In April last year we created an index-like portfolio of major cryptocurrencies; it was constructed using the five coins with the highest market cap each year (measured by year-end) and then held for one year). This approach has shown interesting results over more than seven years of analysis, basically doubling the return of Bitcoin alone and outperforming equities.

One of the goals of creating this portfolio was to compare how a long-only basket of cryptocurrencies would compare to long-only exposure to Bitcoin alone, and see if the additional diversification that one would get among the largest coins at the time helps to improve either overall or risk-adjusted performance.

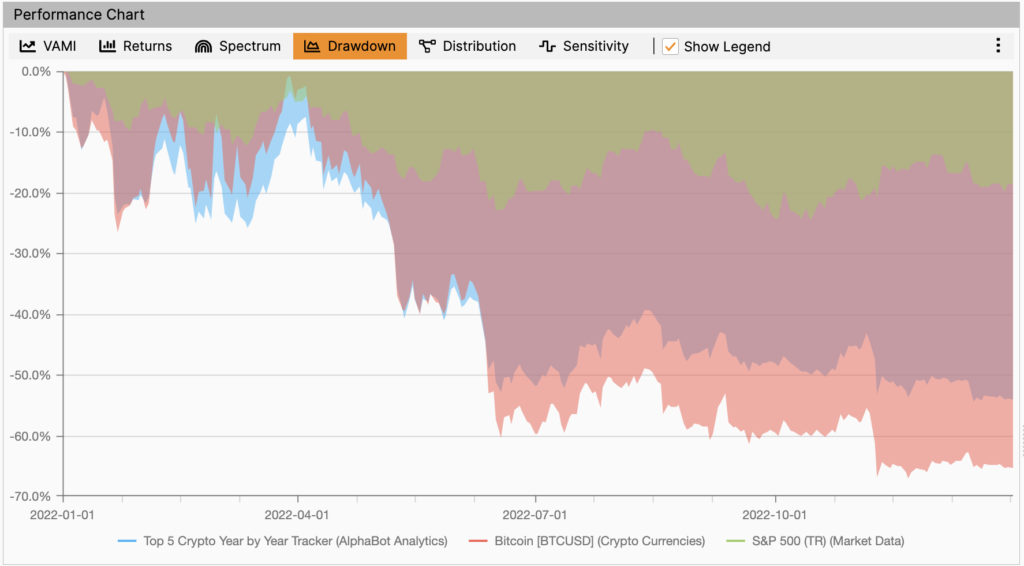

So far we have seen mixed results. During the drawdown of 2022, the diversified portfolio has resisted better than Bitcoin alone, but it’s still lost considerable value – 54% for the portfolio vs 70% for Bitcoin.

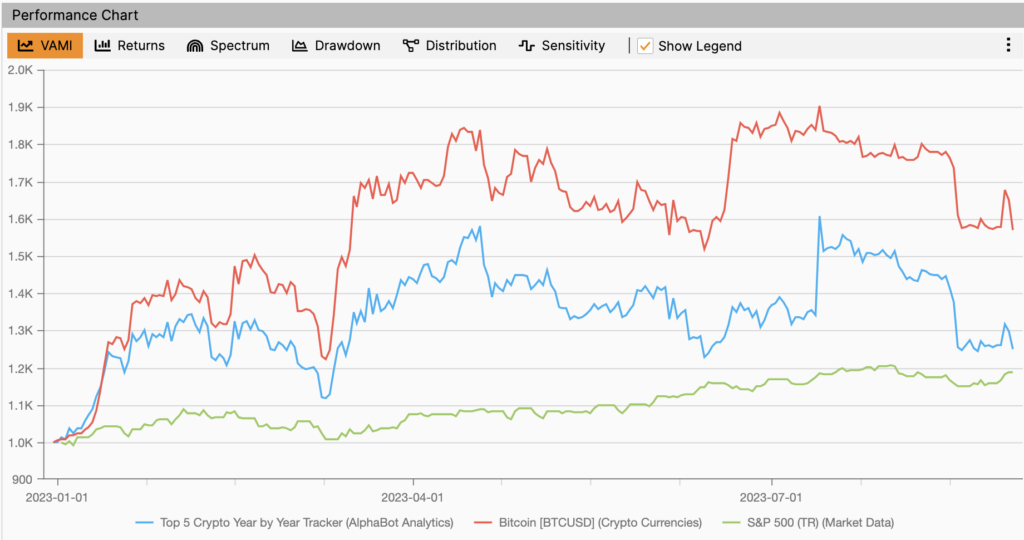

On January 1, 2023, Cardano and SOLA were replaced by DogeCoin and Ripple (Ripple has been consistently included, but dropped just enough in 2022 to be replaced) in our tracker portfolio. As usual, we exclude the stablecoins, focusing on “actual” cryptocurrencies. The year overall has seen the return of the crypto space to growth, with a recovery of about half the losses experienced in the prior year. However, the extra diversification has played its typical stability anchor game, with focus on the “anchor” – the tracker portfolio has grown at a smaller pace than the Bitcoin alone.

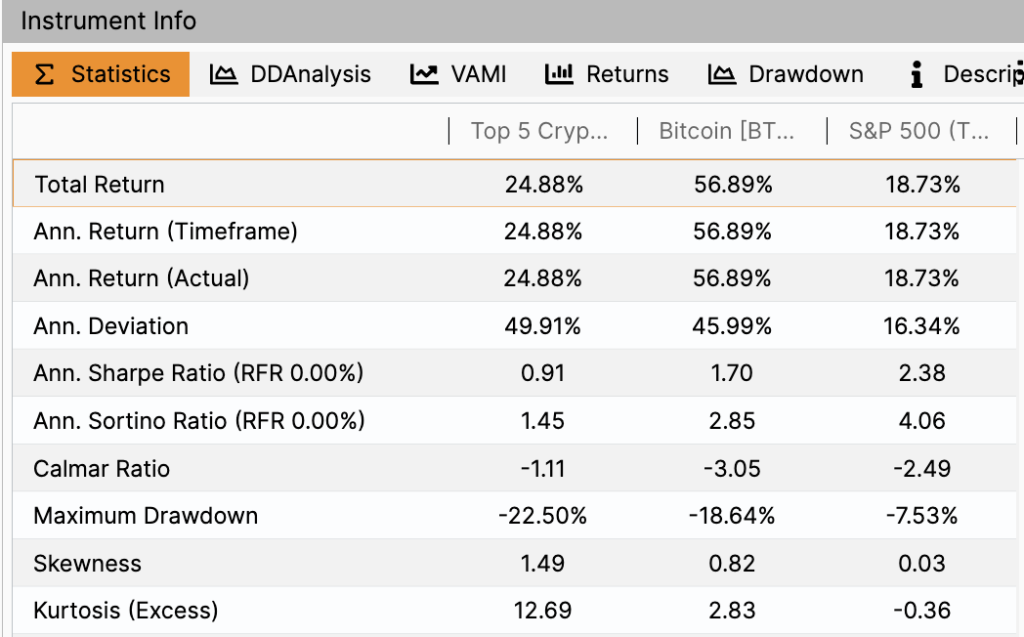

Here are the figures for 2023 YTD.

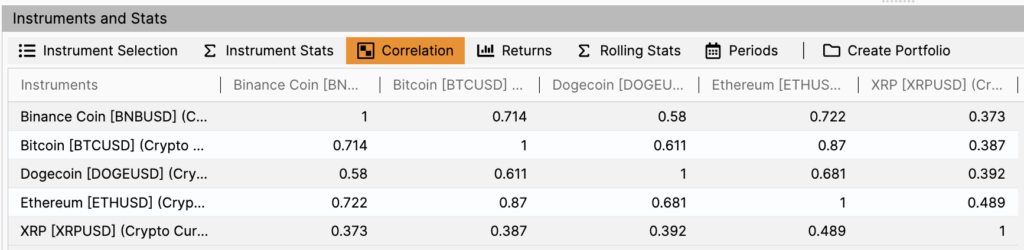

It seems that so far the diversification has provided what would be naturally expected results on performance – slowing down the losses but also impacting the growth or recovery on the upside. However, in the case of our crypto portfolio, it did not really help to reduce volatility. This could be explained by the overall conversion of the crypto space, resulting in pretty high cross-correlations.

As we can see, all the correlations are pretty high (well above 0.5 and all the way to 0.87) with the exception of Ripple (XRP) that is the only coin in this set staying consistently below 0.5 correlation with the other four. This kind of “herding” of large crypto coins seems to emphasize the leading role of Bitcoin – despite its shortcomings due to “old tech”, it continues to be the elephant in the room that drives others both up and down the performance scale.

We will keep monitoring the Crypto space, stay tuned for updates.