A few weeks ago we looked at some CTA specifics, namely which ones were doing well in the middle of the equity market bloodbath. Given the equity market bounce-back recently, we figured we’d take another look to see who’s doing well.

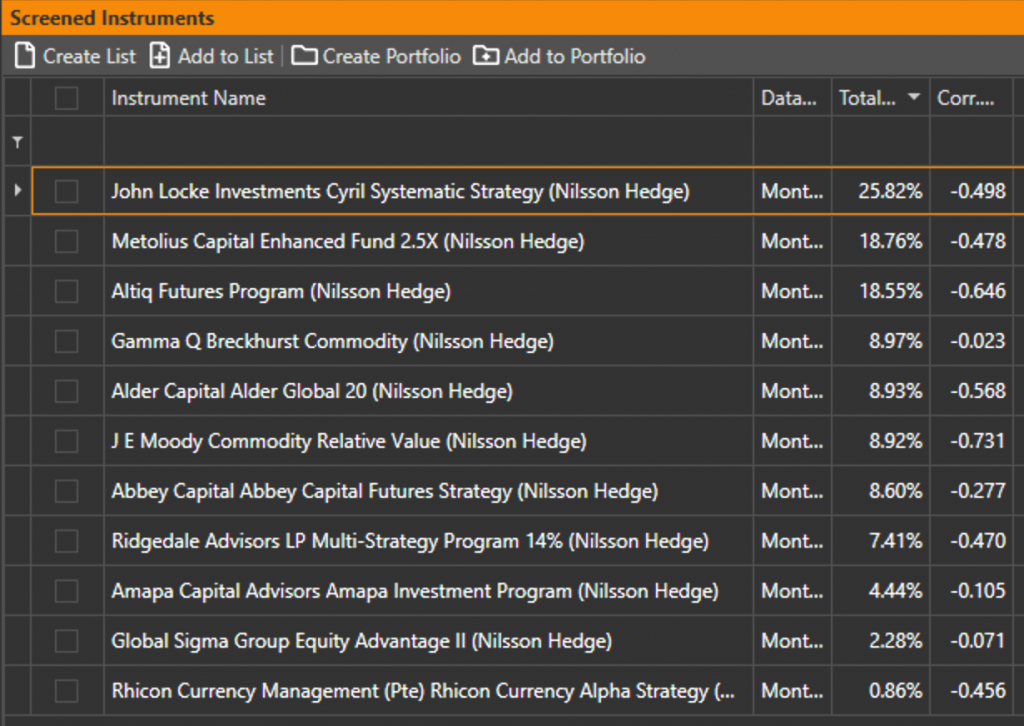

Previously, we used the NilssonHedge database and looked for CTAs that have positive returns through and including March 2020, and found 23 of them. Then we looked at the correlation of those 23 CTAs to the S&P 500 for the past 12 months (including March) and picked those with 0 correlation values or less. So we did the same process this time, expanding our performance filter to include April 2020, and found 11 CTAs satisfying the criteria. The 11 are:

John Locke Investments’ Cyril Systematic Strategy

Metolius Capital’s Enhanced Fund 2.5X

Altiq’s Futures Program

Gamma Q’s Breckhurst Commodity

Alder Capital’s Alder Global 20

J E Moody’s Commodity Relative Value

Abbey Capital’s Abbey Capital Futures Strategy

Ridgedale Advisors’ Multi Strategy Program 14%

Amapa Capital Advisors’ Amapa Investment Program

Global Sigma Group’s Equity Advantage II

Rhicon Currency Management’s Rhicon Currency Alpha Strategy

The reduction in the numbers is somewhat expected, of course, considering that rapidly rising equities are not generally the best environment for CTAs to post positive performance. Regardless of the smaller number, putting together returns and correlations to S&P for the past 12 months gives us a pretty impressive table. We are also glad to see many names from our analysis for the last month sticking to the top of the list (a few of programs have not yet updated in the database as of the time of writing).

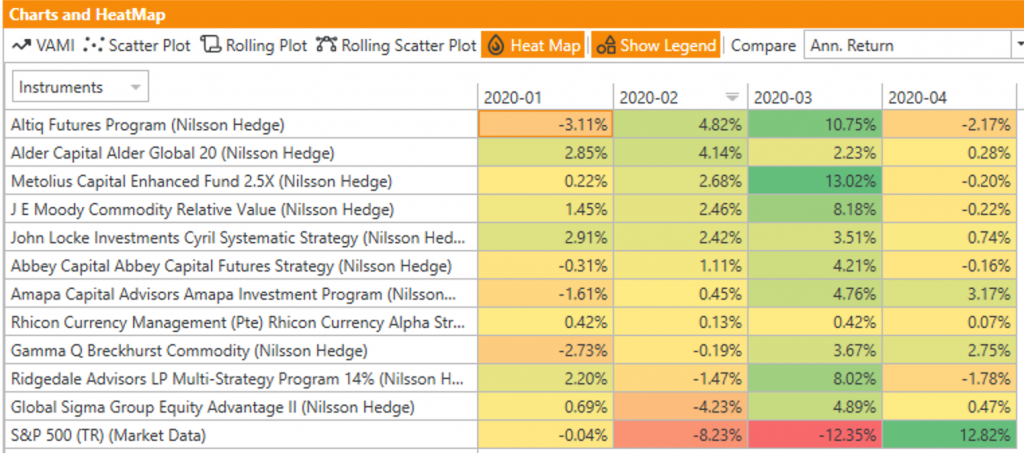

Taking a closer look at monthly returns YTD 2020 we see that March is by far the best month this year for CTAs. However, the secret of these programs’ great returns is their ability to hold their ground when equities come back charging, so even a small retracement does not break their strong overall profile.

Going forward we expect to continue seeing many surprises in 2020, which by itself is not surprising considering how many potential crises are slowly brewing right now, from escalating tensions with China, Iran, and Venezuela, to expectations of a second wave of infections, and, of course, the U.S elections in November. With so many moving parts, it will be interesting to see what kind of programs show their best potential. We will be keeping an eye on it, of course, and revisit later in the year.

This post is part of our Alpha-Week blog and can be found here: https://www.alpha-week.com/some-managed-futures-programs-can-make-gains-rising-equity-markets