Private equity (PE) is no longer just for institutions and ultra-high-net-worth families. Thanks to evolving regulation and industry innovation, 401(k) plans are starting to open up to private equity exposure. This could reshape the retirement landscape—but it also introduces real questions around transparency, performance measurement, and benchmarking.

Is this democratization of alternatives a breakthrough for retirement savers—or a high-fee mirage in a low-liquidity wrapper?

A 2020 U.S. Department of Labor guidance (under the Trump administration) gave 401(k) plan fiduciaries a green light to include private equity exposure in diversified vehicles like target-date funds (TDFs) or balanced funds.

Providers like BlackRock, Partners Group, and Pantheon have already launched products or frameworks to incorporate PE in defined contribution (DC) plans.

Despite the upside, this move raises several concerns, especially around benchmarking, performance measurement, and fiduciary risk:

Private equity funds don’t publish daily NAVs. Investors in 401(k)s are accustomed to seeing daily liquidity and mark-to-market pricing—but PE valuations are quarterly, model-driven, and often delayed.

PE returns are cash-flow-based, with capital drawn and returned over time. Traditional performance metrics like annualized returns (CAGR) or standard deviation fail to capture the timing and magnitude of distributions.

Long lock-ups (7–12 years), performance fees (carried interest), and complex capital calls don’t align well with the liquidity needs and simplicity of retirement investors.

401(k) plans require clear and fair comparisons to evaluate fund performance. But private equity:

So how do you benchmark something you can’t see in real time?

| Approach | Description | Strengths | Weaknesses |

| Public Market Equivalent (PME) | Compares PE IRR to hypothetical public market investment | Adjusts for cash flow timing | Complex; requires full cash flow history |

| Peer Group Median (e.g., Preqin, Cambridge) | Compares fund to similar-vintage peers | Industry standard | Data is voluntary, survivorship bias |

| Absolute Return Targets (e.g., 8–10%) | Sets return hurdle based on long-term goals | Simple for DC plans | Arbitrary; ignores risk |

| Listed PE Indexes (e.g., LPX50) | Uses public PE companies as proxy | Liquid, daily priced | Not representative of actual private holdings |

401(k) fiduciaries must meet ERISA’s prudence standard, meaning they must:

Best practices include:

Firms are addressing benchmarking and performance gaps through:

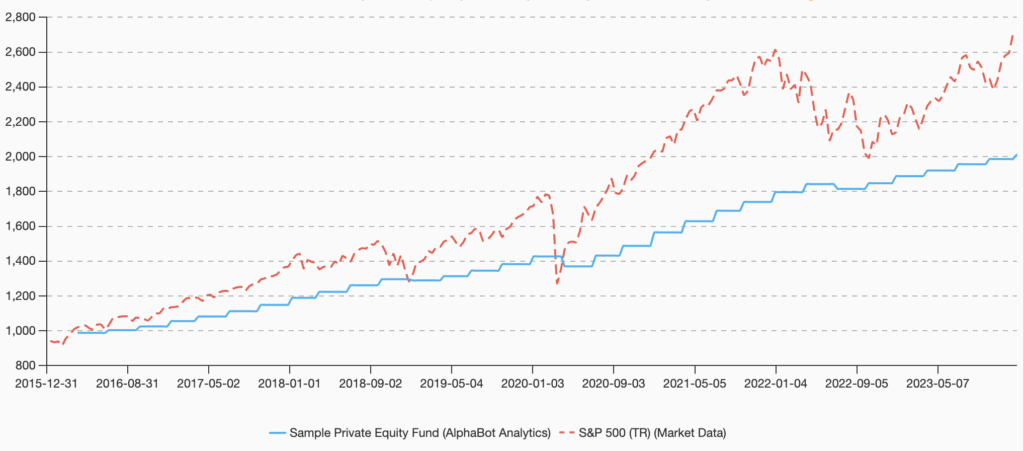

These tools help retirement plans balance the opacity of PE with the regulatory need for transparency. The best tools such as AlphaBot also allow flexibility in return frequency blending (such as quarterly for a PE fund vs daily for the stock market indices), and allow building and modeling portfolios using custom data.

Opening 401(k) plans to private equity is a bold move—one that could enhance returns, but also introduces a new layer of complexity.

For investors: It’s essential to understand that PE in your retirement plan is a different beast than mutual funds—illiquid, opaque, and hard to measure.

For plan sponsors: The key to making this work is rigorous, transparent benchmarking, with realistic assumptions about what PE can deliver—and what it can’t.

In the drive to democratize access to private markets, benchmarking may become the ultimate gatekeeper. It will define whether private equity in retirement plans is a financial innovation—or just a costly illusion dressed in institutional branding. Having the right tools that help solving this issue has the potential to become a decisive factor in the amount of support and inflows the new strategies will receive.

(c) AlphaBot 2025