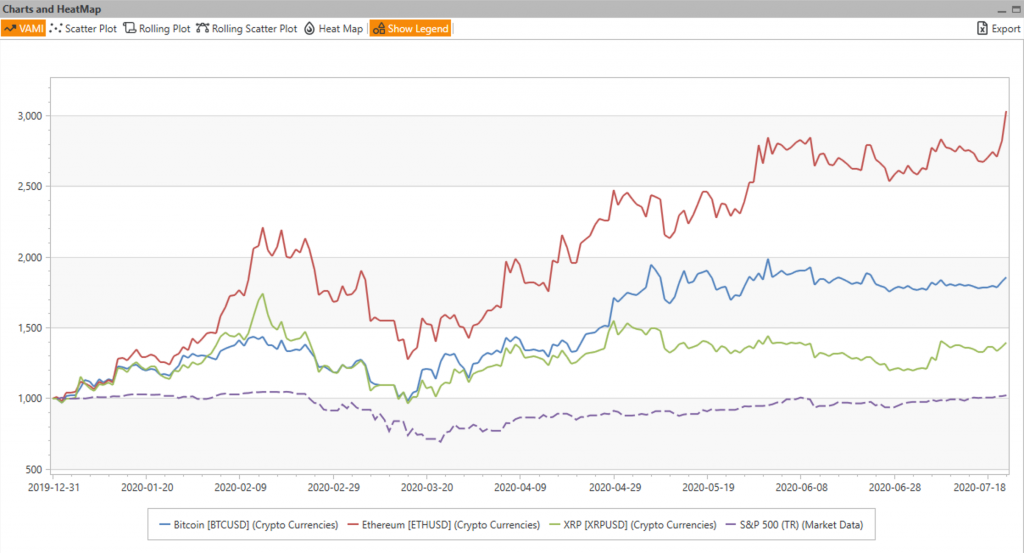

… and beginning to correlate higher with equities? The top 3 cryptos (Bitcoin, Etherium, and Ripple) are considerably outperforming equities this year, but at the same time they show more and more signs of behaving similar to equities – something that has not happened much before and goes against the motto of complete independence from “old” financial markets.

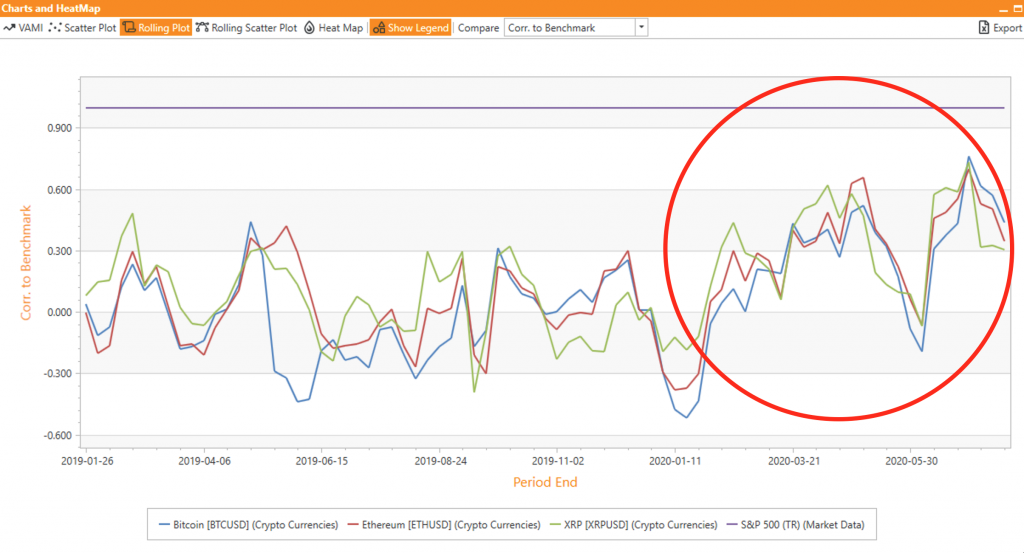

If we look closer on the chart above, we will see the same larger scale features – a rise into mid-February, then a steep decline in March due to COVID-19 impact, and then solid recovery. The volatility of daily moves for the crypto currencies is traditionally larger than that of equities, so that makes the lines more “edgy”. This effect can be better seen if we look at rolling monthly correlations to S&P 500 on a longer time frame – starting in 2019.

During 2019 the correlations were bounding around 0 level, rarely crossing out of +/- 0.3 level (a perfect un-correlated behaviour). Then in 2020, after a short drop in early January the correlations have been steadily rising, hitting the peaks above 0.6 – an extremely high level for cryptos – and stayed positive for almost the entire time this year, with half of it above 0.3 level.

It appears that unprecedented stimulus money printing around the world is finding its way into all asset classes, and is pushing prices up not only for equities (with Central Banks purchasing assets like ETFs now), but also into cryptos. This begs the question of what is going to happen next as the economy refuses to recover (and more than 50M people in the US filing for unemployment benefits since the beginning of the year), and the sound of cars, people and factories being replaced by the buzzing of the virtual printing press. History suggests that too much money and too few real assets (and people having said money) is not exactly a good mix for stable economic development. Will this time be different?