In early 2022, together with AlphaWeek and Nilsson Hedge, we ran a performance-based awards program, recognizing managers achieving excellent results as measured by a combination of parameters targeting risk-adjusted returns and diversification to traditional markets. The time frames considered were 5, 3, and 1 year periods ending in December 2021. The list of winners was broken by market exposure, and can be found here.

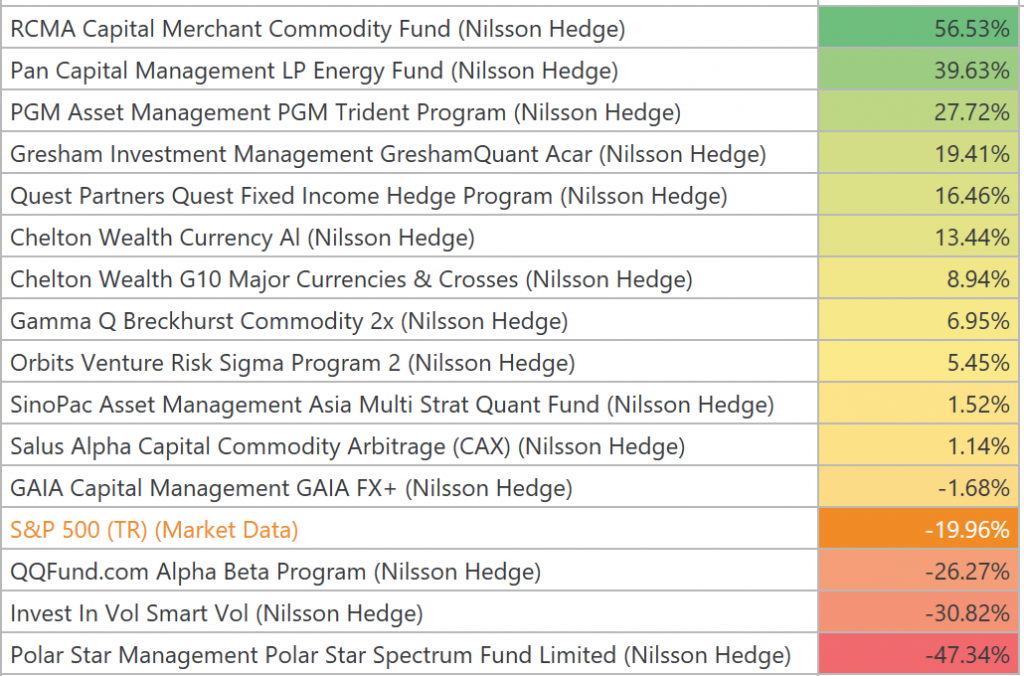

Now, 6 months later we want to see where our winners are and check how our approach of focusing on risk-adjusted returns and diversification have shown themselves so far. Considering the public equity market has endured a difficult year so far, with a 20% drawdown through the end of June, this represents a good test of the approach, even though the time frame is still too short to make any far-reaching conclusions.

Here is what we see: most managers have performed very well, with a third of them posting double-digits gains, and two thirds having a positive return. Only four managers have negative returns, and only three have underperformed the equity markets due to their high volatility strategies and exposure to energy markets, severely impacted by the events unfolding in Europe since the beginning of February.

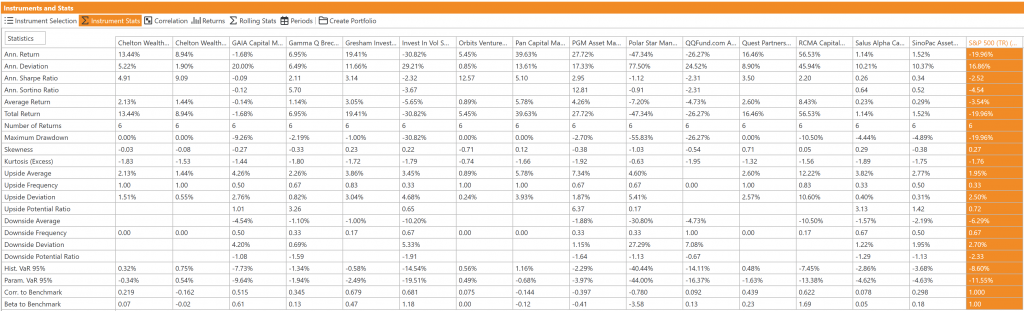

Looking at the larger set of stats we can also see a good indication that our measures continue to persist – a highly desired property of any selection criteria. Naturally, if an investor wants to build a robust selection system for their managers they need to focus on more than just recent performance. However, in our combined multi-year experience of selecting managers and managing assets in the alternative space, we have observed that risk-based characteristics and correlations do have a higher degree of reliability and, when properly used, can in fact be used to build portfolios of managers that tend to deliver such properties as diversification and stable returns over time.

Pardon the small fonts, but if you can see these you can notice the decent Sharpe and Sortino ratios for most of the managers so far (some Sortinos are missing b/c there are no negative returns to calculate downside volatility – an excellent result by itself). And if you really want to dig into analysis and selection of managers – feel free to reach out to me on AlphaBot, I will be happy to share the list of winners for instant analysis.