Are Crypto Hedge Funds Actually Adding Value?

There is a growing number of cryptocurrency based investment funds with the estimated number rotating around a few hundred and AUM of around $20B. Are they adding value for the investors?

There is a growing number of cryptocurrency based investment funds with the estimated number rotating around a few hundred and AUM of around $20B. Are they adding value for the investors?

Join Vishal Olson (Holson Asset Management), Kambiz Kazemi (Financiere Constance) and Timothy Jacobson (Pearl Capital Advisors) for an exciting discussion of benefits, risks, and investor tips when researching and investing in volatility and options based strategies. Moderated by Dmitri Alexeev, Ph.D. (AlphaBot)

Join Vishal Olson (Holson Asset Management), Kambiz Kazemi (Financiere Constance) and Timothy Jacobson (Pearl Capital Advisors) for an exciting discussion of benefits, risks, and investor tips when researching and investing in volatility and options based strategies. Moderated by Dmitri Alexeev, Ph.D. (AlphaBot)

Matt Brown, MSR Indices and Jonathan Webb, C8 Technologies, taking a look at the current state of the art of Risk Premia solutions. Moderated by Dmitri Alexeev, Ph.D., AlphaBot.

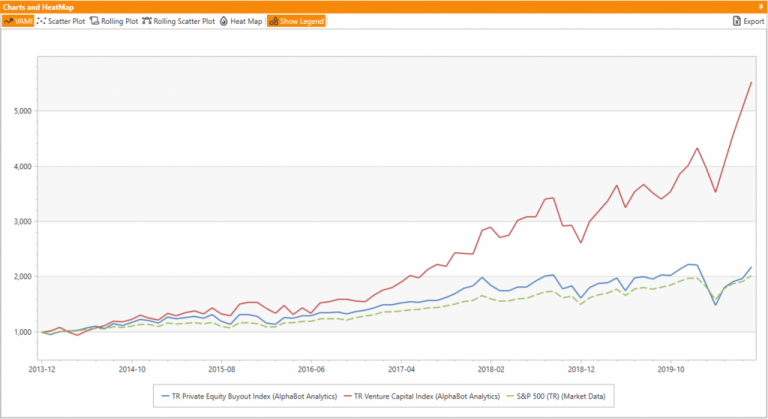

The Venture Capital index demonstrates amazing results by controlling losses and magnifying returns - the "smart money" appears to know what it is doing.

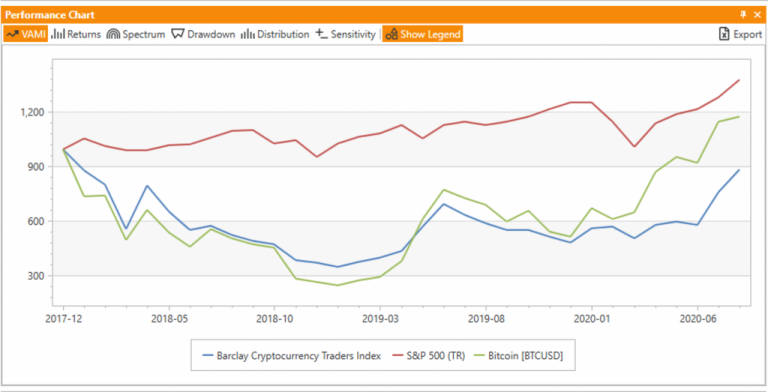

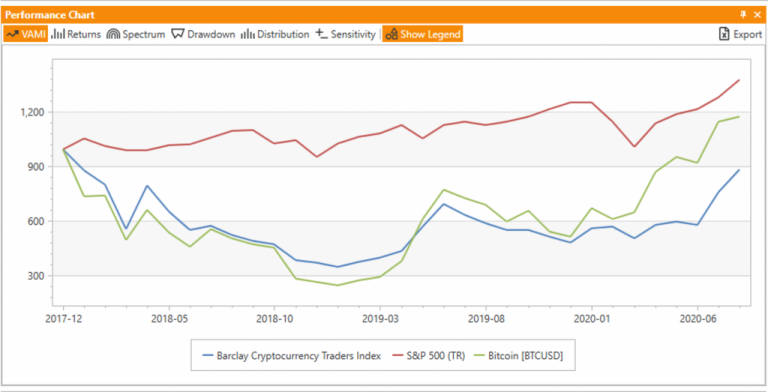

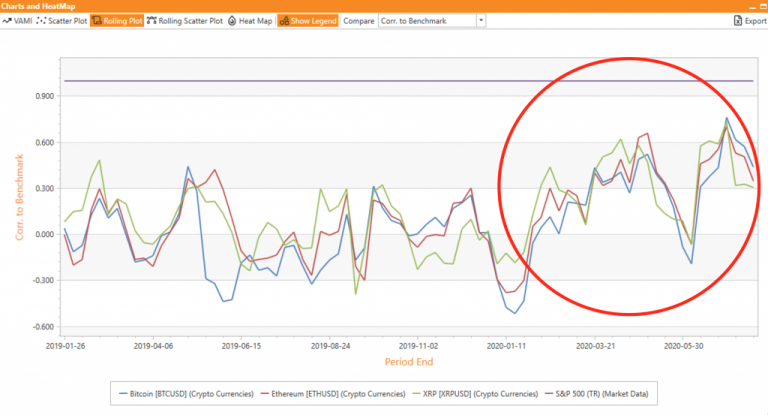

There is a noticeable and unprecedented trend of increasing correlations between crypto and equity markets.

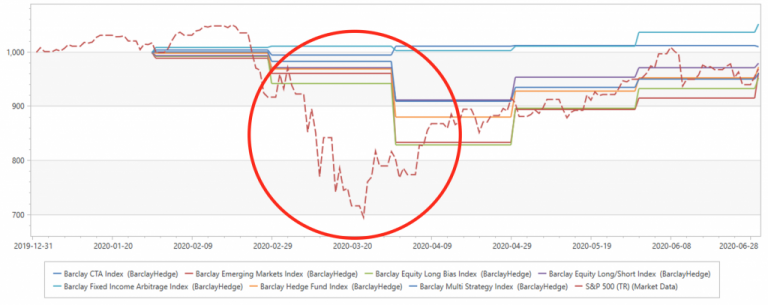

Reaching the midpoint for the year 2020 can be viewed as a positive because many people, I am sure, want this year to be over with as soon as possible. Yet, the end of H1 is a good point to pause and review the first half, and hopefully see some indication of what to expect in the second half. We’re going to take a look at the 7 largest Hedge Fund strategies in terms of AUM, courtesy of BarclayHedge.

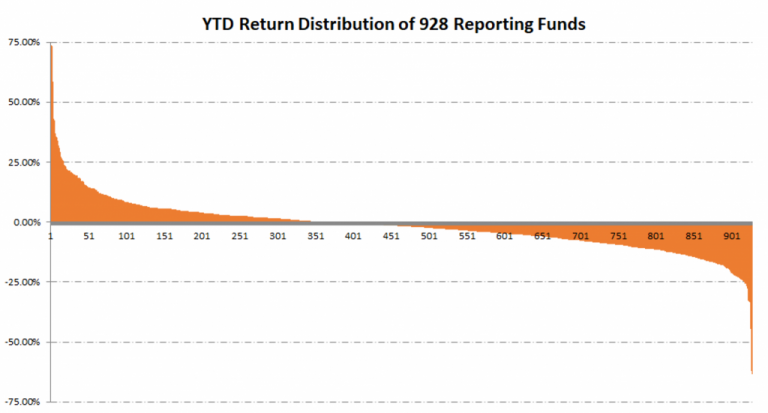

Funds reporting through June on the NilssonHedge database, a public database of hedge fund returns, shows the industry split in half during the first six months of the year. The average positive and the average negative returns of the 928 funds that NilssonHedge has data for through June are the same to within a basis point: 7.82% vs -7.83%, with negative returns being a majority (about 2/3rds or 562 of all returns).

An exciting discussion of recent developments in equity markets, extreme volatility levels, outlook, and valuable hints for investors on dealing with this market environment.

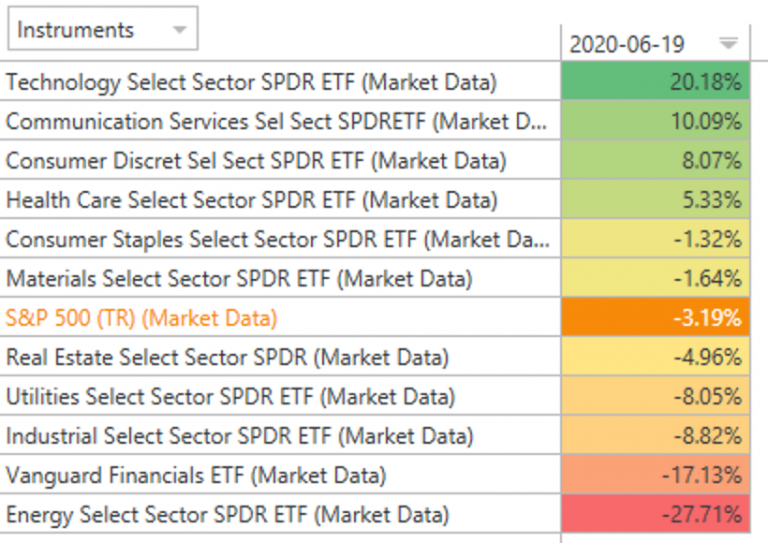

Equity Sector Specific ETFs have very high correlations of 80% or more on average, but it does not stop them from having dramatically different performance this year.