Reaching the midpoint for the year 2020 can be viewed as a positive because many people, I am sure, want this year to be over with as soon as possible. Yet, the end of H1 is a good point to pause and review the first half, and hopefully see some indication of what to expect in the second half. We’re going to take a look at the 7 largest Hedge Fund strategies in terms of AUM, courtesy of BarclayHedge.

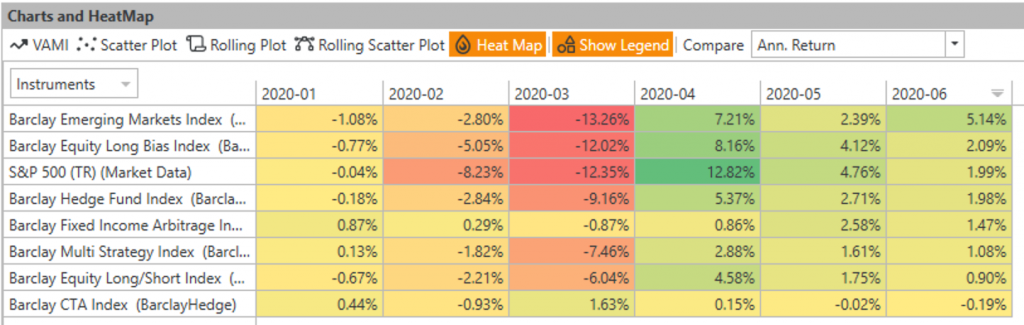

The list below is sorted by June performance, and we are glad to see that Emerging Markets are enjoying a strong recovery after the March beat-up when they were off -13.26%.

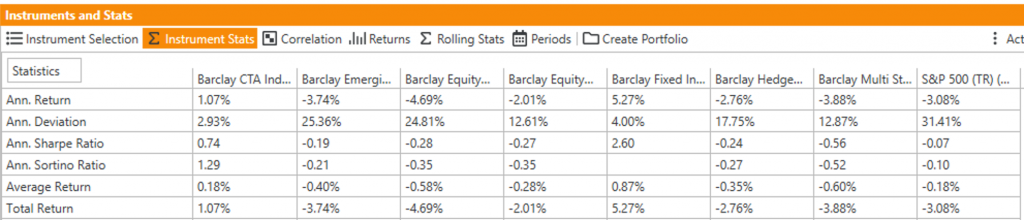

The best performer in H1 is, however, the Fixed Income Arbitrage index, with a more than 5% return through June, and Managed Futures/CTAs a relatively distant second but still positive with a 1% return for the period. Those two are the only positive performers in H1 among the 7, with the Long Bias index trailing the pack with a negative performance of -4.7%.

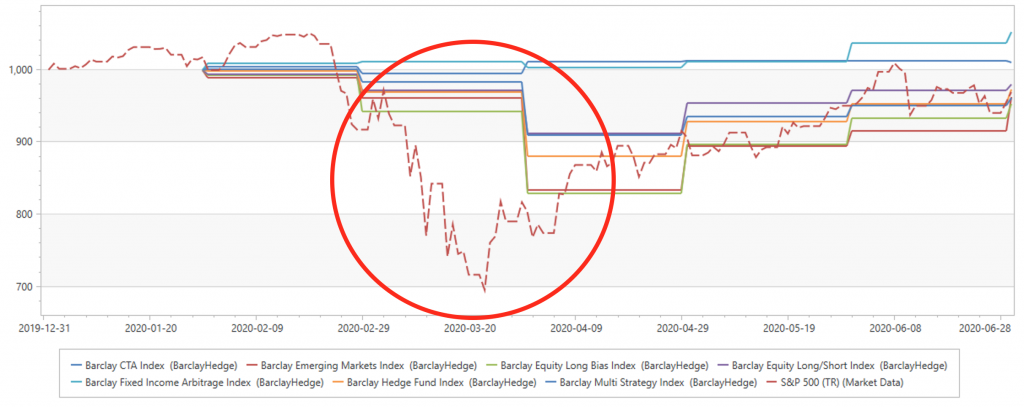

Fixed Income has additional distinguishing traits so far in having only one month of negative returns this year (making its Sortino ratio unavailable as that requires at least two negatives to calculate downside volatility used by the formula), and having the highest Sharpe ratio of the pack. “Slow and steady wins the race”, indeed. And, while equities are not exactly a good benchmark for the hedge funds, overlaying their monthly performance with daily S&P 500 data makes for quite an interesting and revealing chart:

The main focus here is, of course, March performance, where U.S equities crashed more than 30% within a 4 week window, but many hedge fund strategies have shown considerable resistance, with CTA and Fixed Income indices winning the “diversification championship”. The subsequent months have the equities squarely “boxed in” by the hedge funds, and we will continue monitoring the space to see if this relationship continues through the year.