Once a niche corner of the alternative investment universe, private credit is now entering the spotlight. With large institutions like Goldman Sachs preparing to roll out private credit strategies into retirement vehicles like 401(k) plans, the asset class is becoming a foundational building block in modern portfolios—not just for institutions, but also for family offices, advisors, and even affluent retail investors. Having the right tools to incorporate this asset class into alternative portfolios becomes more important every day.

Several converging forces are fueling private credit’s rise:

Bank retreat from middle-market lending post-2008 has opened a wide gap that private lenders have filled.

Higher yields in a rising rate environment make private loans attractive relative to traditional bonds.

Structural protections (like seniority and covenants) in private loans are drawing institutional attention.

Growing demand for less liquid, stable income streams among pension funds and insurance companies.

Now, with regulatory tailwinds enabling inclusion in defined contribution plans, the stage is set for explosive growth.

Private credit offers a unique combination of income, downside protection, and portfolio diversification. Here’s how allocators and managers are thinking about it:

1. As a Fixed Income Replacement

Traditional bond portfolios are under pressure due to inflation and duration risk. Private credit offers:

2. Diversifier Against Equity Volatility

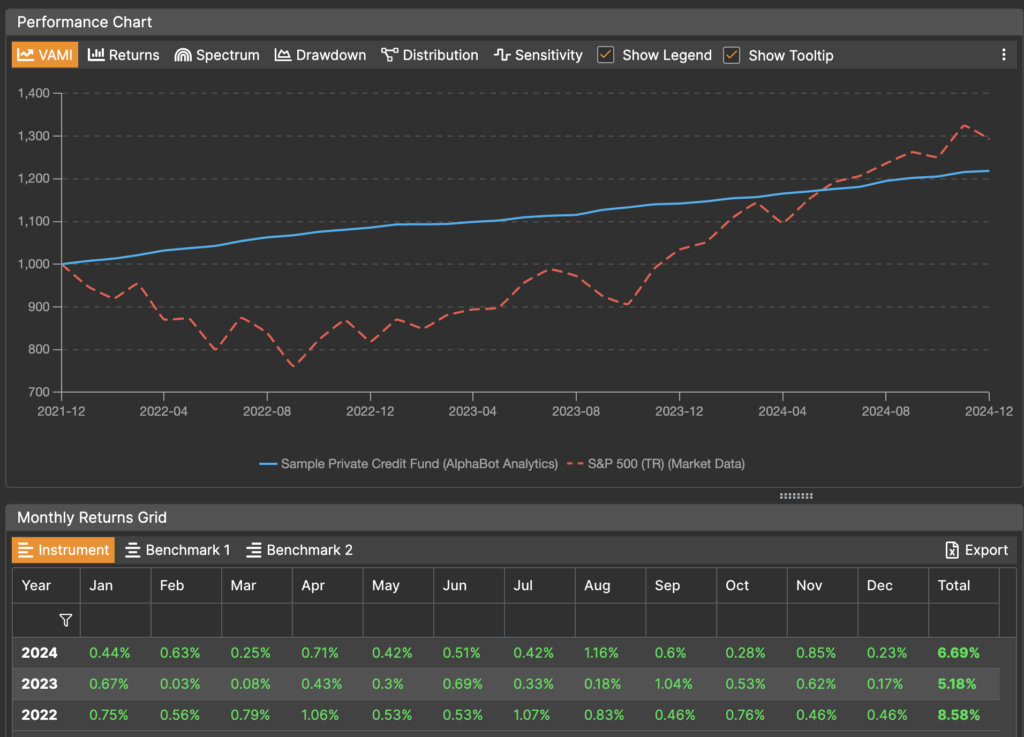

Private credit has historically shown lower drawdowns compared to equities, particularly in stress periods. Allocators increasingly add it to smooth portfolio volatility.

3. Alpha Through Origination and Manager Skill

Unlike index-based investing, private credit performance varies widely by manager. This opens the door for alpha generation through:

4. Tailored Exposure: Direct Lending, Distressed, Mezzanine

Depending on return and liquidity needs, investors can target strategies such as:

As private credit becomes mainstream, new tools are essential for building, evaluating, and managing these allocations. Having access to multiple return sources, data vendors, asset manager feeds in a tool like AlphaBot allows:

Additionally, with growing number of opportunities in the space, it becomes critical to able to:

Collaborative Portfolio Construction approach implemented in AlphaBot allows Family offices, allocators, and consultants to:

Private credit is no longer a niche play—it’s becoming a core holding in alternative investment portfolios. As institutions, advisors, and family offices expand allocations, they need the tools to manage complexity, compare managers, and build intelligent, risk-aware portfolios.

Platforms that offer data sharing, peer group analytics, and AI-powered construction—like yours—are perfectly positioned to support this wave.

Engage with Us

Are you exploring private credit for your portfolio or clients? Want to see how AIphaBot and collaboration tools can help? Get in touch for a live walkthrough or trial access

(c) AlphaBot 2025