The Investment Committee Bottleneck

Investment Committee (IC) meetings are both an opportunity and a pain for Chief Investment Officers (CIOs). On one hand this is where important decisions are approved, such as capital commitments, and on the other this is where a brilliant idea may fall flat on its face due to insufficient clarity or visual perspective.

This is particularly true with alternative investments that are not “plug and play” allocations like mutual funds or ETFs. They raise questions regarding liquidity, portfolio level risk, risk-return trade-offs and strategy overlaps. And the number of possibilities can be large, making detailed analysis and comparisons difficult and time-consuming unless a fast and efficient proforma portfolio construction tool is used.

Instead of tedious and error-prone spreadsheets, memos, manager one-pagers and performance commentaries, the efficient proforma tool allows the CIO to walk into the room ready to provide a visual, quantitative answer the committee’s most critical question:

“What happens if we do this?”

Proforma Tool in Plain Terms

A proforma construction tool is a modeling application / platform that allows you to:

The best tools, such as AlphaBot, for example, allow doing all of this “on the fly” – empowering the CIO to actually welcome the What-If questions from the Committee and building their confidence in a live, engaging discussion instead of a classically boring printout distribution meeting.

While such a tool is not an accounting or financial model and works using historical returns and approximations, the benefits of speed, visualization, and efficiency far outweigh these shortcomings.

Why It Matters for CIOs and ICs

An efficient pro-forma construction tool delivers value to the investment committee process in multiple ways.

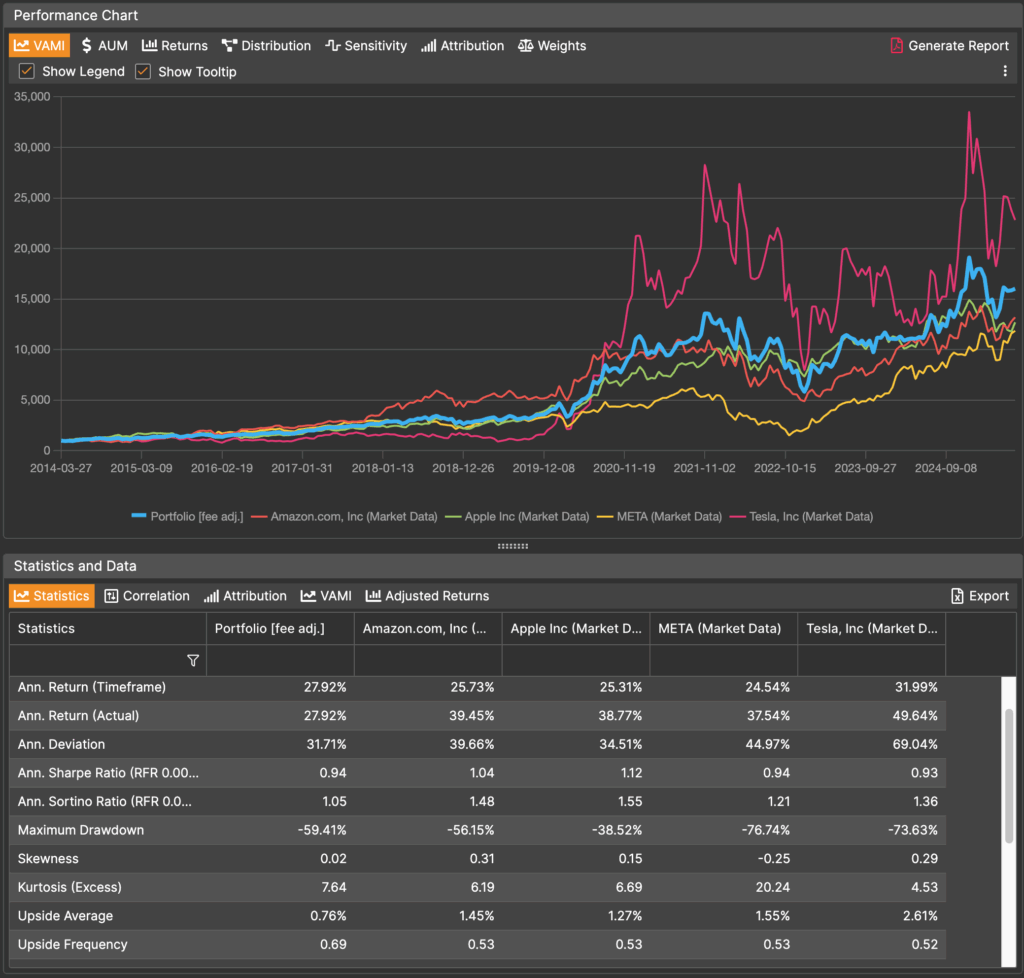

If your team, for example, recommends allocation to a hedge fund manager, a typical discussion would rotate around their returns (typically represented by a one pager with monthly performance and key stats), leaving the actual allocation impact in the realm of imagination. Imagination can also magnify the potential risk related to such a decision out of proportion, triggering the committee to avoid making a decision. With a proforma tool the CIO can:

All of a sudden, the CIO is no longer pitching a “cool” but abstract idea, but rather presenting a path to portfolio *evolution* with visuals and stats supporting it.

2. Streamline Decision-Making

There are lots of things an IC needs to consider, pushing them into a cognitive overload, especially when comparing multiple asset classes, managers or alternative investment vehicles. A quick model can answer questions like:

Going back to the drawing board (more likely, a spreadsheet) will leave these questions hanging until the next follow up, delaying the actual decision, while a quick interactive model can answer them almost instantly and allow the discussion to move onto the next phase.

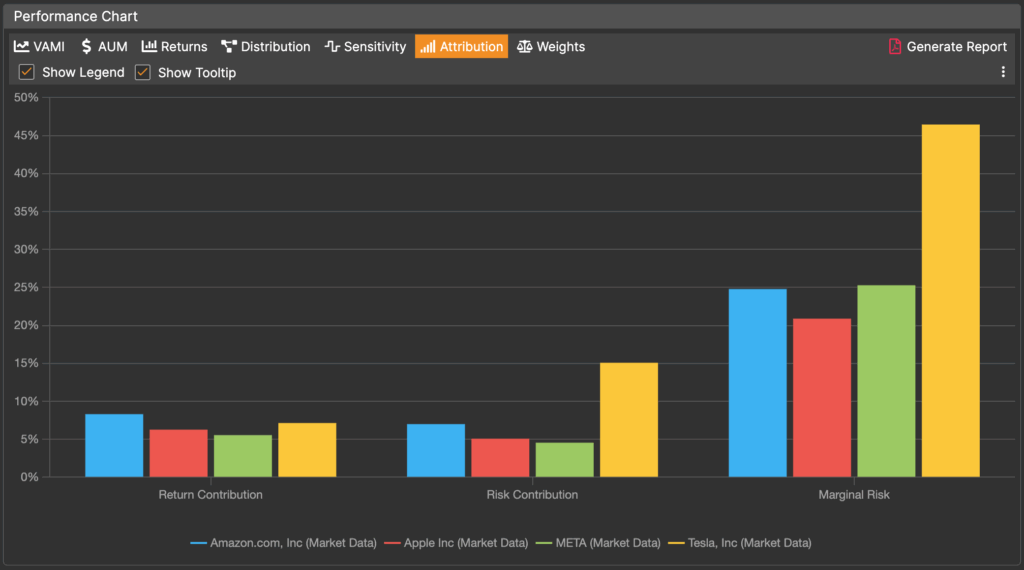

3. Facilitates Investment Choices Comparison

Choosing between two arbitrage or equity hedge managers? A pro forma tool will allow:

The charts and stats provided by the tool will be more clear, faster, and convincing than isolated manager presentations or “gut feeling”.

4. Supports Stakeholder Communication

To communicate IC decisions to a board or investment beneficiaries, clear communication and supporting materials are essential. A good proforma building tool allows quick production of:

| Feature | Why It Matters |

| Professional and fast interface | Speeds up modeling and mid-meeting what-if discussions |

| Custom asset inputs | Supports alternatives with custom return streams |

| Scenario testing | See outcomes under historical stress events and compare multiple adjustments at once |

| Report generation | Enables smooth IC documentation |

| Integration with existing portfolios | Keeps everything grounded in your actual exposure |

A platform like AlphaBot, for example, provides these features and empowers the CIO with speed, flexibility, and relevance needed to focus the IC attention on important decisions.

Closing Remarks: Transition From Analyst to Allocator in a Click

For CIOs managing complex portfolios and diverse ICs, fast and efficient proforma building tools are not just nice to have, they are strategic accelerators. They allow:

(c) AlphaBot 2025