Back in January we looked at two indices created by Chicago-based DCS Quantitative Group in collaboration with Thomson Reuters (now Refinitiv) – the Thomson Reuters Private Equity Index (TRPEI) and the Thomson Reuters Venture Capital Index (TRVCI). The TRPEI is a private equity replication index which uses a combination of liquid, publicly traded securities to replicate the gross performance (i.e., before fund fees) of the U.S. private equity/buyout industry, and the TRVCI is the venture capital version. We wanted to revisit their performance this year and check the impact of the COVID-19 pandemic.

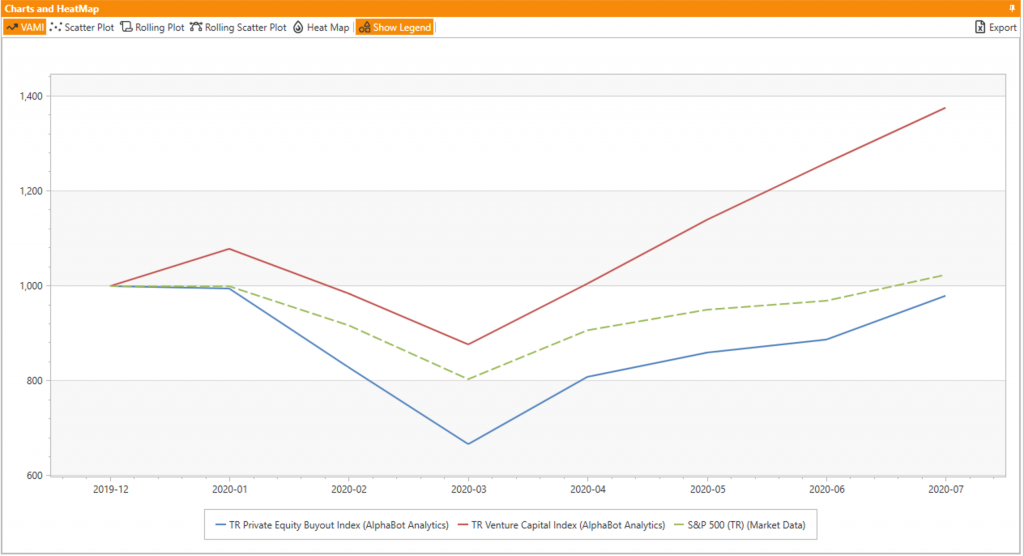

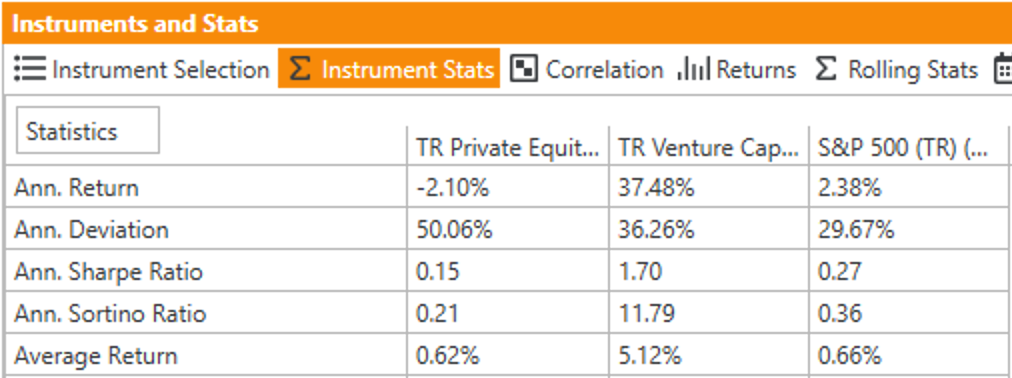

The results are in line with our expectations. Venture capital, or “smart money”, has done an excellent job and generated very impressive performance. Private equity has still not recovered from the blow and is trailing the S&P 500 by a few percent YTD.

All three indices (VC, PE and S&P) had their lowest point in March, when the impact of the lockdowns on the global economy were perceived as being at their most severe, but Venture Capital suffered a much smaller loss while the subsequent gains were the strongest. Combined together, that resulted in almost a +40% return difference through July.

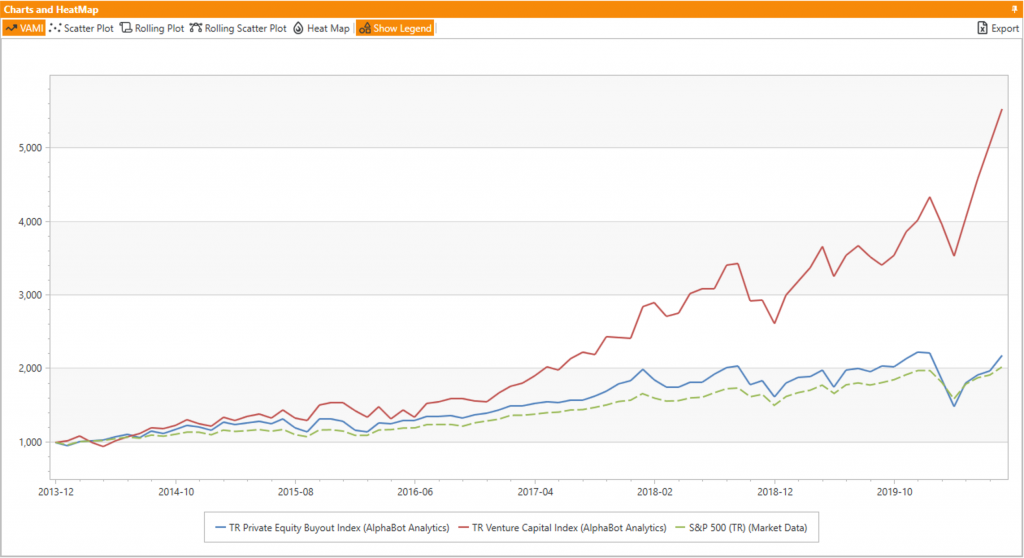

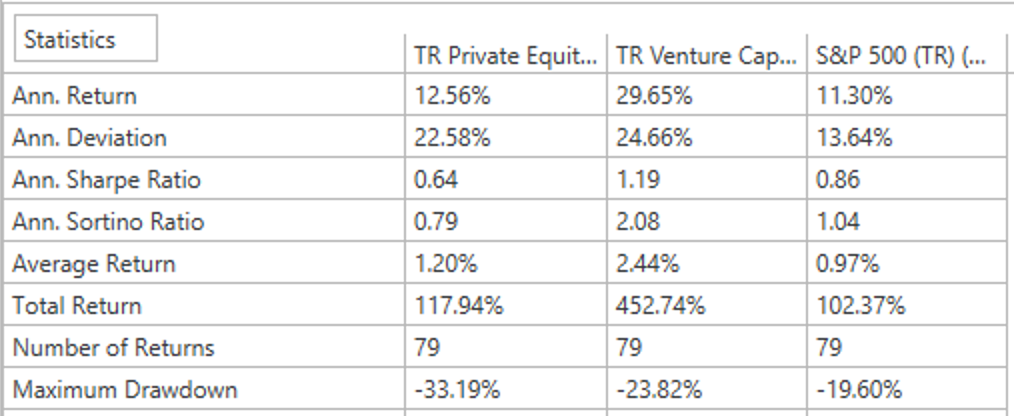

The time frame is only 7 months, of course, so we wanted to check if this kind of relative performance is true on a longer horizon. So we ran the analysis for the period of commonly available returns for all 3 indices. The results are very consistent:

While the Private Equity index is flirting with equities, the smart guys and gals at venture shops are absolutely flooring it with almost *triple* the annualized return of S&P and yet comparable drawdowns. The ability to control losses while magnifying gains is what defines excellent long term performance, and the “smart money” seems to know how to do it just right.

Time will tell whether private equity and venture capital will continue to thrive but of course, we will be keeping an eye on things and will be sure to revisit these indices by the end of the year for another look, so stay tuned.