In today’s market environment, resilience isn’t optional—it’s essential. For family offices stewarding wealth across generations, traditional strategies no longer provide the downside protection or long-term growth needed to withstand today’s volatility. That’s why the move toward multi-asset class portfolio construction—especially with a strong allocation to alternatives—has become a defining trend among sophisticated allocators.But the real shift? It’s not just in the assets—it’s in the tools.

Legacy 60/40 portfolios are buckling under the weight of modern market challenges. Low yields, high inflation, and geopolitical uncertainty have driven family offices to rethink their approach to risk and return. Instead, they’re constructing customized, diversified portfolios that blend:

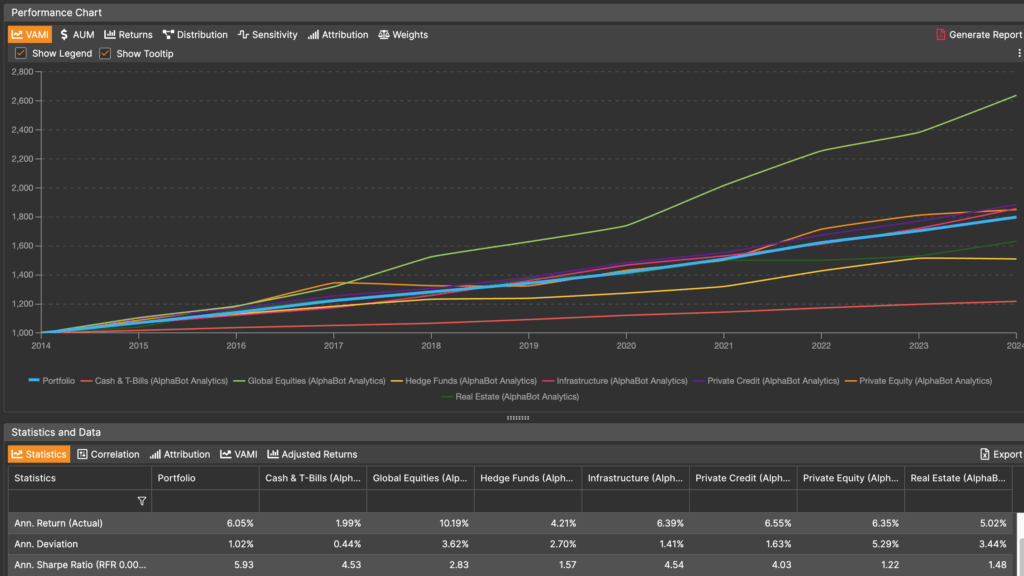

This level of diversification helps smooth volatility, protect capital, and uncover sources of return that aren’t available in traditional markets.

The complexity of a multi-asset portfolio—especially with alternatives—demands more than spreadsheets and siloed reports.

Family offices need an integrated, intelligent portfolio construction platform that allows them to:

Combine private and public market investments into a unified portfolio view. Whether it’s real estate, hedge funds, private equity, or muni bonds, clarity is key.

Understand how each component contributes to portfolio behavior. Can your direct lending fund offset drawdowns in public equities? Will a rise in inflation impact your core real estate fund and TIPs the same way?

Model different market conditions (rate hikes, equity shocks, recession) to see how the full portfolio holds up—not just the liquid sleeve.

Compare private market investments to custom benchmarks and peer portfolios, rather than outdated public indices.

A modern portfolio construction tool not only streamlines operations—it sharpens decision-making.

For investment committees and principals, it delivers:

For CIOs and analysts, it offers:

Teams collaboration and insights sharing securely, enabling both internal discussions and trusted advisor interactions without friction.

In the new world of investing, resilience comes from thoughtful construction—not just broad diversification. Family offices that adopt flexible, intelligent portfolio tools can confidently build portfolios that preserve wealth, capitalize on opportunities, and stand up to tomorrow’s challenges.

Engage with Us

Are you building diversified multi-asset class portfolios or clients? Want to see how AIphaBot and collaboration tools can help? Get in touch for a live walkthrough or trial access

(c) AlphaBot 2025