AlphaWeek Tactical Trading Awards Winners: 6 months later

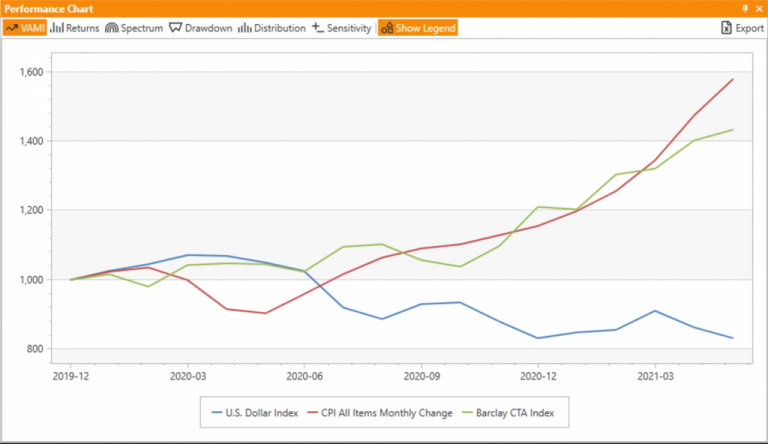

In January we announced winners of 2021 Tactical Award Winners, and 15 managers made the list across a number of categories. Where are they now, 6 months into the difficult 2022?

In January we announced winners of 2021 Tactical Award Winners, and 15 managers made the list across a number of categories. Where are they now, 6 months into the difficult 2022?

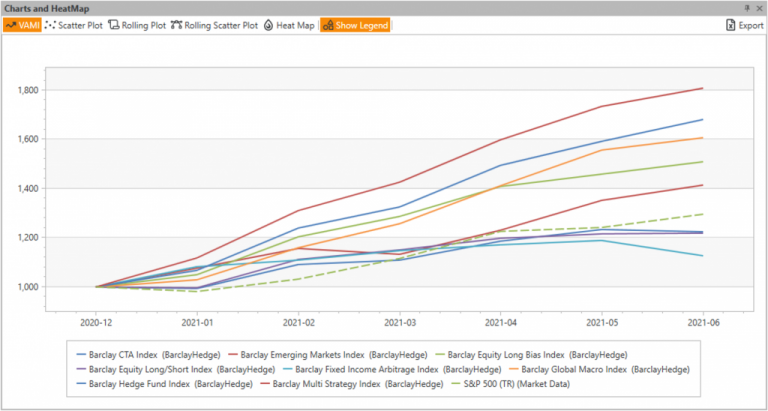

Commodities have traditionally been an inflation hedge, and with growing concerns over rising prices expressed by many, including yours truly, we wanted to take a look at how managed futures strategies are doing in the current environment.

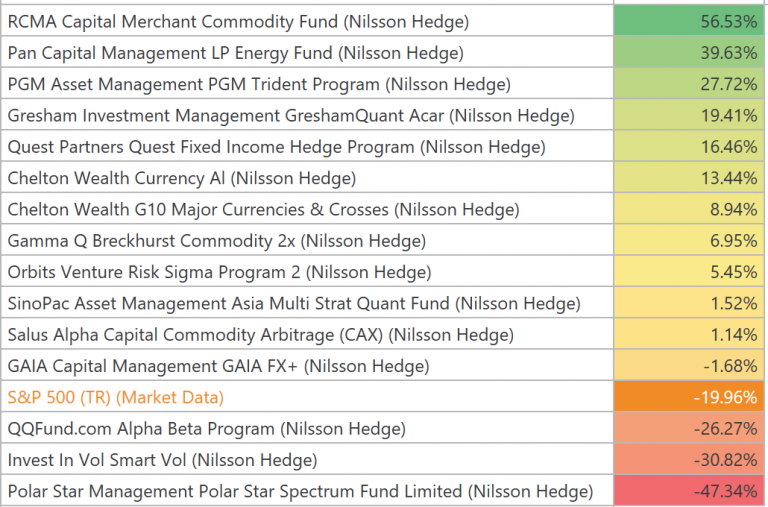

The equities keep charging forward as the first half of 2021 comes to a close, and hedge fund strategies performance in H1 seems to correlate to the amount of equites they hold. However, on Risk-Adjusted basis the picture is not so obvious.

Commodities have traditionally been an inflation hedge, and with growing concerns over rising prices expressed by many, including yours truly, we wanted to take a look at how managed futures strategies are doing in the current environment.

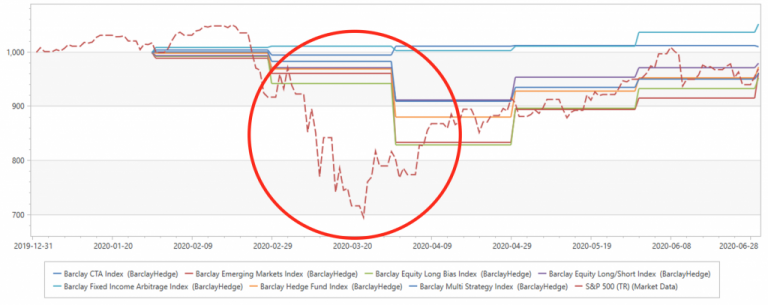

Reaching the midpoint for the year 2020 can be viewed as a positive because many people, I am sure, want this year to be over with as soon as possible. Yet, the end of H1 is a good point to pause and review the first half, and hopefully see some indication of what to expect in the second half. We’re going to take a look at the 7 largest Hedge Fund strategies in terms of AUM, courtesy of BarclayHedge.

Dmitri Alexeev, CEO, AlphaBot, and Jon Stein, CEO, Kettera Strategies, provide valuable hints and tips in selecting alternative managers with support of AlphaBot technology. Things to know and things to watch out for, based on years of hands on industry experience in researching, allocating, and modeling alternative portfolios with the investor in mind.

We are happy to have organized and conducted this webinar and enjoyed the conversation deeply. It was great to hear in-depth comments, analysis, and hear views of seasoned professionals in the space and from different sides of the spectrum - systematic and discretionary managers and a platform / investor. AlphaBot has been up to the challenging task of providing information backdrop with interactive charts, peer group analysis and sample portfolios.

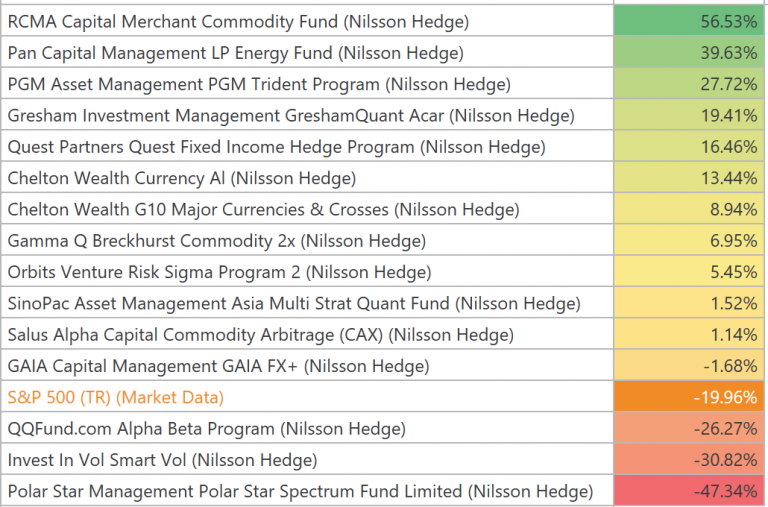

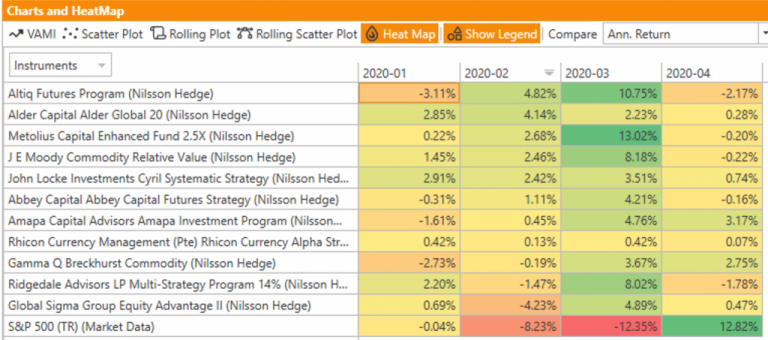

We repeat our filtering to find CTAs that are performing well YTD through April by using Nilsson Hedge database.

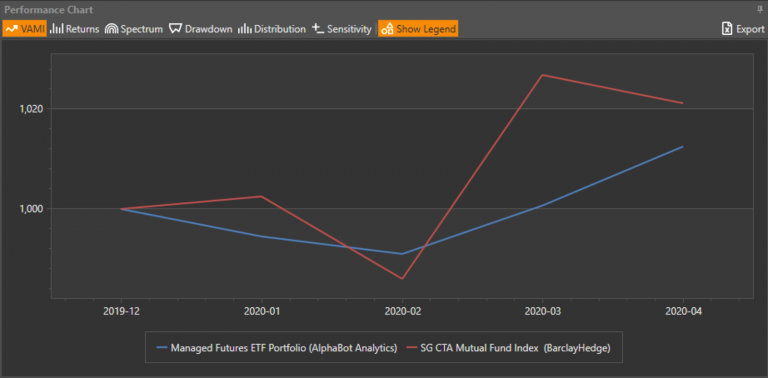

How do Managed Futures ETFs compare to SG CTA Mutual Fund Index? Quite decently, in fact, read more for details.

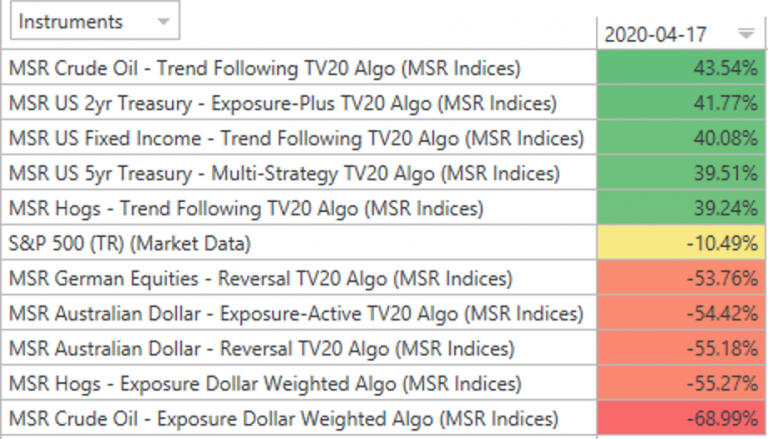

There is a huge dispersion in strategies trading oil, from 50% up to 70% down Year-To-Date