As Bitcoin reached a new all-time high, surpassing $123,000 on Monday, July 14, 2025 fueled by ETF inflows, growing institutional interest and investor optimism, it is important to reflect on its overall relationship with the stock market. As an investor, understanding the dynamics between different asset classes is critical in crafting a balanced and diversified portfolio. One of the most intriguing relationships that has been the subject of much debate in recent years is the correlation between Bitcoin and the stock market. While Bitcoin is often viewed as a digital asset distinct from traditional financial markets, many investors have questioned how its price movements are tied to the stock market.

Bitcoin, launched in 2009, is the first and most well-known cryptocurrency. Over the years, it has been touted as a decentralized form of currency, a store of value, and even a hedge against inflation. On the other hand, traditional stocks represent ownership in companies that are governed by the laws of supply and demand, financial performance, and market sentiment.

While these two assets—Bitcoin and traditional stocks—may appear to be worlds apart, their interactions have become a focal point for investors trying to predict market trends, manage risk, and decide where to allocate their funds.

The correlation between Bitcoin and the stock market has fluctuated significantly over the years. Historically, Bitcoin was seen as an uncorrelated asset to traditional markets, meaning its price movements were independent of stock market performance. In fact, Bitcoin often showed little relationship with stock market trends, behaving as a standalone entity influenced by its unique drivers, such as adoption, regulation, and speculative trading.

However, in recent years, especially with the rise of institutional interest in cryptocurrency, the correlation has shifted. Research from various sources indicates that Bitcoin’s correlation with the stock market has increased in times of heightened market stress, like the 2020 COVID-19 market crash, when both Bitcoin and stocks experienced sharp declines. During such periods, the market dynamics of traditional stocks and Bitcoin seemed to align, suggesting that Bitcoin could no longer be fully insulated from the broader financial market.

On the other hand, during times of low volatility or steady market conditions, Bitcoin and the stock market may operate more independently, as Bitcoin’s performance is often driven by its own set of factors, including crypto-specific news, regulatory developments, and its use as a store of value.

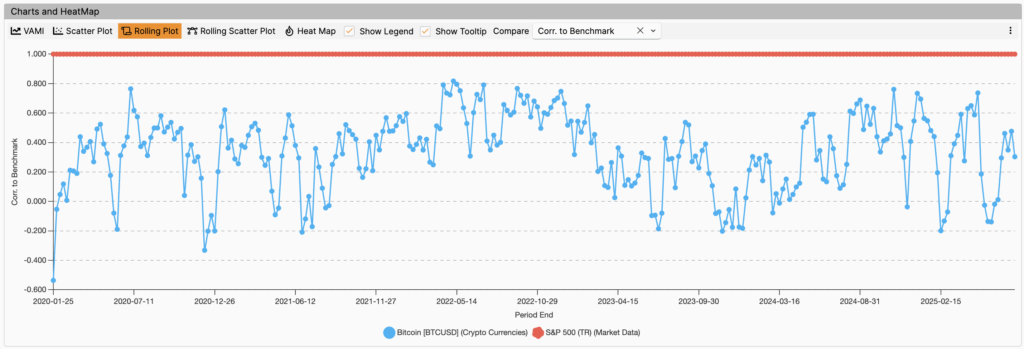

As follows from the above chart, the 1 month rolling correlation of daily returns for Bitcoin vs SP500 varies strongly in the range of -0.2 (very low and diversifying) to as high as 0.8, with the noticeable flips between the extremes happening almost monthly.

For investors, understanding the shifting correlation between Bitcoin and the stock market is vital in crafting an investment strategy. The relationship between these assets can have significant implications for portfolio diversification, risk management, and overall investment performance.

Traditionally, investors have relied on diversification across different asset classes (stocks, bonds, real estate) to reduce risk. By adding Bitcoin to the mix, many hoped to create an even more resilient portfolio. If Bitcoin and stocks were truly uncorrelated, it would act as a natural hedge against stock market downturns. However, as the correlation has grown stronger, especially during times of market uncertainty, the effectiveness of Bitcoin as a diversification tool may be diminished.

It’s important for investors to closely monitor the relationship between these assets and understand that there may be periods when Bitcoin offers less protection against stock market declines than initially believed. This could necessitate a reevaluation of diversification strategies.

Bitcoin’s volatility has always been one of its defining characteristics. While stocks can be volatile, especially in the short term, Bitcoin’s price swings can be far more extreme. In recent years, Bitcoin’s correlation with stocks has risen during periods of heightened risk in the broader financial system.

For investors, this means that the risk profile of Bitcoin in their portfolios may change over time. A high correlation during market volatility suggests that Bitcoin could behave similarly to stocks during a crisis, which might expose investors to a higher level of risk. It’s crucial for investors to adjust their risk management strategies accordingly, whether that means reducing their exposure to Bitcoin or using derivatives and other tools to hedge against price fluctuations.

One of the primary reasons Bitcoin gained popularity was its potential as a hedge against inflation. Many viewed Bitcoin as a store of value similar to gold, especially in an environment of unprecedented money printing and low-interest rates.

However, the correlation between Bitcoin and the stock market during times of market turmoil has raised questions about its effectiveness as a hedge. During major stock market crashes, such as the 2020 pandemic-induced crash, Bitcoin fell alongside equities, casting doubt on its ability to act as a safe-haven asset. Despite this, Bitcoin may still be a valuable hedge against inflation in the long run, as its limited supply and decentralized nature make it resistant to inflationary pressures from government monetary policy. Still, investors should be aware that its short-term performance could be closely linked to stock market movements during periods of heightened market stress.

The increasing involvement of institutional investors in the cryptocurrency market has played a key role in the growing correlation between Bitcoin and the stock market. Major firms like Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, while prominent asset management firms like Fidelity and Grayscale have launched Bitcoin investment products. This institutional interest has brought Bitcoin more into the fold of traditional financial markets.

As these institutions continue to invest in Bitcoin, it is likely that the asset will become more intertwined with global markets. For investors, this could mean that Bitcoin is no longer the “wild card” it once was, but rather an asset influenced by similar macroeconomic and geopolitical factors that drive stock market movements.

While short-term fluctuations and correlations may raise concerns, Bitcoin’s long-term investment outlook is still promising for many investors. The digital asset’s role as a store of value, its finite supply, and its decentralized nature could make it an attractive investment in the face of future financial instability. For those willing to withstand short-term volatility, Bitcoin could complement a traditional stock portfolio, especially if its correlation with the stock market remains weak in the long term.

The correlation between Bitcoin and the stock market has evolved, particularly with the increased institutional interest in digital assets. For investors, this evolving relationship underscores the importance of monitoring market conditions, adjusting risk strategies, and being flexible in asset allocation.

Bitcoin may still offer unique benefits such as high potential returns and diversification in a portfolio. However, its increased correlation with traditional markets—especially during periods of market stress—suggests that it might not always act as a hedge against stock market downturns.

Ultimately, understanding Bitcoin’s role in the broader financial ecosystem is essential for investors looking to harness its potential while mitigating risk. By staying informed and strategically adapting, investors can make smarter decisions about how to incorporate Bitcoin into their portfolios in an ever-changing market landscape.

(c) 2025 AlphaBot