Alternative investments — including private equity, hedge funds, infrastructure, and real assets — offer diversification and potential outperformance. But unlike traditional asset classes, they don’t fit neatly into well-known market indices.

How do you benchmark a private equity fund? Or a real asset portfolio? Unlike equities (S&P 500) or bonds (Bloomberg Agg), there’s no standard reference for many alternatives.

There are many sophisticated quant tools for performance analysis, including Factor Analysis, Regression and Time-Series Modeling, PCA (Principal Component Analysis), growing more and more popular Machine Learning Methods such as Clustering, and Simulation and Bootstrapping. However, their sophistication is often negated by the limitations of the data available for alternative investments – from frequency of returns (quarterly or even annual for private equity, RE holdings, etc) to different kinds of biases present in databases of hedge fund returns (such as survivorship and backfill biases). Applying complex analysis tools to less than perfect data is not going to fix data deficiencies, to the contrary it is the proverbial hitting of nails with the microscope and can lead to the same kind of outcome – being totally useless (and damage the microscope in the process, lol)A practical, transparent solution is to construct model portfolio benchmarks using public indices and representative asset classes — giving investors and analysts a yardstick to measure relative performance. And while the apparent simplicity can be viewed as a limitation, it can, at the same time, be a powerful benefit because of the efficiency, transparency, and ability to customize and track, provided a proper portfolio construction tool is used that allows for a quick and effective modeling process as well as subsequent updates.

A model portfolio benchmark is a hypothetical blend of commonly available public indices that aims to mirror the risk-return characteristics of a specific alternative strategy or fund.

These benchmarks are:

The blend is constructed like a portfolio – with periodic rebalancing, for example, on quarterly basis to ensure consistency of weights over time, creating a return stream that can be used for comparisons and analysis.

Here are some widely available indices and ETFs that can be used as building blocks:

| Alternative Asset Type | Public Proxy | Examples |

| Private Equity | Public small-cap or growth indices | Russell 2000, S&P 600 |

| Real Estate | REIT indices | FTSE Nareit All REITs Index |

| Infrastructure | Listed infrastructure ETFs | DJ Brookfield Global Infra, iShares IFRA |

| Private Credit | High-yield or leveraged loan indices | S&P/LSTA Leveraged Loan Index, HYG ETF |

| Hedge Funds (Macro, L/S Equity) | Multi-asset or factor ETFs | SPY (beta), MTUM (momentum), TLT (duration) |

| Commodities | Commodity index ETFs | DBC, Bloomberg Commodity Index |

| Venture Capital | Nasdaq or thematic tech indices | Nasdaq 100, ARKK ETF |

Understand the alternative investments and their role in your investment strategy

Choose a set of public indices or ETFs that capture the above characteristics. Avoid overly granular or niche proxies unless justified.

Start with a strategic mix (e.g., 40% small-cap, 30% REITs, 30% credit). Use:

Rebalance quarterly or semi-annually, aligning with the revaluation cycle of the alternative investment. Maintain consistency for meaningful comparisons.

Fund Profile: U.S. focused, middle-market buyouts, long duration, equity-like risk.

Model Benchmark:

This model benchmark won’t match private equity exactly — but it captures broad exposure to market beta, illiquidity premiums, and leverage-driven returns. This “rough” approximation is exactly the goal due to its simplicity and comparison with the actual fund performance may prove quite revealing and raise important questions (we will touch on that later).

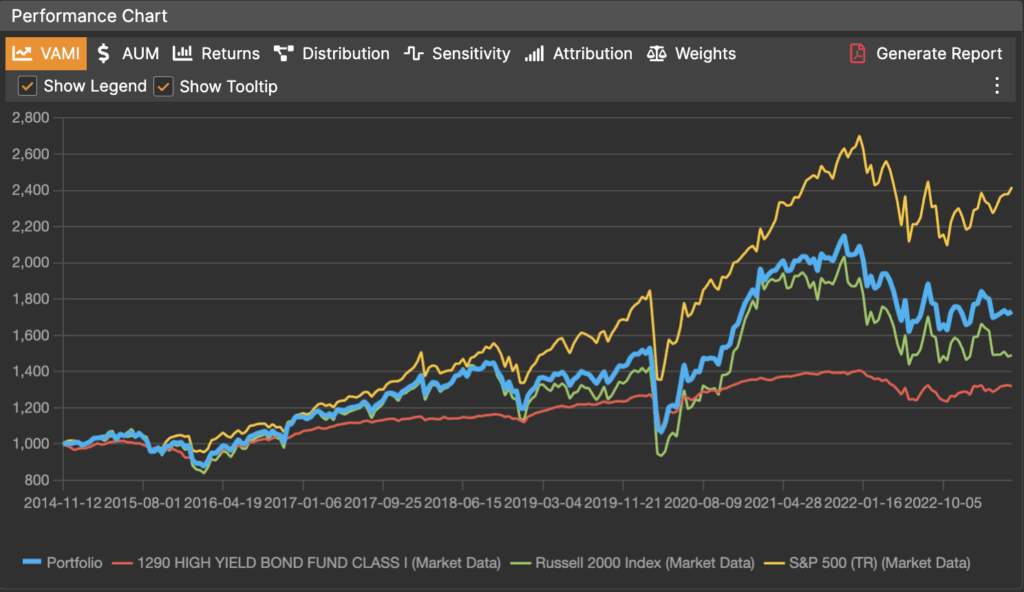

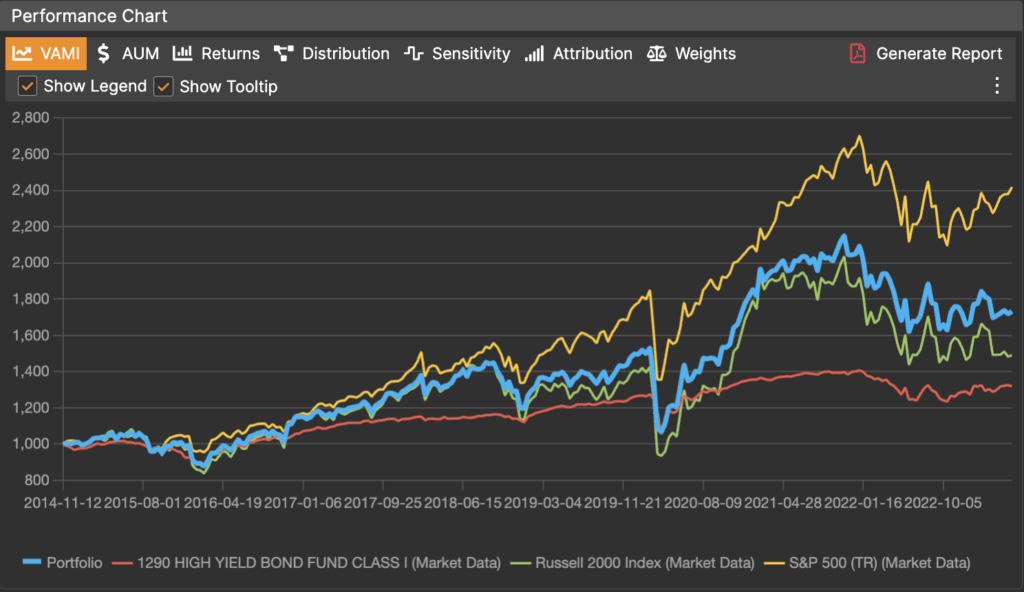

Here is performance chart for the Model Portfolio we generated using AlphaBot:

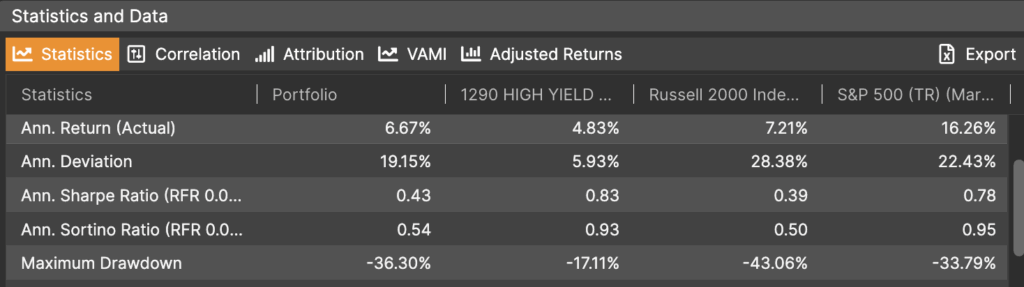

The thick blue line is the weighted portfolio – our Model Benchmark. And here are some stats for it:

Improving index selection: there is a growing number of specialty indices created to address the void in alternative investments benchmarks, such as Refinitiv Private Equity Buyout Index, Nasdaq eVestment Peer Benchmarking project and others that allow for more accurate representation of certain alternative investment types, or give investors better understanding of where they stand among their peers. These additional indices can also be used in the Model Portfolio approach further improving the results.

Model portfolio benchmarks are not perfect, but they’re indispensable for bringing rigor and transparency to alternative investment evaluation. By leveraging commonly available indices and effective tools for portfolio construction investors can better:

In a world where capital is increasingly flowing into non-traditional assets, smart benchmarking is no longer optional — it’s essential. The only thing needed to implement this direct and simple approach is a reliable tool that can manage public daily indices and ETFs, monthly and quarterly fund returns, and ability to mix them into comparisons and portfolios, such as AlphaBot. Empowered with a tool like this, you can start building synthetic benchmark portfolios almost instantly as well as analyze, compare, and model your existing investments performance, entering a new level of understanding the alternative investments universe and your positioning in it.

(c) AlphaBot 2025