As 2021 begins and everyone is looking forward to a (hopefully) much better twelve months, for our first blog post of the year we’re going to take a look at the (growing) Nilsson Hedge database, a publicly available database of hedge fund returns, that now contains more than 4,200 funds to see which products fared best in 2020.

To find the winners, we looked at funds / programs which Nilsson Hedge had December data for AND that have been in existence on or prior to January 2020. We found 834 such funds, and then we calculated their returns and volatility for the entire year. Then we sorted the list by annual return.

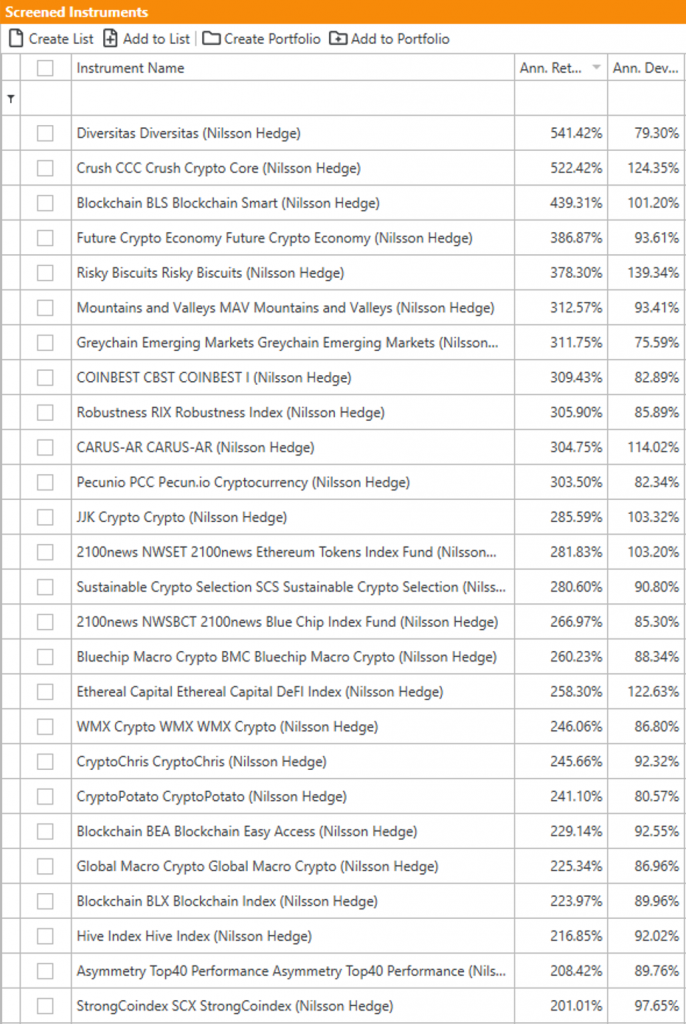

It is not surprising for many investors keeping an eye on the different asset classes that crypto funds completely dominated the top performers list last year. 26 funds in the Nilsson Hedge database had returns of more than +200% for the year, and ALL of them are operating in the crypto space:

Source: AlphaBot

Two funds in particular, Diversitas and Crush Crypto Core were able to produce astonishing returns above +500%. The high volatility – a persistent characteristic of the crypto space – is still there (in double digits and often going over 100% annualized) but the returns are still very impressive, even on a risk-adjusted basis. The first non-crypto (or “traditional”) fund, Purple Valley Capital Diversified Trend, is coming in at +198% – still an extremely good result for an “old strategy”. It becomes especially notable when contrasted with many big names in the space that have posted overall losses in 2020, with some losses well into double digits and even exceeding -50%.

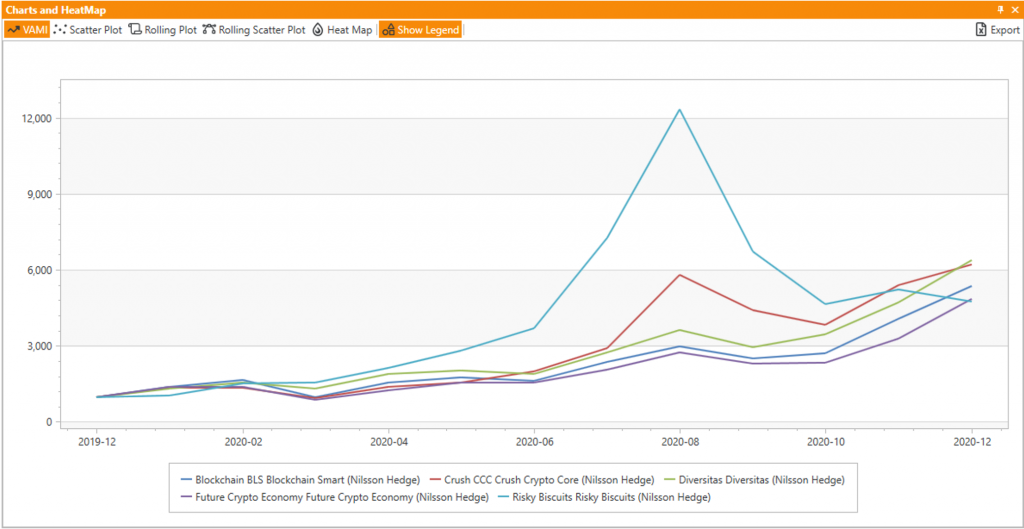

To take a closer look, we plot the performance of the top 5 performers, and notice that for some of them the numbers close to August were even more dramatic. For example, Risky Biscuits fund was up more than +1,100% through August, and is technically in a -60% drawdown since then.

Source: AlphaBot

Such a rollercoaster will definitely give a few sleepless nights to any investor with real money on the table, and this leads us to a few practical questions for 2021:

We will definitely keep an eye on this exciting and dynamic space, so stay tuned – and Happy New Year 2021!