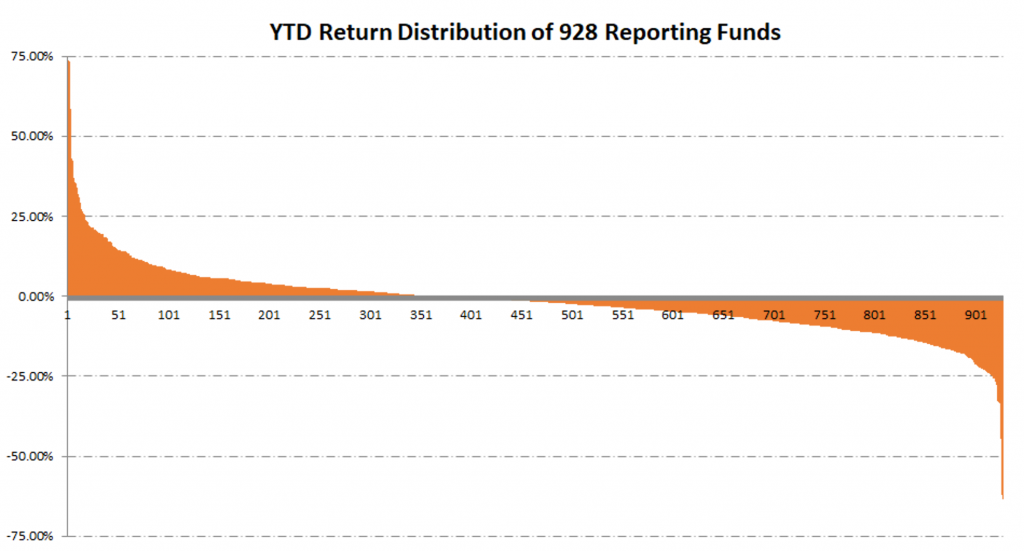

Funds reporting through June on the NilssonHedge database, a public database of hedge fund returns, shows the industry split in half during the first six months of the year. The average positive and the average negative returns of the 928 funds that NilssonHedge has data for through June are the same to within a basis point: 7.82% vs -7.83%, with negative returns being a majority (about 2/3rds or 562 of all returns). There is some good news, which is that the positives show some higher maximums.

The highest YTD return among reporting funds is +154%, while the lowest is -63.5%. We want to take a closer look at the 5 best funds so far to see where their returns are coming from.

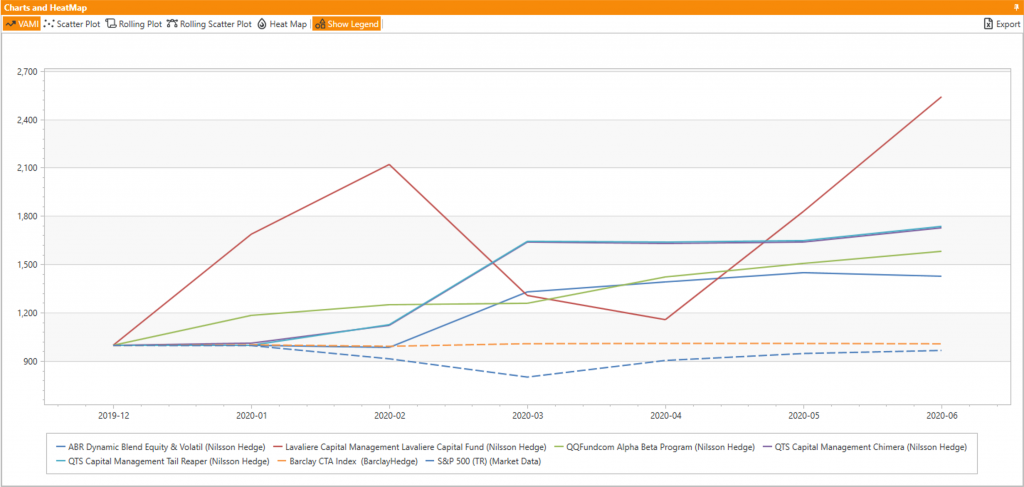

The best result by far is achieved by Lavalier Capital Fund, based in Palm Beach, Florida, and which trades crypto currencies. A couple of funds by QTS Capital Management trading equities and utilizing tail strategies, and funds by QQFund.com and ABR, both systematic but the former a trend-following fund and the latter being an options strategy also produced some stellar numbers in the first half of this year.

So, there is clearly a diversity of approaches amongst our top 5, and the funds got to their total result in different ways, leaving both CTAs and equities far behind.

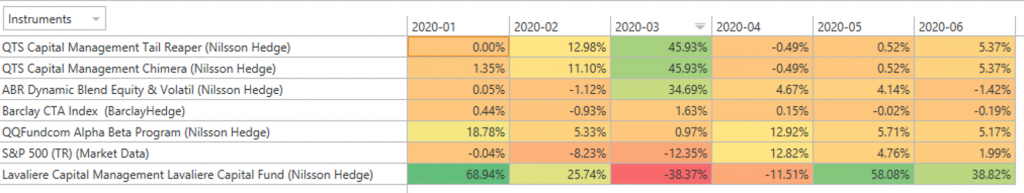

The difference in investment style is quite clear – while Lavaliere was hit pretty hard by the turbulence in March and April, but graciously recovered, QTS funds had most of their performance come out of March, and QQFund.com managed to grow pretty steadily month by month. This may be easier to see in a monthly return table or heatmap:

This is pretty good news as it shows the investment field is ripe with different styles, markets, and approaches that are able to deliver stellar results in such turbulent times, a boon for active management believers. It needs, of course, be put in perspective vs the risks and losses, as there are plenty of different styles and strategies that have lost money so far this year. But having the right tools, and following proper research procedures, one can still find diamonds in the rough.