While observing the U.S. stock market performance this year, if you pause and listen carefully, you may well hear a giant sucking sound. And, if you listen more carefully, you realise there are, actually, different giant sucking sounds going on at the same time. The first one is the sound of a deflating economic bubble caused by the lockdowns imposed by governments to attempt to slow the spread of the coronavirus (and the consequent shutdown of the global economy and trade). But the air does not just escape into a vacuum, it floats into the other bubble, rapidly inflating, as if in a physics experiment with connected balloons of different gas pressures.

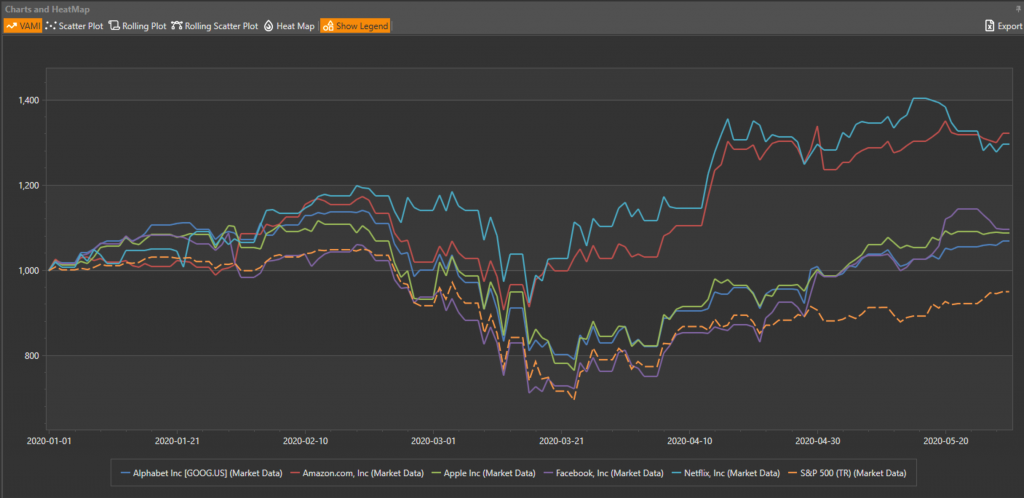

Those two balloons are the overall U.S. stock market and the FAANG stocks, respectively. The famous Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOG) gang has come out swinging while everybody else has had to take cover and hide from the global fallout. Here is a comparison chart of their year to date performance through the end of May vs the S&P 500 index:

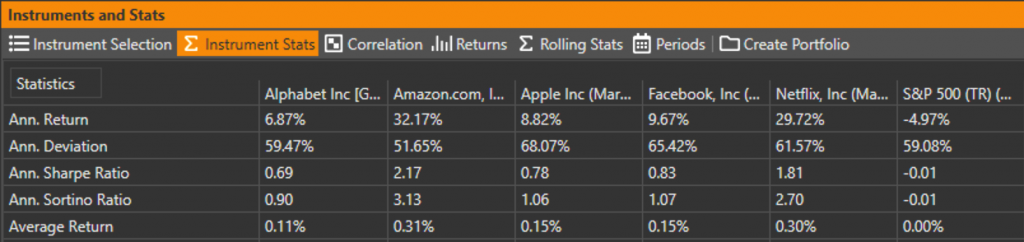

And here are the stats for this chart:

To put this into a better perspective, we looked up the weights of FAANG stocks in the S&P (totaling more than 15% of the index!) and created two portfolios – the FAANG portfolio with proportional weights, and the S&P-FAANG portfolio (with the 5 stocks taken out of the index), and we compare all three of them together.

The difference is an astonishing 25%! The FAANG portfolio is up more than 15% while S&P-FAANG is down almost 10% through the end of May. The small caps rally in the last week of May has helped to close the gap just a little bit but it is still huge.

The reasons for this behaviour have been largely commented on, so there is no mystery. But even without the mystery, it is still very hard to accept that only 5 stocks account for more than 15% of the iconic index that is often used to represent the entire US economy, and that those 5 stocks have risen so much while everything else was crashing down. Whether it is due the substitution effect, or winner-takes-all mentality, the dynamics look scary and in many ways unhealthy.

Can we really stop doing everything except browsing Facebook on our iphones while also watching Netflix and Googling everything we need to have it delivered the next day through Amazon? If this description really fits “the new normal” then we better watch out – as these new Zeppelins of the 21st century economy continue to inflate and rise higher and higher, so many other things are going to start falling from the sky left and right.