The topic of “smart” money continues to generate interest in these turbulent investment times. As an example, we have been keeping an eye on Goldman Sachs Hedge Fund VIP ETF (GVIP), an ETF of equity hedge fund best ideas, trying to see if the consensus behind the HF industry picks can produce long term value added to an average investor that does not have direct access to hedge funds. Our findings have been mixed; there was a period when GVIP outperformed the general market indices, and there have been times where it lagged.

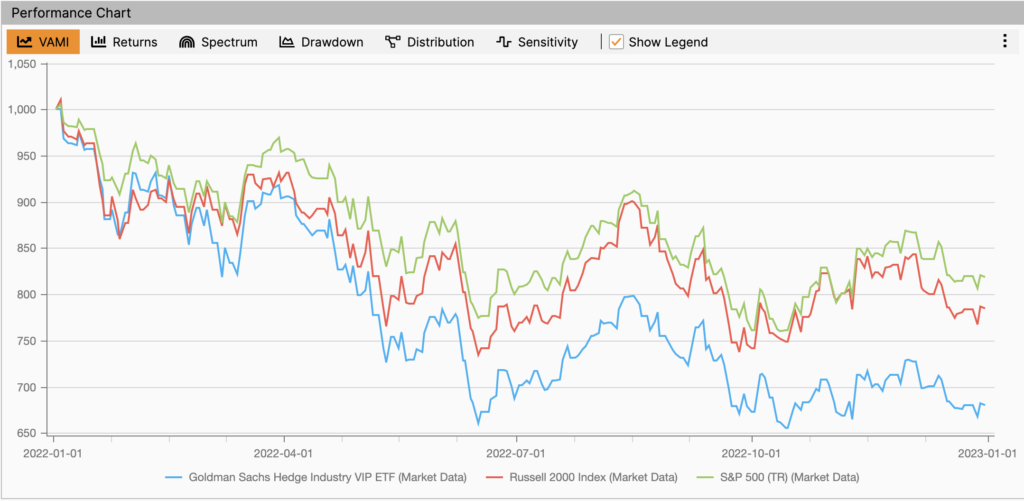

In this review we are looking back at the entire year 2022, and are using the Russell 2000 index in addition to S&P 500 to be more fair to smaller cap stocks.

Unfortunately, the hedge fund darlings have been lagging the market in general quite consistently, despite the large and small cap indices not differing as much in comparison. So it is not the size that matters here, apparently, and more of a bias towards a particular type of companies, in my opinion. And those companies, it appears, are not doing so well in the environment where the money is not so free any more (even though interest rates remain pretty low by historical standards). In addition, echoes of lockdowns and supply chain interruptions have likely affected a number of players, too.

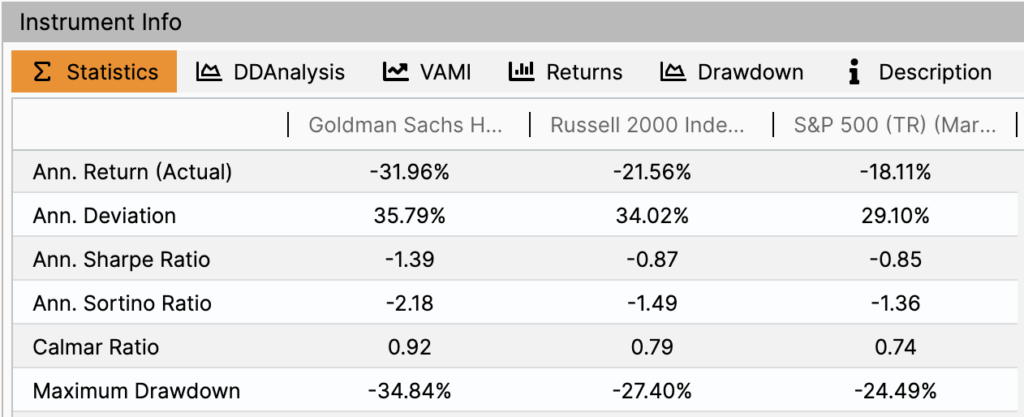

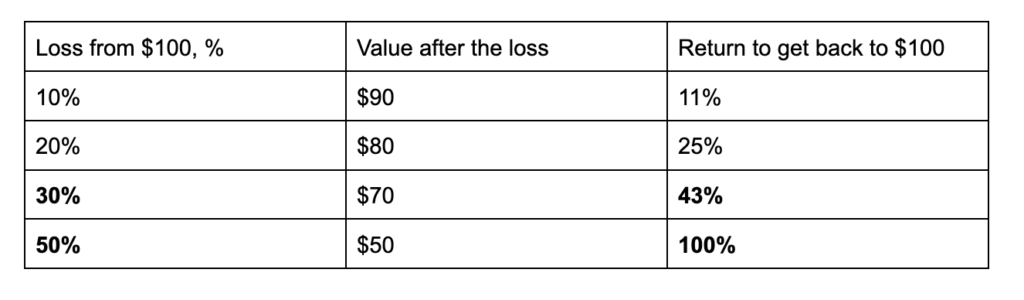

We notice that despite volatility levels being very comparable, the performance of GVIP lagged the general market by more than 10 percentage points last year. That is a notable lag, as the more it goes into the negative territory, the more it takes to recover afterwards. Few investors realize this asymmetry of returns, even though it is “baked into” the compounding returns formula: if you lose 10% then you need 11% to get back (b/c you are now starting with a smaller amount or base), and if you lose 20% you need 25% to recover, and with 30% loss you need a whopping 43% to break even. Do the math and see for yourself what it takes if you lose 10, 20, 30, or 50% to get back to where you started.

The point of this observation is simple: at some point, the amount of loss begins to really affect the recovery, as it takes so much more positive return to get back, and investors need to be aware of such effects, evaluating their ability to stomach drawdowns and market volatility. To see it from a different angle, consider that even if you are “lucky” and your investments generate 50% return after a 50% drawdown, you are still at 25% loss overall and it will take even more luck to climb back. This is why large losses are much heavier than large gains.

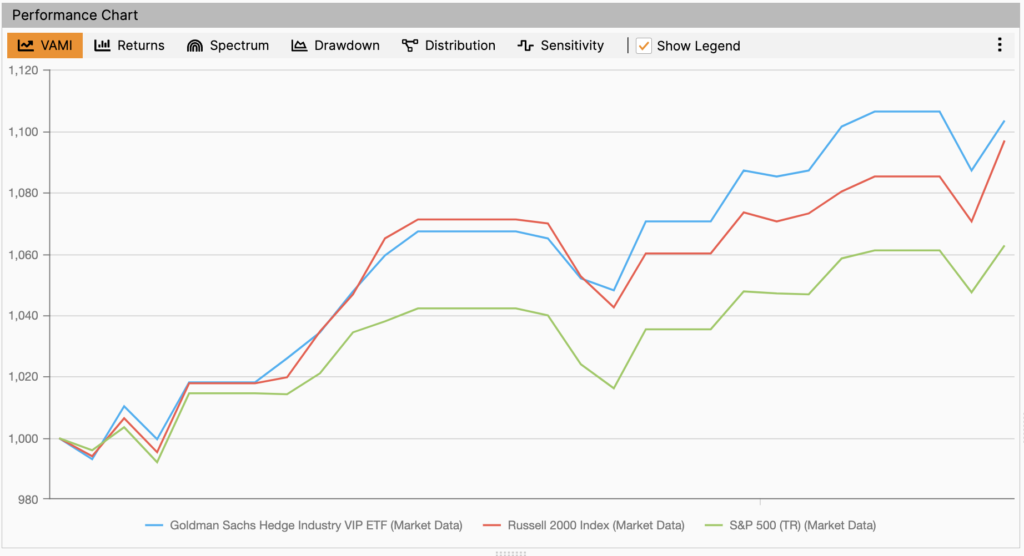

Returning to our GVIP observations, to justify their level of volatility and drawdown we will need to see if the hedge fund favorite picks are able to recover the losses quickly, and that depends on whether they are a result of sophisticated analysis and forecasting, or some form of financial mode of operation that gets affected when such financial regimes begin to change. In January 2023, the GVIP recovered about 10%, which is very close to the general market performance.

As we noted earlier, it will take extra effort to recover the extra loss. We will keep monitoring this interesting ETF; the latest wave of 13F filings are due out in mid-February, showing which U.S. stocks hedge funds bought and sold in the final quarter of 2022. If they recover (and outperform the markets again) it will be a spectacular comeback, so we’ll be watching with interest!