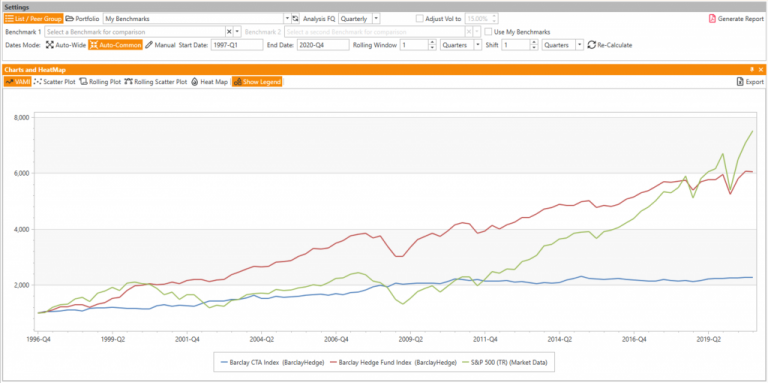

It appears that CTAs tend to outperform in the last quarter of US Presidential Election years. Will this effect hold true in 2020?

It may be difficult to believe but the year 2020 is almost over. We are reviewing a number of international stock market indices in search for hints in 2021.

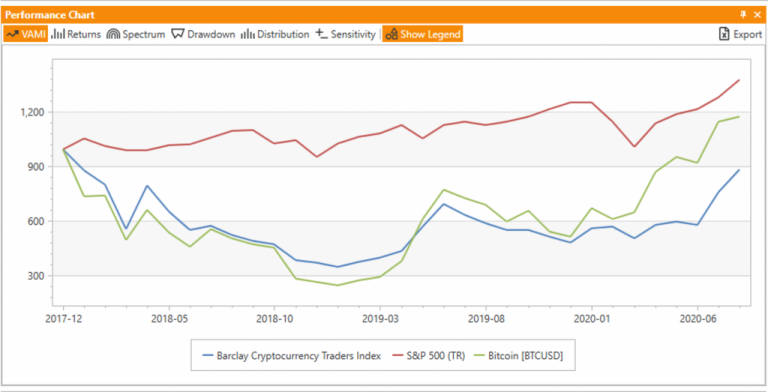

There is a growing number of cryptocurrency based investment funds with the estimated number rotating around a few hundred and AUM of around $20B. Are they adding value for the investors?

Join Vishal Olson (Holson Asset Management), Kambiz Kazemi (Financiere Constance) and Timothy Jacobson (Pearl Capital Advisors) for an exciting discussion of benefits, risks, and investor tips when researching and investing in volatility and options based strategies. Moderated by Dmitri Alexeev, Ph.D. (AlphaBot)

Matt Brown, MSR Indices and Jonathan Webb, C8 Technologies, taking a look at the current state of the art of Risk Premia solutions. Moderated by Dmitri Alexeev, Ph.D., AlphaBot.